Hedge funds: putting asymmetry to the test

01 April 2021

You’ll find a short briefing below. To read an in-depth analysis of this article, please select the ‘full article’ tab.

-

Summary

Key takeaways

- Diversification through asset allocation may not be enough

- Time sensitivity and complexity may justify outsourcing to hedge funds

- Hedge funds can potentially help asymmetric return profiles during down markets.

In the March issue of Market Perspectives, we highlighted that although having a well-diversified portfolio might be necessary to manage portfolio volatility, it may not be sufficient in avoiding the least probable, extreme, tail risk.

With returns tending to mirror a bell curve distribution but with fatter tails, the left tail corresponds to heavier losses. So, eradicating, or alleviating, the pressures that a left tail scenario could impose on a portfolio, should be a key objective for investors.

While using options (that is, buying puts) eliminates the left tail, it does so at a cost. Dynamic hedging through futures contracts may be less expensive than options, but requires an embedded framework: constant monitoring/adjusting of the portfolio and can also be difficult when timing market corrections.

Outsourcing the management of tail risks and considering investing in hedge funds with systematic asymmetric returns may be worth considering. Successful strategies will need to show that during down markets, the strategy can outperform the market.

Looking at the average quarterly returns during down markets for the MSCI USA net total return index since 2000 and comparing it against hedge fund indices, reveals that the negative return on hedge fund indices was significantly better than seen with equities.

Average returns in down markets since 2000 MSCI USA Net TR Index -11.92% HFRI Fund Weighted Index -5.37% HRFI Equity Hedge Total Index -7.80% HFRI Event-Driven Total Index -6.15% HFRI Macro Total Index -0.01% HFRI Relative Value Total Index -3.46% The second hurdle facing hedge funds is achieving an asymmetric return profile – protecting investors’ wealth during down markets while participating in up markets.

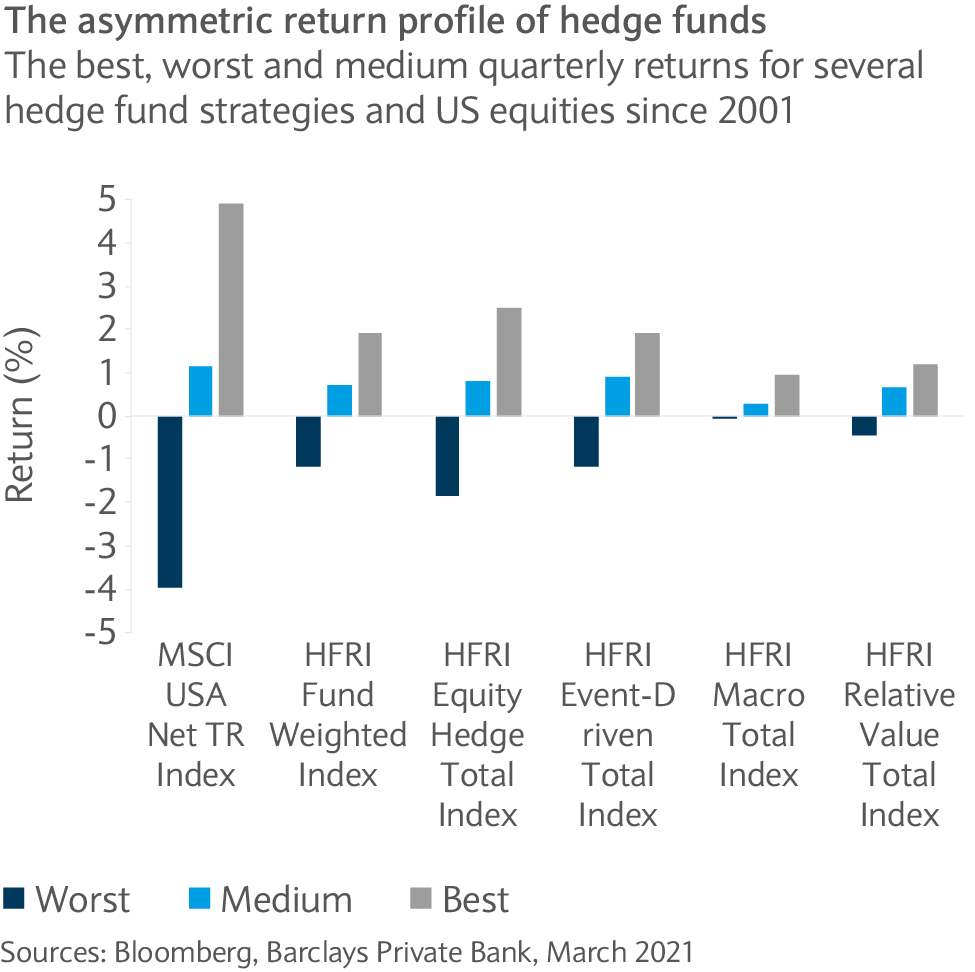

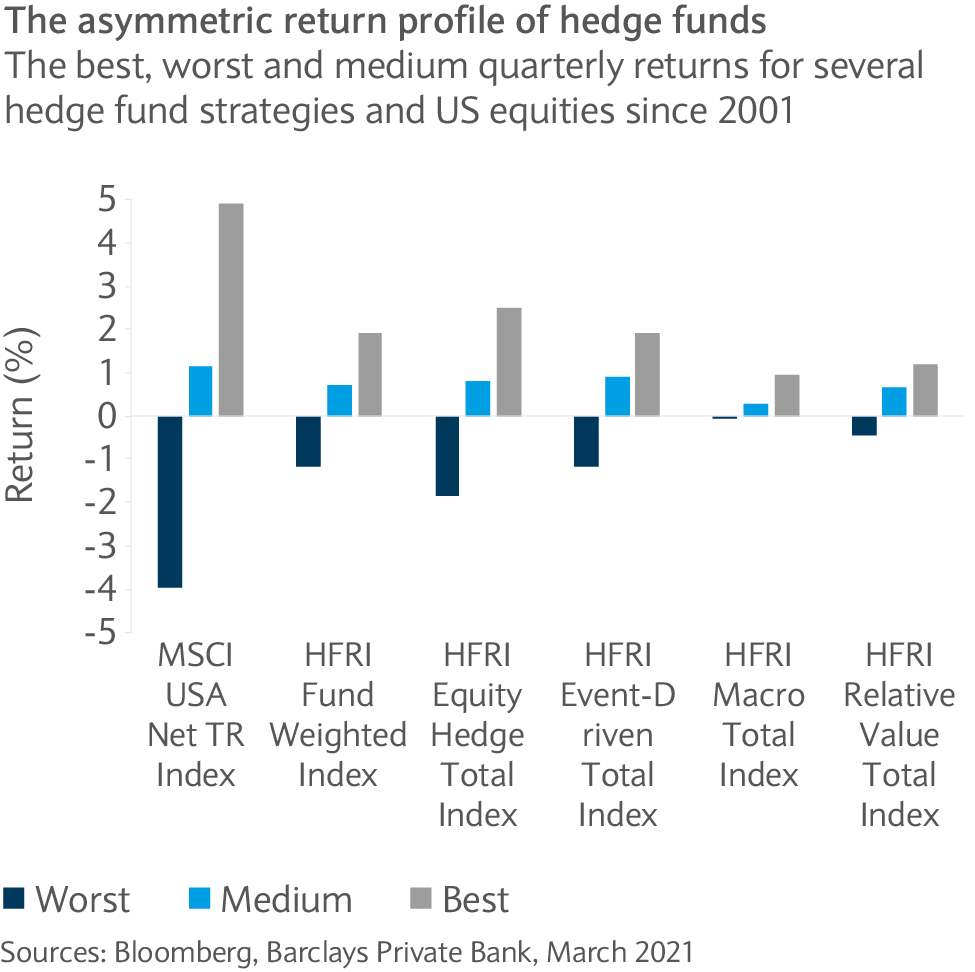

Splitting the data into its worst, medium and best average monthly returns for the MSCI USA net total return index and reviewing it against each hedge fund strategy shows us that hedge funds go some way to providing asymmetric returns, even at an index level (see chart).

Overall, the data suggests that hedge funds provide protection for down markets without sacrificing significantly on upside returns.

In fact, the key takeaway is that – at the asset allocation level – hedge funds have improved portfolio returns historically by up to 30-40 basis points for a given level of risk.

Hedge funds can offer diversification benefits and act as portfolio stabilisers, even over the long term – and clearly, this suggests that hedge funds may prove an important element in the optimal asset allocation mosaic.

-

Full article

With volatile equity markets and rising yields pressuring equity risk premiums, hedge funds could be poised to take portfolios from effective diversification to asymmetric-return providers: limiting losses in down markets while participating in gains when markets are rising.

In the March issue of Market Perspectives, we highlighted that although having a well-diversified portfolio might be necessary to manage portfolio volatility, it may not be sufficient in avoiding the least probable, extreme, tail risk. That is, tail risk that lies towards the edges of so-called bell curve distributions of investment returns.

Hedging the left tail

With returns tending to mirror a bell curve distribution but with fatter tails, the left tail, although less probable, corresponds to heavy losses that tend to be greater in frequency, duration and magnitude. Given this, it could be argued that eradicating, or alleviating, the pressures of a left tail scenario could impose on a portfolio, should be a key objective for investors.

While using options (that is, buying puts) eliminates the left tail, it does so at a cost. Dynamic hedging through futures contracts may be less expensive than options, but requires an embedded framework: constant monitoring/adjusting of the portfolio and can also be difficult with regards to timing market corrections.

However, outsourcing the management of tail risks and considering investing in hedge funds with systematic asymmetric returns could be worth considering. For such a strategy to be successful, the first hurdle it must pass is to show that during down markets, the strategy can outperform the market.

Limiting down-market losses with hedge funds

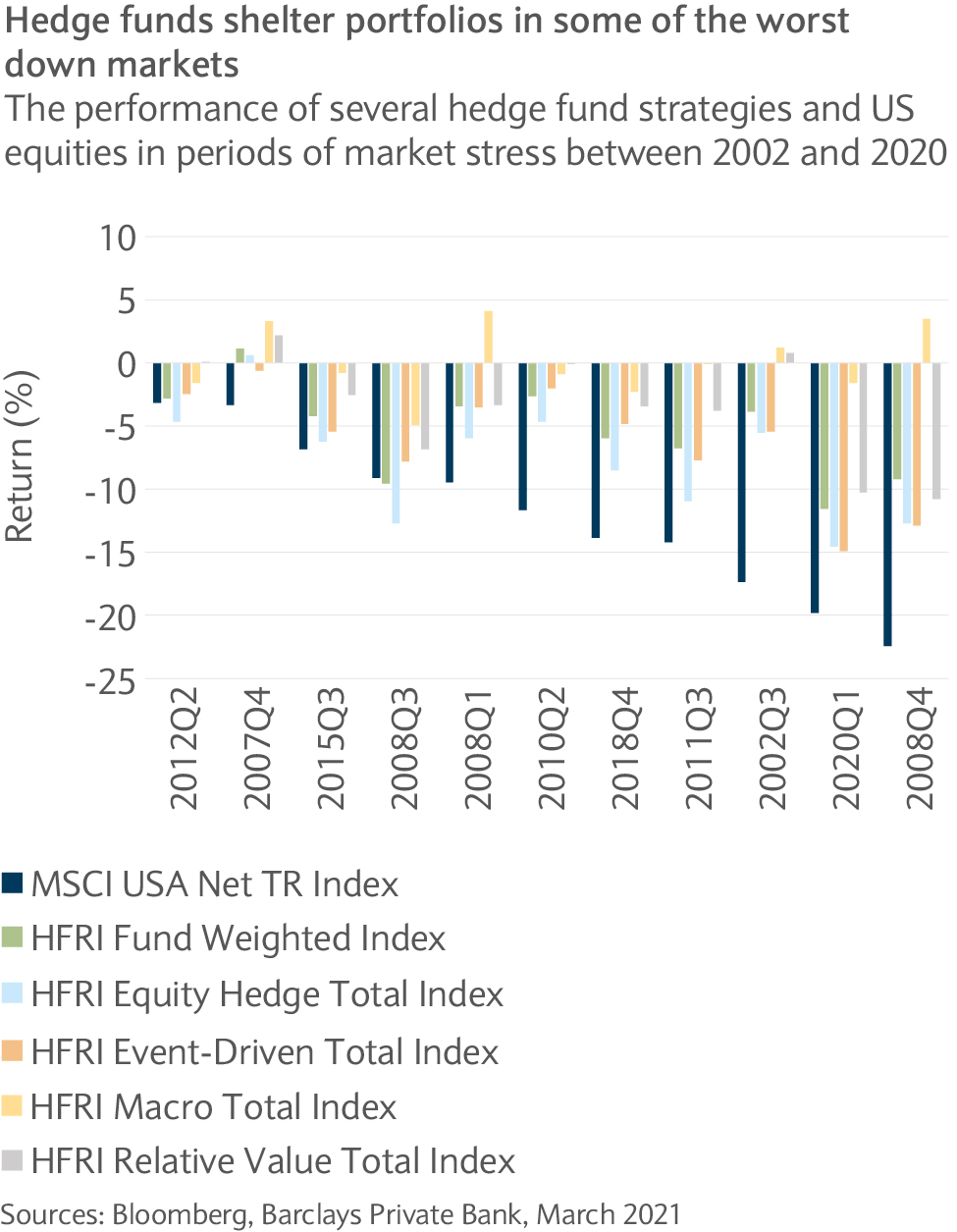

Looking at the average quarterly returns during down markets for the MSCI USA net total return index and comparing it against hedge fund indices, reveals that the negative return on hedge fund indices was significantly better than seen with equities (see table).

Average returns in down markets since 2000 MSCI USA Net TR Index -11.92% HFRI Fund Weighted Index -5.37% HRFI Equity Hedge Total Index -7.80% HFRI Event-Driven Total Index -6.15% HFRI Macro Total Index -0.01% HFRI Relative Value Total Index -3.46% Furthermore, during the six worst down markets since 2000, low beta strategies such as market-neutral have proven their worth in limiting losses and, in some cases, earning a positive return (see chart).

Deliberately asymmetric

The second hurdle facing hedge funds is achieving an asymmetric return profile. In other words, protecting investors’ wealth during down markets and still participating in the up markets.

Splitting the data into its worst, medium and best average monthly returns for the MSCI USA net total return index and reviewing it against each hedge fund strategy shows us that hedge funds go some way to providing asymmetric returns, even at an index level (see chart).

Overall, the data suggests that hedge funds provide protection for down markets without sacrificing significantly on upside returns.

While some low beta strategies, such as the equity hedge total index, were less effective in protecting portfolio valuations during down markets, it is worth noting that hedge funds differ greatly by strategy and within strategies. Each fund tends to be quite heterogeneous. As such, this suggests that investors may be well-served by adding hedge funds to a portfolio while also actively selecting managers with robust processes and proven investment methodologies in low-beta strategies.

Hedge funds for the long run

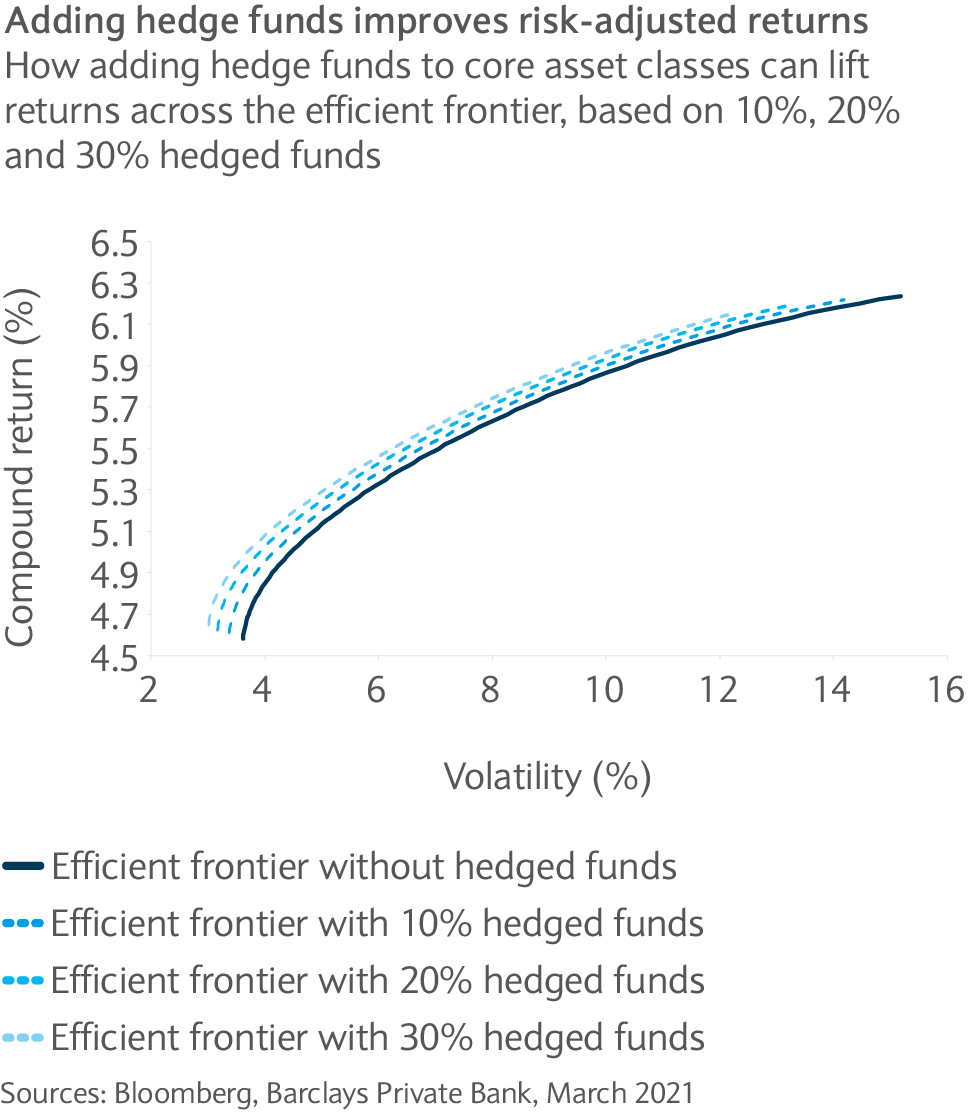

To understand the role hedge funds can play in a multi- asset class portfolio over the long term, we consider an investment opportunity set comprising core asset classes and hedge funds. In particular, we look at the “efficient frontier” for asset mixes consisting of US equities, US government bonds, and the HFRI Fund Weighted Composite Index (a hedge fund benchmark).

The optimisation engine is based on our new strategic asset allocation framework, which accounts for compounding effects and tail risk. To examine the impact that hedge funds have had on optimal asset allocation policy, we estimate the optimisation input parameters using the last 20 years of data.

The key takeaway is that – at the asset allocation level – hedge funds have improved portfolio returns historically up to 30-40 basis points for a given level of risk. Alternatively, adding hedge funds to equities and government bonds has reduced portfolio volatility by 1-3% and expected shortfall by 1-6%, depending on the efficient frontier segment. The combined effect of return enhancement and risk reduction implies improved portfolio efficiency (see chart).

Portfolio diversifier and stabiliser

The efficient frontier (see chart below) example illustrates how hedge funds can offer diversification benefits and act as portfolio stabilisers, even over the long term. Clearly, this suggests that hedge funds represent an important element in the optimal asset allocation mosaic.

Related articles

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This communication:

- Has been prepared by Barclays Private Bank and is provided for information purposes only

- Is not research nor a product of the Barclays Research department. Any views expressed in this communication may differ from those of the Barclays Research department

- All opinions and estimates are given as of the date of this communication and are subject to change. Barclays Private Bank is not obliged to inform recipients of this communication of any change to such opinions or estimates

- Is general in nature and does not take into account any specific investment objectives, financial situation or particular needs of any particular person

- Does not constitute an offer, an invitation or a recommendation to enter into any product or service and does not constitute investment advice, solicitation to buy or sell securities and/or a personal recommendation. Any entry into any product or service requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding documents

- Is confidential and is for the benefit of the recipient. No part of it may be reproduced, distributed or transmitted without the prior written permission of Barclays Private Bank

- Has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.