Market Perspectives August 2021

Financial markets remain in upbeat mood despite rising inflationary pressures and the increase in coronavirus cases due to the Delta variant.

06 August 2021

By Michel Vernier, CFA, London UK, Head of Fixed Income Strategy

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

The search for positive yield in the euro area looks set to remain challenging for some time, despite the European Central Bank’s new inflation targeting regime. ECB president Christine Lagarde has understood that the key to success is finding a compromise.

Negative rates to stay

There seems little positive news for euro bond investors, but the overall message and direction has not changed: rates at the short end are likely to stay negative while those at the longer end may not have much room to rise.

In July, the European Central Bank (ECB) introduced its new inflation target after an 18-month review. The main upshot is the central bank’s change from its previous inflation target, from “just under 2%” to 2%. Additionally, the ECB now tolerates periods of above-target inflation.

ECB copycats the US

While the central bank’s framework seems to mirror the US Federal Reserve’s more accommodative framework introduced a year ago, the tone appears subtler. According to the new strategy, actual inflation can rise moderately above 2% for a transitory period if the economy and interest rates are at the “lower bound”.

Reading between the lines, and listening to previous ECB comments, the central bank wants to ensure that under the new framework such an overshoot of inflation is only tolerated when the economy is operating at the lower bound, thus at lower interest rate levels. The Fed, by comparison, seems more determined to target higher average inflation. It also incorporates employment in its mandate which provides a more aggressive mandate to push inflation compared to the ECB.

Lagarde’s sensible move

While the ECB’s approach is now more “dovish”, Lagarde had to find a compromise to win a majority among central bank members, something she can do best and was hired to do.

In contrast to the previous president, Mario Draghi, she has kept more defensive members, like those from Germany or Belgium, on board and avoided resignations (as seen with Axel Weber and Juergen Stark in 2011 and Sabine Lautenschlaeger in 2019). “We had a very friendly, open, substantive discussion around these issues – the Governing Council was together on these,” she commented regarding the new forward guidance and framework.

Inflation thought to be transitory

During July’s monetary meeting, the ECB guided around inflation and the rate path over coming quarters. First, president Lagarde recognised some improvement: “inflation has picked up though this increase is expected to be mostly transitory”. After climbing to 1.9% in 2021, the central bank expects inflation to moderate towards 1.5% in 2022, echoing consensus.

As for the policy rates, the ECB stated that the “Governing Council expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon”.

Avoiding past mistakes

Even if inflation should rise above forecast, the ECB is unlikely to react immediately. Lagarde emphasised that an “element of patience” has been embedded in the new guidance which is “intended to avoid premature tightening that would be detrimental to the economy”.

In 2011, the ECB committed a policy error by hiking rates, which was followed by a recession, something the central bank would like to avoid at all costs. The harsh reality is that there seems little economic reason to lift interest rates for now and a rate hike before 2024 seems unlikely.

Bond buying to persist

During the summer the pandemic emergency purchasing programme (PEPP) received much attention. While the ECB accelerated its bond buying earlier this year to counteract then rapidly rising yields, the pace of purchase has slowed and spurred concerns of a gradual tapering of the programme.

While a slightly slower pace of bond purchasing is possible from September, the ECB is likely to use the entire envisaged amount of €1.85tn by March 2022. From then on part of the temporary programme is likely to be transferred to the longer-term asset-purchase programme (APP), so continuing bond buying.

EU yields with less upside risk

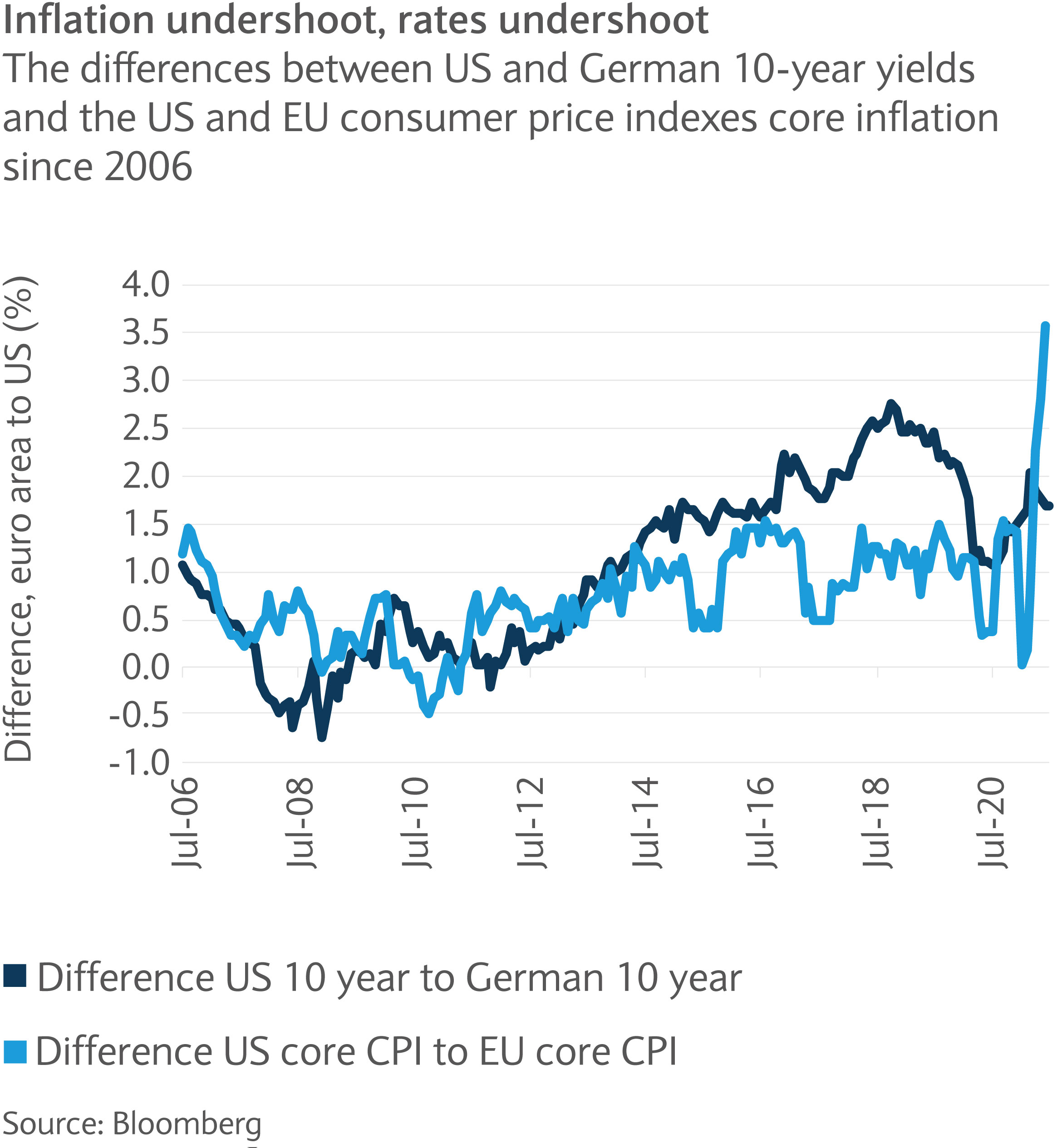

Given all the efforts, the euro area seems trapped in a low yield environment. The inflation differential to the UK or the US is substantial and with a less determined and aggressive monetary framework, eurozone rates are prone to stay substantially lower than US ones, for example (see chart). History shows that euro long-end rates tend to undershoot US rates in times when inflation is relatively lower. A scenario which seems very likely in the foreseeable future.

The great escape from negative yields

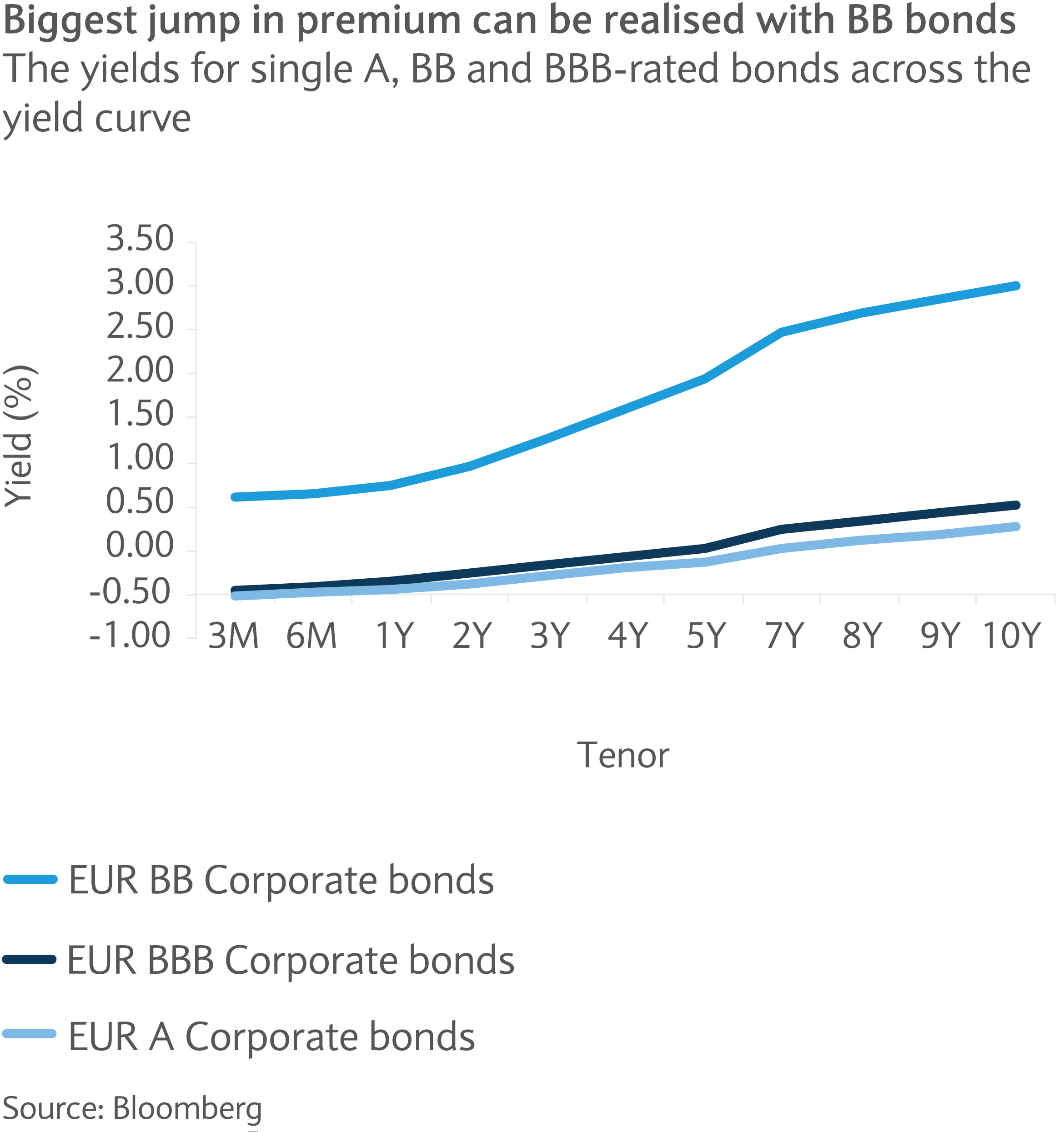

The question is how to avoid negative rates in the euro area. Within the bond market, we see three ways. First, take on duration. In isolation this seems the least effective option, given that even French 10-year government bonds yield 0% at most after July’s downward move in rates. Even single A-rated corporate bonds only offer positive yields in average beyond 7-year maturities (see chart).

Another option is taking on credit risk. With BBB-rated bonds, for example, positive yields can be achieved with 5-year maturities. Furthermore, the segment seems to offer the most value given moderate interest rate risk combined with positive yields. At the same time, BB-rated bonds from the high yield segment may provide a larger step-up in yields.

BB-rated bonds, another option

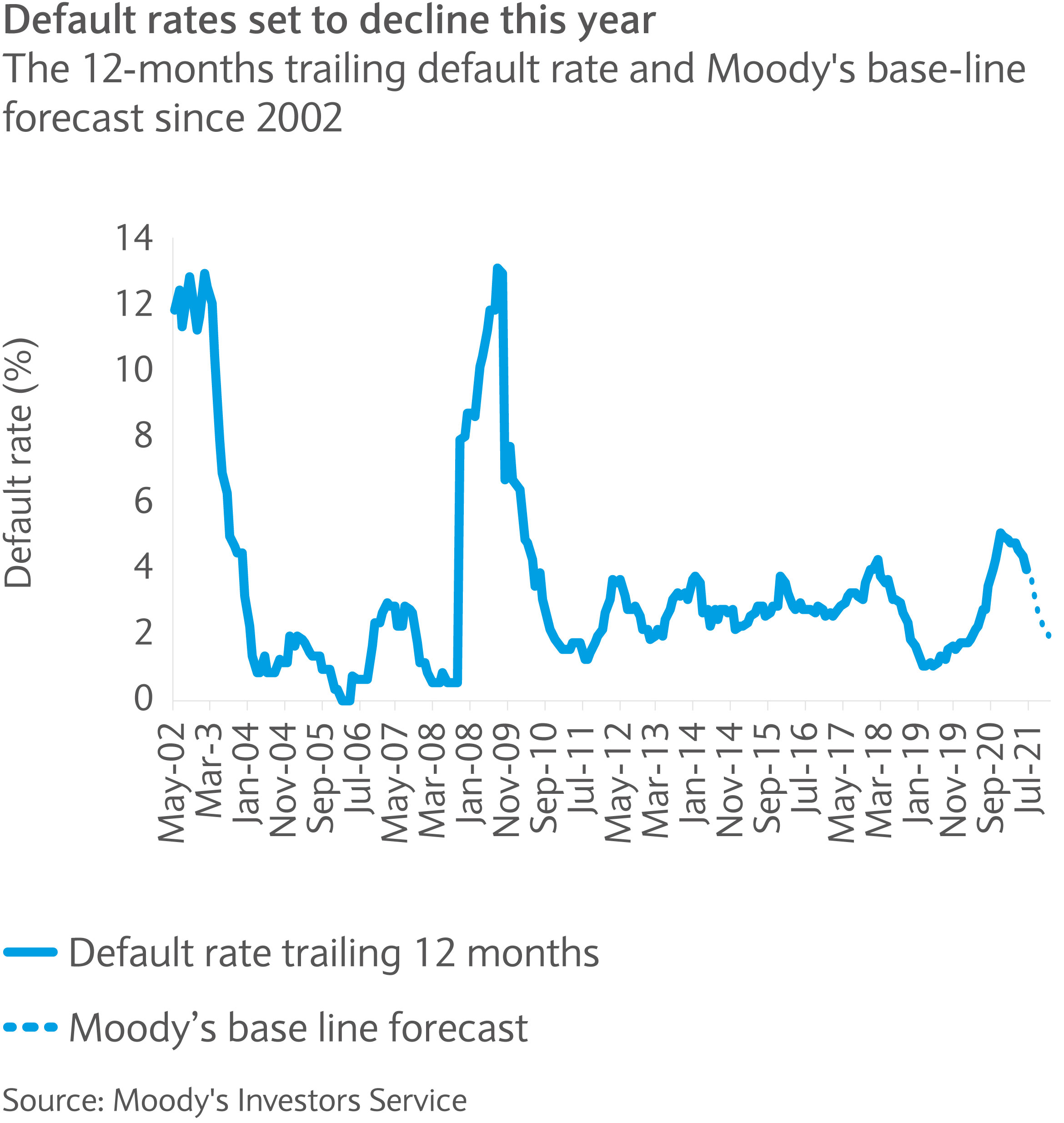

Admittedly, spreads have compressed to historically tight, and expensive levels, and credit risk is generally higher compared to the investment grade segment. Default rates have dropped substantially and are likely to drop even further, helped by the recovery and extremely accommodative financial conditions, according to the rating agency Moody’s (see chart). Given the recently observed higher dispersion in credit quality and spreads in the segment, selection looks like being key.

A third potential way to gain yield premium is by taking on structural risk in the bond market. In this respect, the most prominent segment is subordinated hybrid bonds from financial, but also non-financial issuers. The more complex nature of the bonds, which usually feature extension risk, coupon risk and additional capital risk, means they warrant additional analysis, investment experience and appropriate risk appetite.

While the eurozone offers little scope for high returns, the balancing act is between avoiding a certain loss (-0.5% short rates) and not being too exposed to potential losses (duration risk/credit risk). Investors might best consider a mix of taking on duration and some credit risk as an effective compromise.

Financial markets remain in upbeat mood despite rising inflationary pressures and the increase in coronavirus cases due to the Delta variant.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.