Market Perspectives October 2020

Financial market sentiment has taken a turn for the worse as COVID-19 infection numbers climb and the US presidential election nears.

02 October 2020

7 minute read

By Julien Lafargue, CFA, London UK, Head of Equity Strategy

While volatility is unlikely to fade and risks remain, we look for potential ways to benefit from staying invested in equities in the current environment.

While uncertainty is par for the course in equity markets, rarely have investors faced so many potential flashpoints clouding the outlook. Although a “wait and see” approach may feel more comfortable to some, constructing diversified portfolios and employing active management could help unearth attractive opportunities in highly uncertain times.

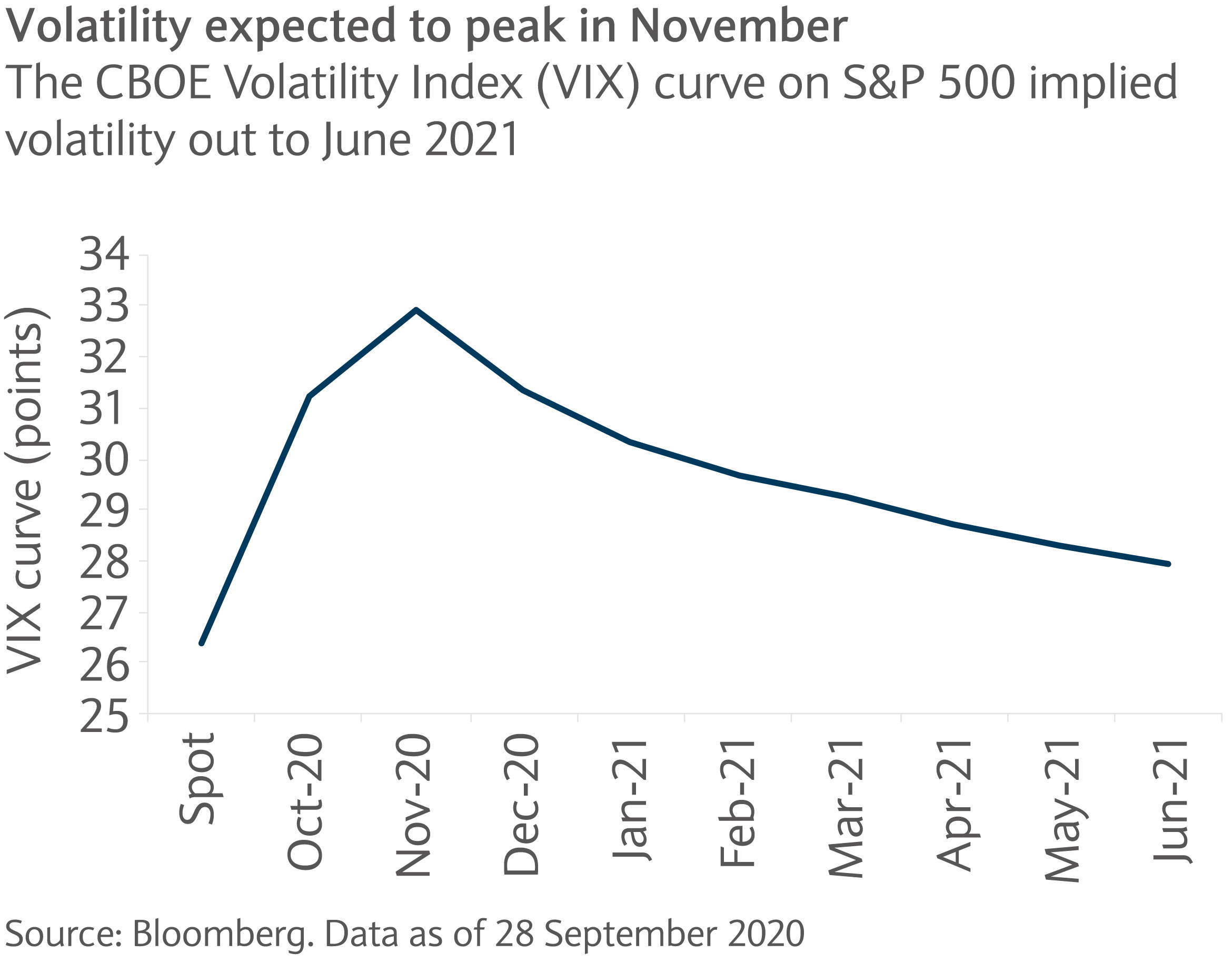

One way to measure investors’ hesitation is through implied volatility. The most widely followed volatility indicator, the VIX (see chart), has remained stubbornly elevated despite stock market indices reaching all-time highs. Indeed, since 2012, the VIX, or “fear index”, has largely been stuck in a range between 10 and 20 points.

After briefly spiking to levels comparable to 2008 when the COVID-19 pandemic hit, the VIX appears to have stalled in a new range that is 10 points higher than norm seen in the previous eight years, reflecting how much more uncertainty is being perceived. In addition, when looking at the VIX curve, the market appears to be pricing an even higher level of volatility over the next three months, pointing to possible concerns over the outcome of the US presidential election.

The 2020 US presidential race is shaping up to be one of the most contentious votes in recent history. The increasing polarisation of US politics in recent years has caused some commentators to envisage scenarios of continued political gridlocks or a contested election.

Without venturing the probability one should assign to these outcomes, election day, 3 November, may mark a period of more uncertainty rather its end. Over the medium term though, the impact of political events on financial markets remains relatively minimal and should not be seen as a determining factor when considering asset allocation decisions.

Another key question mark for investors revolves around the world after the COVID-19 crisis subsides. Whether it is about the timing of any vaccine becoming available, the continued popularity or not of homeworking and online shopping or if a period of deglobalisation is under way, the pandemic has completely reshuffled the cards. This leaves investors wondering what’s to come next?

While the world will undoubtedly be different in some aspects (like even larger government indebtedness), there are also secular trends that should be unaffected: the increased usage of digitalisation, the shifting shape of demographics or the impact of climate change on policy should continue unabated, providing investors with some degree of long-term visibility.

While long-term trends can be resilient anchors for portfolios, most investors still pay (too much) attention to shorter term developments, often in trying to time their entry points accordingly. Here, earnings growth trends are a key determinant and, on this front too, uncertainty runs high.

Quarterly earnings figures have lost some of their relevance in the wake of the pandemic as exemplified by 85% of US companies beating consensus expectations in the second quarter. As such, the third-quarter numbers might not be considered too relevant, although another way-better-than- expected quarter may be seen.

Looking further ahead, despite all the uncertainty surrounding the US election, the shape of the economic recovery and the timeline for a possible COVID-19 vaccine, the consensus still expects 2021 earnings to be back at 2019 levels (see chart). While possible, this projection appears to be more the result of analysts refraining from updating their models and passing on 2020 cuts rather than the reflection of strong conviction about 2021 numbers. Without clear guidance from many companies, and analysts alike, investors can be left guessing what aggregate earnings growth will look like.

Doubts surrounding companies’ ability to generate earnings have ripple effects on investors’ ability to value them, adding to the present level of uncertainty. Indeed, with equities trading at 20-year high valuation multiples (on dubious earnings forecast), there are growing concerns that a bubble may be forming and that a correction is nearing.

As we’ve explained previously, we believe that the current backdrop of low interest rates and interventionist central banks, justify moving to a relative rather than absolute-valuation framework and, in this context, equities seem to be the most attractive asset class.

Indeed, even if, on aggregate, US companies generate no year-on-year earnings growth in 2021 (against the +27% currently expected), the equity risk premium would be north of 300 basis points, in line with its 2017-2018 levels and well above the -200bps reached in the lead up to the popping of the dot-com bubble.

As we’ve established, there is no shortage of reasons for investors to sit tight and wait for better days to put their capital to work. Yet, we believe this approach could be detrimental to long-term wealth preservation, especially when real interest rates are negative. Risks are inherent to investing and waiting for the “all clear” may result in getting involved at the top of the market.

Rather, the focus should be to manage those risks in order to reap the highest possible rewards. Encouragingly, whether it’s through the VIX or the equity risk premium, it appears that the market is pricing some of the risks likely to occur in the coming months. As such, staying invested appeals at this juncture, while focusing on diversification and active management to help try to improve the risk/reward trade off.

Financial market sentiment has taken a turn for the worse as COVID-19 infection numbers climb and the US presidential election nears.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.