Market Perspectives October 2020

Financial market sentiment has taken a turn for the worse as COVID-19 infection numbers climb and the US presidential election nears.

02 October 2020

7 minute read

By Michel Vernier, CFA, London UK, Head of Fixed Income Strategy

With a US election nearing during COVID-19 and all eyes on central bank policy, what next for rates, bond market volatility and spreads?

September saw much of the market attention focused on central banks. Despite the lack of further action in the month, investors received very important messages from the central banks. As mentioned in our weekly on the 18 September the message from the US Federal Reserve (Fed), the European Central Bank and the Bank of England alike is loud and clear: if you wait for higher yields, you might get disappointed.

The Fed revealed the results of its largely anticipated new policy framework and followed up with further details during September’s Federal Open Market Committee meeting. The new framework leaves more room for the central bank to keep rates lower even in periods when when inflation was below the target) leaving the possibility of inflation overheating.

However, according to the Fed’s projections inflation is not expected to hit the 2% mark before the end of 2023. There is a risk that inflation takes longer to reach that target rate, suggesting that short-term rates may be stuck at low levels for some time.

The market reaction has been revealing. Since April, rates have stayed in a relatively narrow band accompanied by ultra-low rate volatility.

The yield on 30-year bonds has attempted to break above a 1.5% resistance level, but failed. The steepening, which has been most pronounced in the 30-year to 5-year segment of the market, may have lost some steam of late, but the idea of a steepening seems compelling. Rates are anchored at the short end, while long-end rates are exposed to treasury supply risk, potentially higher US inflation, in the wake of the Fed’s more relaxed attitude towards inflation targeting, and perhaps a V-shaped recovery.

We believe that a steepening move may only be temporary for now. As long as the levels of uncertainty about the recovery, the unemployment rate and size of state-support initiatives remain high, a sustainable increase in yields seems unlikely.

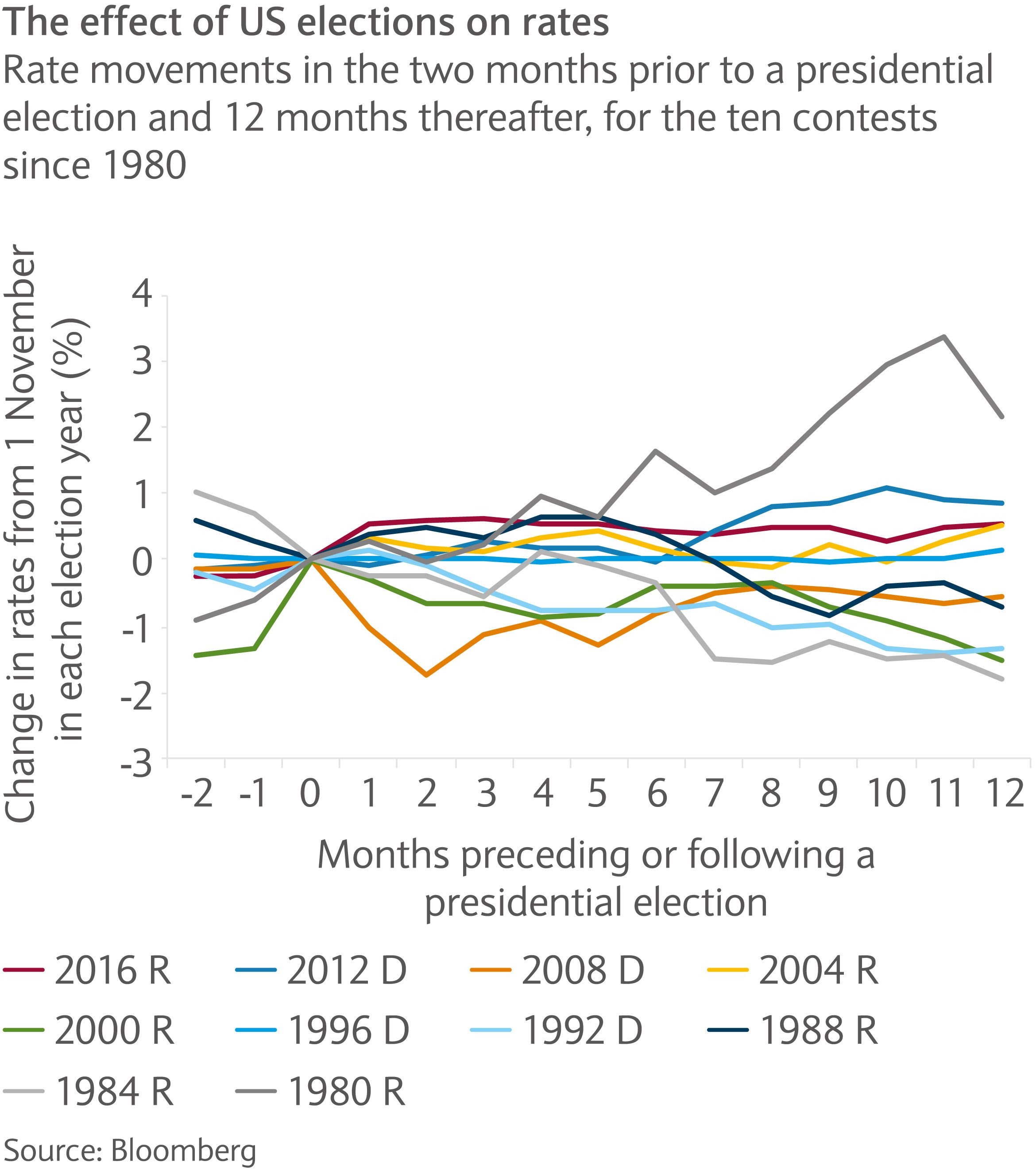

Might the US presidential election be a catalyst for higher yields, as seen in 2016? We looked at prior rate movements in American election years to see if any pattern exists (see chart). That said, basing investment decisions on the anticipated result of an election can be risky.

The last presidential election, in 2016, saw a Republican victory which raised the expectation of more fiscal stimulus, lifting 10-year rates to roughly 2.6%, from around 1.8%, in a short period. This year the focus on the outcome of the US election appears high too.

There seems to be little direct link between the result of the last ten US elections and the movement of rates in the following 12 months. While a Republican victory lifted rates in 2016, by a similar margin to that seen in 1980 under Ronald Reagan, rates declined in the period after the Republican governments of Reagan and George W Bush in 1984 and 2000 respectively. The Democrats had a similarly mixed impact on rates after their wins between 1992 and 2008.

Two things can be observed about the effect of the elections that are worth noting. First implied rate volatility seems significantly higher during the election period and this year it seems the demand for hedging is particularly high. Implied option volatility for 10-year forward swaps, for example, are six times higher than for periods outside of the post-election period. In the past, implied volatility has been only two times higher on average.

Second, when election results were delayed, like in 2000 when votes in Florida had to be counted again, yields trended lower and reflected the demand for safe-haven assets in times of heightened uncertainty over the outcome.

What are the takeaways for investors? Rate movements can be mostly explained by inflation expectations, central bank policy and economic leading indicators. Election periods have often fallen in the middle of economic shocks, such as the credit crisis in 2008 or an equity market crisis in 2000, that dominated prospects for yields.

It seems we face a similar situation this year given the COVID-19 crisis: it is likely that the shape of the recovery and news on the medical front will have the greatest impact on yields. However, higher implied rate option premiums or any potential delay in the result this time around might push rate volatility up and see rates trend lower in November.

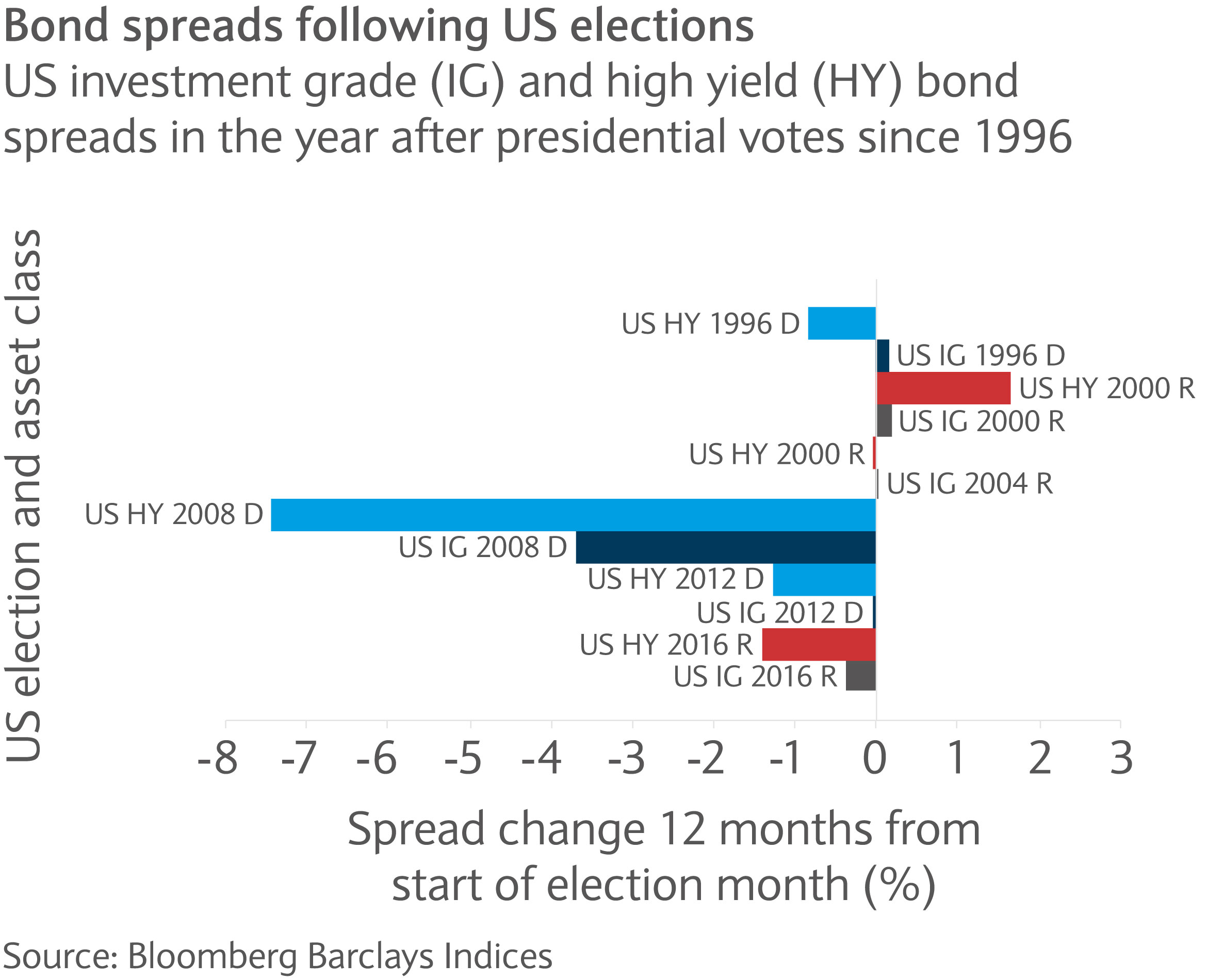

Similar observations can be made with spreads of investment grade or high yield bonds that have not appeared affected by presidential election results in the past (see chart).

Interestingly spread levels seemed to either tighten or stay close to the initial level 12 months after the respective election month, except in 2000 during the equity crisis. While the sample size is comparatively small, arguably investors felt more comfortable investing in US investment grade and high yield bonds after the result was known and uncertainty largely removed.

While US elections have usually gained much attention, past patterns showing various outcomes suggest that strategies that aim to predict bond returns based on election results seem ineffective. Economic factors appear to remain the biggest driver for bond returns, even during election periods.

Financial market sentiment has taken a turn for the worse as COVID-19 infection numbers climb and the US presidential election nears.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.