Are equities too expensive?

10 September 2020

6 minute read

The outlook for equities appears highly uncertain, not least with pandemic-related and US election risks. However, markets may sustain their elevated valuations while central banks remain in the driver’s seat. In this context a focus on appropriate diversification and the use of active management may appeal.

As rich as it gets

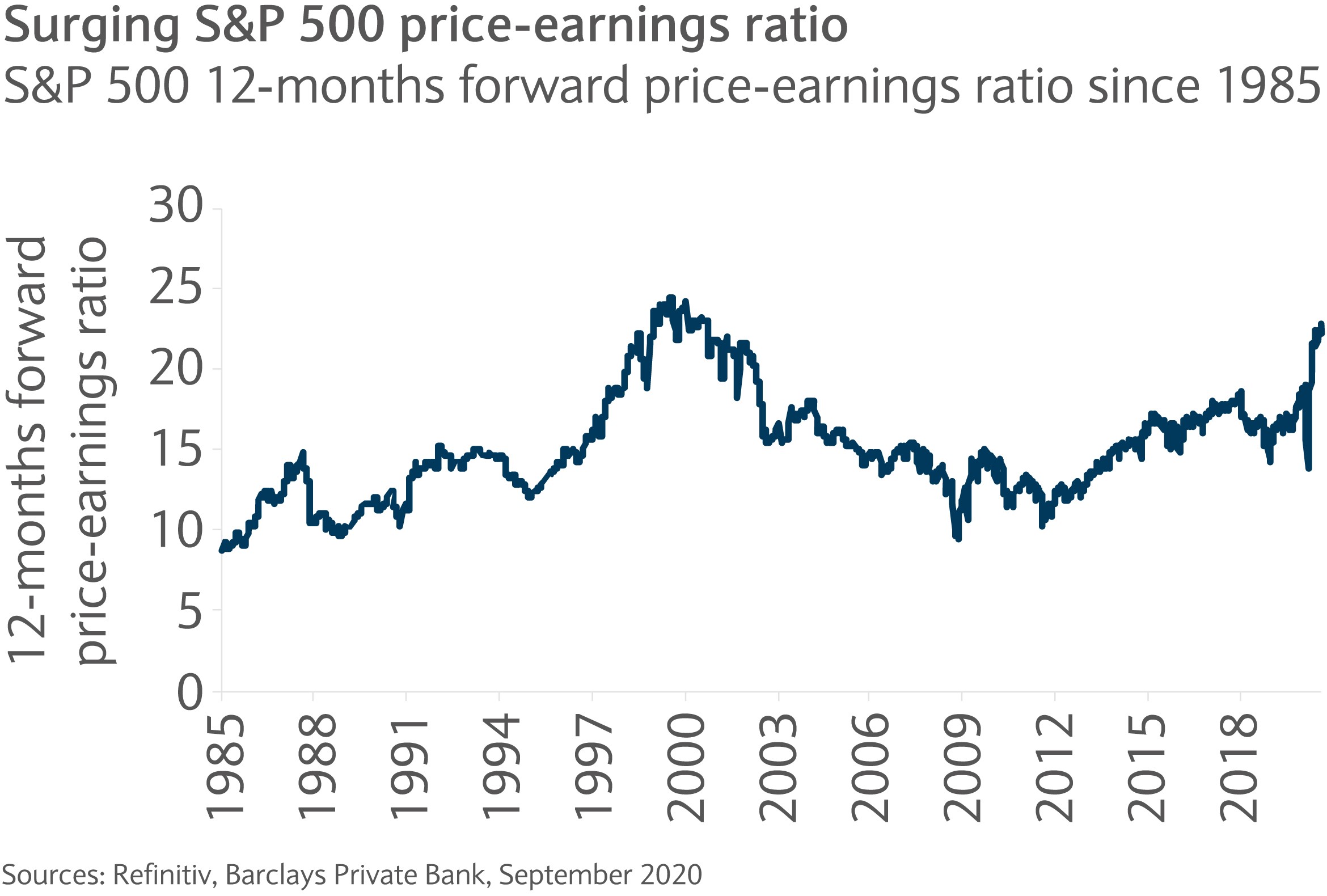

In absolute terms, US (and global) equity valuations are undoubtedly expensive when compared to their historical average. The S&P 500 trades at 22 times the next 12 months projected earnings compared to an historical average of 15.5 times (see chart). The same is true for revenues and profits-based valuation measures. At face value, US equities have only been more expensive in 2000, during the technology bubble.

It’s all relative

Yet, using historical values to assess the cheapness or expensiveness of equities may be flawed on this occasion. These are strange times. The world, equity markets and the economy were significantly different say 10 or 20 years ago than even before the COVID-19 outbreak struck this year. That outbreak, along with the monetary and fiscal response to it, suggests that we are living through a unique period.

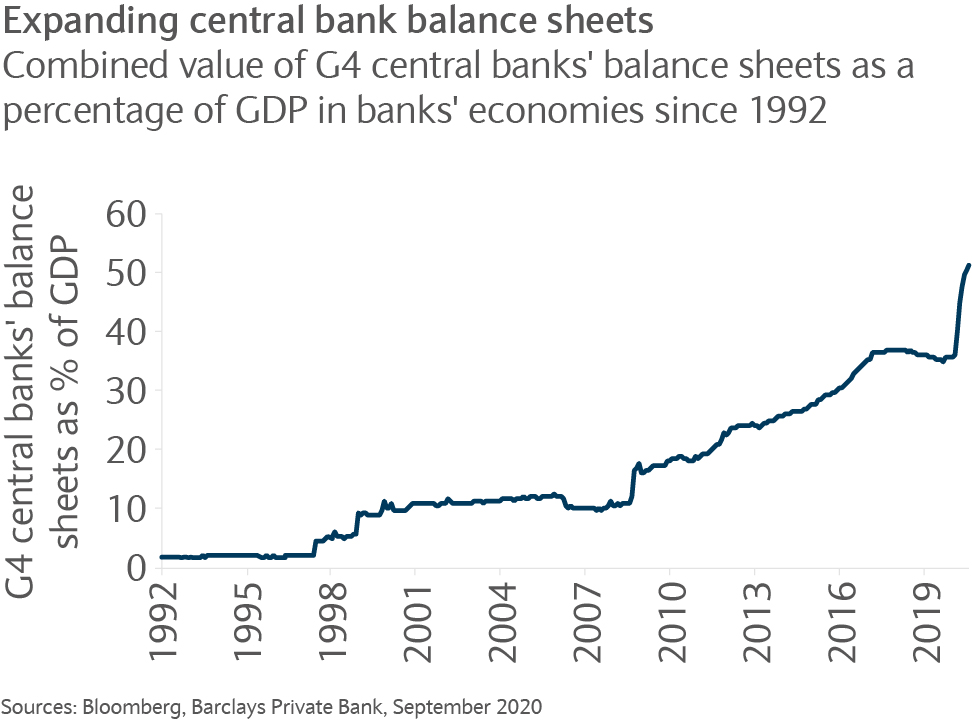

Central banks’ involvement has never been more pre-eminent as they have expanded their balance sheets, flooding financial markets with more liquidity than at any point in modern history. In fact, the G4 central banks’ balance sheets, being central banks in the US, Japan, euro zone and the UK, now represent 51% of the gross domestic product of the four economies (see chart). Furthermore, negative interest rates have almost become the norm in the developed world.

Unprecedented quantitative easing and ultra-low interest rates have arguably been distorting markets, and the way investors perceive risk, for the last decade. This year’s “buyer of last resort” interventionism has only reinforced this trend. This can be seen in the significant increase in valuation multiples for equities, which have been compounded by the (temporary) collapse in earnings this year due to the economic and health effects of the virus.

Attractive equity risk premium

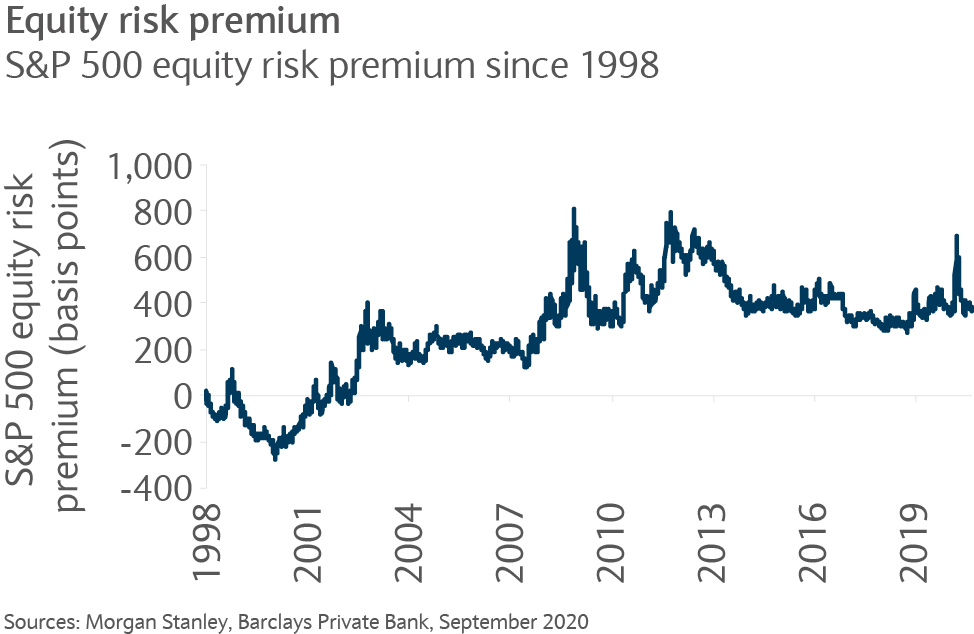

Because of the distortion to asset values sparked by central bank policies, we believe that to truly assess the “attractiveness” of equities, relative measures should be used. In particular, the equity risk premium (ERP) can help evaluate whether an investor is appropriately compensated for the amount of risk taken when allocating assets, such as preferring stocks to US treasuries.

Based on this measure, equities aren’t as “overpriced” as they may appear otherwise. Indeed, the S&P 500’s ERP is around 370 basis points (bp), largely in line with both its five-year (375bp) and 20-year (280bp) averages. The S&P 500 ERP is also significantly higher than it was in 2000, when it turned negative (-280bp) as the dot-com bubble was about to pop (see chart).

With real rates deep in negative territory and high yield bond spreads below 500bp, there appears to be “no alternative” to equities for asset allocators. While this argument may seem weak, unless interest rates drop further into negative territory or high yield spreads compress to zero, the reality is that only stocks seem to offer long-term upside potential.

Valuations should compress

This is not to say that equities’ valuations are sustainable. In fact, multiples are likely to gradually compress. As the world emerges from the pandemic, monetary support should eventually (and gradually) return to more reasonable levels. This may force valuation multiples down towards their long-term average.

However, as earnings recover from their 2020 collapse and, as they have for the last hundred years, grow over the long term (probably by mid-single digits every year), equities can still deliver positive (albeit lower) total returns.

Time to stay invested

Given the equity markets’ impressive rally since March’s selloff, many may be tempted to take profits or wait for a better entry point. This could seem a sensible strategy in light of all the uncertainty being faced (such as the US presidential election, pandemic developments or Brexit trade negotiation outcome, to name three risks).

However, timing the market is often a losing proposition and investments are not switches to be turned on and off. Time in the market tends to be a preferable option, allowing portfolio returns to profit from long-term compounding effects and, when necessary, “dim” exposure. This may be best achieved through appropriate diversification and select hedging strategies.

Related articles

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This communication:

- Has been prepared by Barclays Private Bank and is provided for information purposes only

- Is not research nor a product of the Barclays Research department. Any views expressed in this communication may differ from those of the Barclays Research department

- All opinions and estimates are given as of the date of this communication and are subject to change. Barclays Private Bank is not obliged to inform recipients of this communication of any change to such opinions or estimates

- Is general in nature and does not take into account any specific investment objectives, financial situation or particular needs of any particular person

- Does not constitute an offer, an invitation or a recommendation to enter into any product or service and does not constitute investment advice, solicitation to buy or sell securities and/or a personal recommendation. Any entry into any product or service requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding documents

- Is confidential and is for the benefit of the recipient. No part of it may be reproduced, distributed or transmitted without the prior written permission of Barclays Private Bank

- Has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.