Hydrogen energy: the industry’s response

As governments and companies search for renewable energy sources, who stands to profit from a hydrogen market forecast to be worth $2.5 trillion by 2050?

29 October 2020

9 minute read

By Julien Lafargue, CFA, London UK, Head of Equity Strategy and Gerald Moser, CFA, London UK, Chief Investment Strategist

With the effects of climate change seemingly accelerating, the latest in our “See Beyond: thematic investing” series, introduced in August, focuses on the sustainable world thematic and the carbon aspect of it. This fits in with the initial report, which identified four structural, long-term themes changing society meaningfully: 1) Globalisation reversion; 2) Demographic shifts; 3) Smart everything; 4) Building a sustainable world.

CO2 emissions may need to fall by 8-10% every year for the next decade for the warming in average global temperatures to be less than 1.5 degrees, according to last November's United Nations Environment Report. In the fight against global warming, a new potential solution has grabbed the headlines in the last few months: hydrogen (H2).

At face value, the first element in the periodic table offers many advantages and could represent a credible alternative to fossil fuels in lowering carbon emissions, posing significant threats but also creating opportunities across industries. However, strong policy support will be indispensable to get there.

Download a copy of this article and Gerald's discussion with Daryl Wilson (Excutive Director of the Hydrogen Council) as a PDF - Hydrogen energy: the fuel of the future and the industry's response [PDF, 876KB]

H2 isn’t new. The element has been around for more than 13bn years and is the most common substance in the universe. It is also the richest energy source for stars like the sun. Indeed, hydrogen has the highest energy content of any common fuel by weight.

Hydrogen is a high energy, low polluting fuel that can be used for transportation, heating and power generation. NASA has used liquid hydrogen since the 1970s to propel the space shuttle and other rockets into orbit while hydrogen fuel cells power the shuttle’s electrical systems, producing a clean byproduct — pure water — for the crew to drink.

Although H2 is thought to comprise 90% of the visible universe1, it rarely exists on its own. Since it forms covalent compounds with most non-metallic elements, most of the hydrogen on Earth exists in molecular forms such as water or organic compounds. As a result, hydrogen needs to be “extracted”, a process than can require a significant amount of energy. Once extracted, hydrogen can be a carrier and store of energy.

The green attributes (hydrogen’s only direct emission when burnt is water) and versatility of the element make it an ideal candidate to reduce carbon emissions. With applications as a direct source of energy (say for fuel or heat) or as a feedstock into chemical or manufacturing processes, H2 appears to be a feasible alternative to fossil fuels, which still represent 80% of the energy consumed today2. In particular, hydrogen could help clean “hard to abate” sectors such as steel, cement or aluminium production.

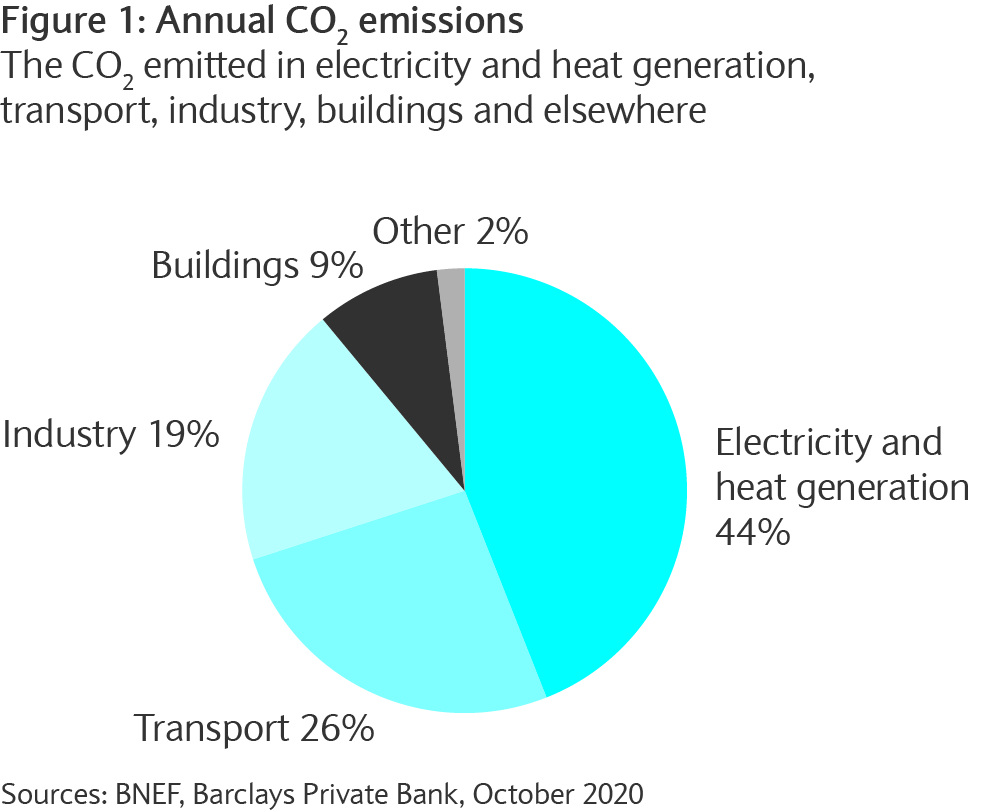

H2 could also play a role in reducing emissions in transportation, a sector that represents around a quarter of current CO2 emissions (see figure one). This is why the BloombergNEF (BNEF), a provider of primary research on clean energy, estimates that hydrogen could generate a quarter of our energy needs by 2050 compared with 4% at the moment.

As the world struggles to control climate change and CO2 emissions, the search for alternative sources of energy is accelerating. Renewables (solar, wind and hydro power) have made good progress in terms of both capacity and efficiency, driving down costs. This, together with technological improvements, is key for hydrogen to become a feasible source of energy.

As mentioned earlier, hydrogen is not a readily available energy source but an energy carrier. As hydrogen production requires the use of a primary energy source, the cost of hydrogen is always going to be higher than the cost of a primary source. Depending on the energy source used to produce hydrogen, the resulting hydrogen is defined according to a colour:

Over 99% of the hydrogen produced today is made using fossil fuels, accounting for 6% of natural gas demand, 2% of coal globally, and consequently 2.2% of global carbon emissions3. In order for this fossil-powered hydrogen to turn green, it is imperative to use renewable sources of energy to extract H2. This process, called electrolysis, takes place in an electrolyser and uses electricity to split water into hydrogen and oxygen.

Green hydrogen typically costs between $2.50 and $4.50 a kilogram versus traditional carbon-intensive methods that can cost as little as $1 a kg3. The efficiency factor of green hydrogen, the energy produced compared with that used, is around 65% to 75% and acts as a drag on its use4.

However, the cost of generating green hydrogen could fall by more than 60% in the next decade5, aided by falling renewables prices, increasing policy support to better price carbon, ramping up of the private sector hydrogen, investments and improving technology. In turn, this would make the element a credible source of energy.

Green H2 also becomes competitive at times of negative power prices. The rising use of renewable energy results in more volatile power prices and it is likely that negative power prices – when the electricity supply exceeds demand – will happen more and more. In that case, hydrogen production from renewable energy is an attractive solution to store energy, especially as it can be stored for a long time compared to electricity.

Despite all its advantages, hydrogen is not a panacea. Indeed, storing H2 is a relatively inefficient process (two-thirds of the original electricity can be lost). In addition, the element is highly flammable and its low density means that, outside of a pipeline, it requires almost four times more transport capacity or needs to be transformed before being transported (compression, liquefaction or chemical components). This makes the overall production process pricier.

As such, hydrogen should be seen as a possible complement to other renewable sources of energy rather than a one-size-fits-all solution. H2 is particularly relevant as an energy source for areas of the market that are difficult to electrify, such as industrial use or long-haul transport mobility.

Forecasting the potential growth of any market is usually more of an art than a science and hydrogen is no different. A lot depends on whether the strong political will to develop the industry continues.

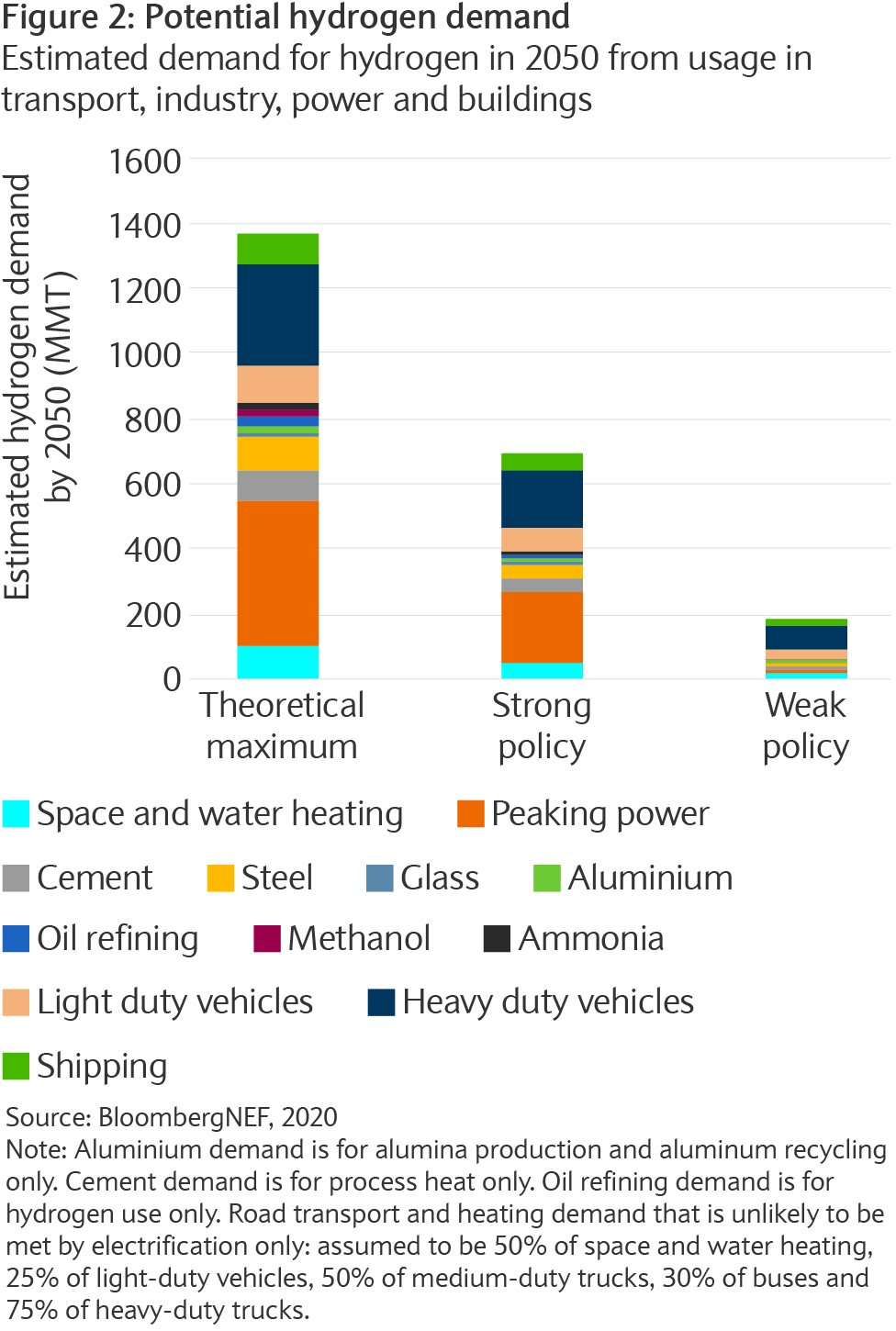

If there is strong and comprehensive policy, the BNEF estimates that 696m metric tons (MMT) of hydrogen could be used a year by 2050, a six-fold increase on current levels, representing $700bn in annual sales (see figure two). This scenario would require over $11 trillion of investment in production storage and transport infrastructure. If, on the other hand, policy is piecemeal, then the consumption could rise more modestly to just 187MMT.

Encouragingly, hydrogen energy could benefit from the COVID-19 pandemic to some degree. Indeed, as governments rushed to find ways to stimulate their domestic economies, a series of unprecedented stimulus packages have been unveiled in recent months, many of which included investments to help boost hydrogen usage.

| Country | Commitment | Announced |

|---|---|---|

| US | The US has shown increased support for hydrogen and fuel cell technologies each year, especially within the inclusion of many hydrogen provisions in a proposed $1.5 trillion infrastructure package. | |

| EU | The EU Hydrogen Strategy targets total investments of up to €400bn through 2030. |

July 2020 |

| Germany | As part of its €130bn economic stimulus package, €9bn was earmarked for the expansion of hydrogen production as part of a national hydrogen strategy. | June 2020 |

| France | A third of France’s €100bn coronavirus recovery package will be spent on green energy policies, with €7bn going towards the development of green hydrogen for the transport and the industrial sectors by 2030. | September 2020 |

| UK | Although no details have been given, the prime minister has committed to “invest massively in hydrogen”. | Summer 2020 |

| China | As many as 12 state-owned companies are all actively laying out their hydrogen plans as President Xi Jinping committed China to be carbon neutral by 2060. | Summer 2020 |

| Australia | The Australian minister for energy and emissions reductions created the “Advancing Hydrogen Fund” that offers A$300m to finance hydrogen projects. | May 2020 |

While significant, these funds remain small in comparison to the total amount required to make hydrogen a real contender to fossil fuels. Yet, the intention is clearly there and the momentum is supportive. In addition, a lot of private capital — whether it is early stage venture capital funding or capital expenditures by larger and established groups — is being channelled towards the development of hydrogen production and distribution.

In a scenario where, supported by strong policy, hydrogen use takes off, we believe that it may create significant opportunities and challenges across many sectors. The most obvious winners are likely to be the producers of hydrogen.

Utilities and renewable electricity providers are naturally seen as best positioned to prosper from a surge in demand (perhaps doubling by 2050) as grey and brown hydrogen sources turn green. However, most of the value may be created higher up in the value chain, in the industrial and chemicals space. Winners will be able to use their expertise to capture a significant portion of the infrastructure build-up (such as electrolysers development and pipelines).

On the other hand, the emergence of green hydrogen poses existential threats to the oil, gas and coal industries. While oil and gas majors could pursue vertical integration from their nascent positions in renewable electricity generation, from the production of green hydrogen and to distribution via their retail service stations (offering potential upside to downstream margins). However, this may not be enough to offset a likely collapse in demand. In any case, such vertical integration would require significant investment in the short term.

Hydrogen’s impact should not be limited to the energy sector and could have repercussions across a wide array of industries. Transport — whether its trains, trucks, autos, commercial aircrafts or ships — is at the epicenter of the H2 revolution and could be one of the most affected by such a change in demand.

While shipping could benefit the most from the reduction in emissions that hydrogen will provide, road transport is likely to be the fastest adopter. There are already several hydrogen-fuelled cars publicly available in some markets. As with electric vehicles, a move towards hydrogen-powered engines could completely reshuffle the cards and see the emergence of new contenders and leaders. This could be true for original equipment manufacturers (OEM) as well as suppliers.

The move towards hydrogen could revolutionise entire industries, potentially offering numerous opportunities for investors. However, as with any other similar paradigm shift, this process won’t happen overnight and not every company will succeed (or possibly survive) in this new environment.

For investors this has two main implications. First, hydrogen investing should be seen as a long-term commitment rather than a short-term trade. Second, as it matures, the industry’s fundamentals will likely change, requiring investors to adopt an active approach and adjust exposure accordingly.

Industry also has its part to play. To find out what this might be, we discuss with Daryl Wilson, Executive Director of the Hydrogen Council, what is needed for the hydrogen market to take off, the countries and industries best positioned to benefit from this and potential headwinds to the development of hydrogen energy as part of the transition to a low-carbon world.

As governments and companies search for renewable energy sources, who stands to profit from a hydrogen market forecast to be worth $2.5 trillion by 2050?

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.