Rates may rise but unlikely at the short end

17 September 2020

7 minute read

Economic data pointed to a sharp recovery in the largest economies in June and July, while market-implied inflation expectations in the eurozone, US and UK rebounded from their lows. Central banks have so far succeeded with their accommodative monetary policy strategies, preventing further stress and bringing confidence back to financial markets and the respective economies.

Given the sharp recovery, higher market-implied inflation expectations and build-up of government debt piles, investors seem to be bracing themselves for higher interest rates. The US Federal Reserve’s (Fed) new interest rate policy framework, which will tolerate higher inflation in certain circumstances, seems to emphasise the pressure for higher rates. Rightly so?

Rates, which rates?

When referring to higher interest rates, this is not a one dimensional figure. The rate outlook may differ between countries. And even within one economy or currency bloc rate levels typically differ depending on the tenor, expressed by the respective rate curve.

For simplicity, each curve can be divided into the short end, maturities of up to five years, and long end. While the short end is highly affected by the policy rate, the medium and long end of the curve is mostly dependent on the long-term inflation outlook as well as supply and demand. In this environment, differentiating between different parts of the curve, and at least between the medium and long end, seems key in judging appropriate investment decisions.

In this article, we focus on the short end of the rate curve. Whether the Fed (policy rate 0-0.25%), the European Central Bank (ECB, -0.5%) or the Bank of England (BOE, 0.1%), leading central banks in the developed and larger emerging economies have not only lowered interest rates drastically, but sent a strong message to the market: rates will stay low for some time.

Fed opens the door for higher inflation

But not only the long end is affected by the inflation outlook given inflation is a key input for central bank decisions. During August’s Jackson Hole Economic Symposium of central bankers, the US Fed revealed its new approach to policy on inflation and followed up with more detail on its latest Federal Open Market Committee meeting.

The approach was summarised by chair Jerome Powell as follows: “In order to anchor longer-term inflation expectations at this level, the Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time”.

In addition, the Fed put greater emphasis on employment: “Maximum employment is a broad-based and inclusive goal”. The willingness to let the economy overheat for a limited period as well as the strong link to actual employment data suggests that inflation is more likely to rise leading to higher yields. This is partly reflected in the recent surge of breakeven inflation expectations (as discussed in Markets Weekly on 21 August) and may be expressed by higher rates at the long end of the curve.

But primarily the strategy emphasises the Fed’s commitment to keep rates low at the short end. This was reiterated through the new forward guidance, where the bank expects to act only once inflation should sustainable run over 2%, which the Fed does not expect to see before the end of 2023.

Limited ammunition for the Fed

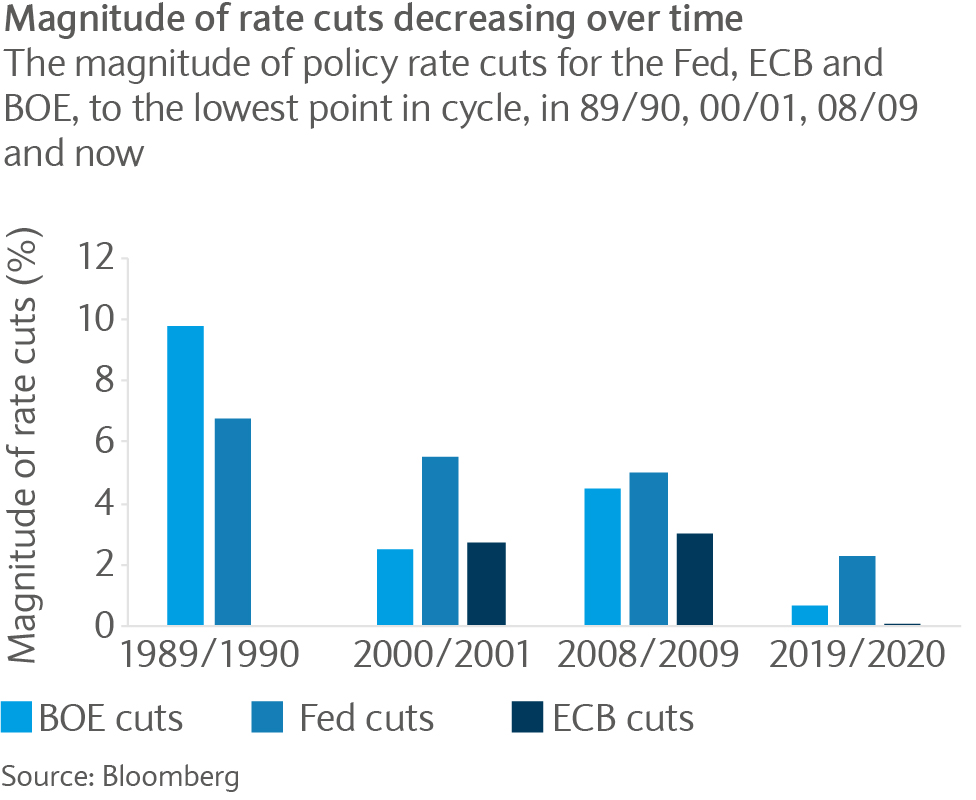

The Fed’s toolbox might be large but the scope for rate cuts is limited given the central bank has almost ruled out negative rates. It should be remembered that back in 1989 the Fed reduced rates by 675 basis points (bp), during the equity crisis in 2000 by 550bp and during the credit crisis in 2008 by 500bp. A cut by 225bp this time seems meagre by comparison.

So all that seems to be left is to assure that rates (short rates) will stay lower: “We are not even thinking about thinking raising rates”. It remains to be seen if inflation rises to 2% or more by end of the 2023. Since the central bank set its inflation target in 2012, inflation has averaged 1.4%.

Low, lower ECB rates

The chances of higher short-term rates in the eurozone and UK seem even slimmer. The ECB has not cut the policy rate during the COVID-19 crisis simply because the benefits of lowering rates from -0.5% appear limited. According to president Christine Lagarde and chief economist Philip Lane, the ECB will rather focus on its bond-buying programme while keeping rates low thus trying to prevent a deflationary environment (the eurozone consumer price index being at -0.2% year on year at the last reading).

In addition, there is increased pressure on the currency front given that the positive interest rate differential between the US dollar and the euro has shrunk to 75bp from 210bp. The eurozone recovery is highly dependent on a pick-up in exports and a further increase in the currency will provide more motivation for the ECB to keep rates low.

BOE: Negative rates unlikely but not ruled out

Inflation expectations in the UK according to the 5-year, 5-year forward breakeven rate meanwhile are at 3.3%, suggesting a pick-up in inflation and rates. But breakeven rates carry a large liquidity and demand premium, particularly in the UK, while the year on year retail price index stood at 0.5% in August.

In its latest policy meeting, the BOE governor, Andrew Bayley, did not rule out negative base rates in case they are needed. While negative rates may be unlikely for now, they may become a possibility. It seems clear that Brexit and COVID-19 uncertainty should at least provide a sufficient backdrop for the BOE to keep rates low.

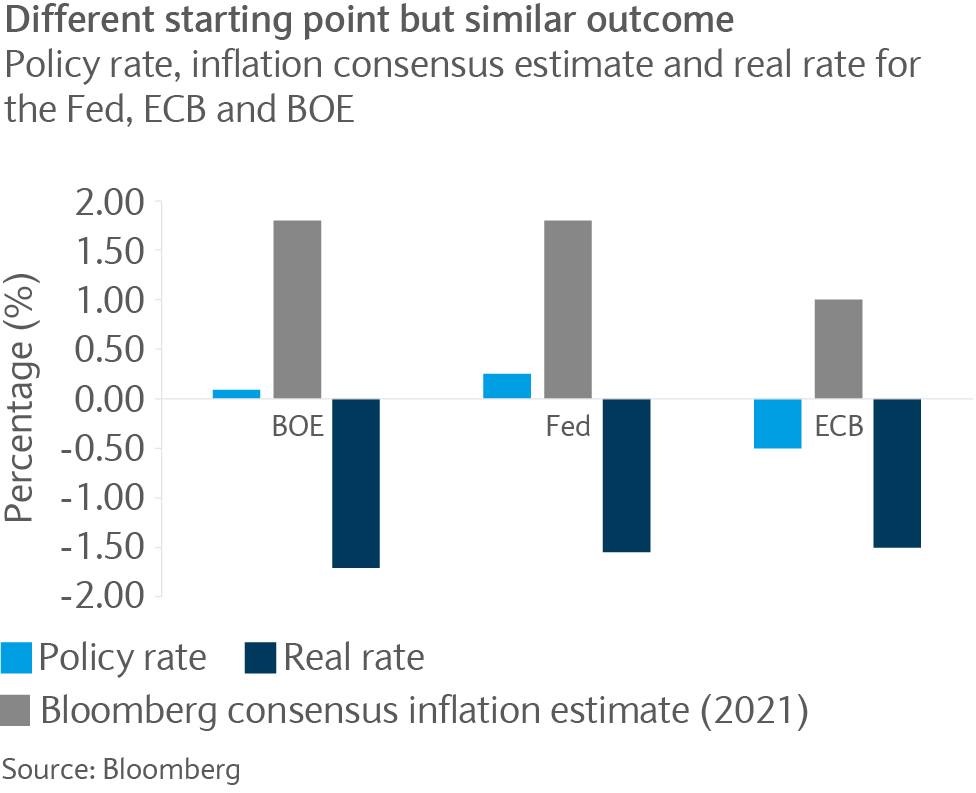

When making assumptions on rates, it is important to differentiate between the long end and the short end. While the long end tries to find a balance between supply and inflation concerns and growth uncertainty, the outlook for the short end seems clearer. In the meantime, investors’ beware. Adjusted for inflation UK, US and euro rates are negative and eating into inflation-adjusted wealth.

Related articles

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This communication:

- Has been prepared by Barclays Private Bank and is provided for information purposes only

- Is not research nor a product of the Barclays Research department. Any views expressed in this communication may differ from those of the Barclays Research department

- All opinions and estimates are given as of the date of this communication and are subject to change. Barclays Private Bank is not obliged to inform recipients of this communication of any change to such opinions or estimates

- Is general in nature and does not take into account any specific investment objectives, financial situation or particular needs of any particular person

- Does not constitute an offer, an invitation or a recommendation to enter into any product or service and does not constitute investment advice, solicitation to buy or sell securities and/or a personal recommendation. Any entry into any product or service requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding documents

- Is confidential and is for the benefit of the recipient. No part of it may be reproduced, distributed or transmitted without the prior written permission of Barclays Private Bank

- Has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.