Markets Weekly podcast

31 Mar 2025

06 October 2020

7 minute read

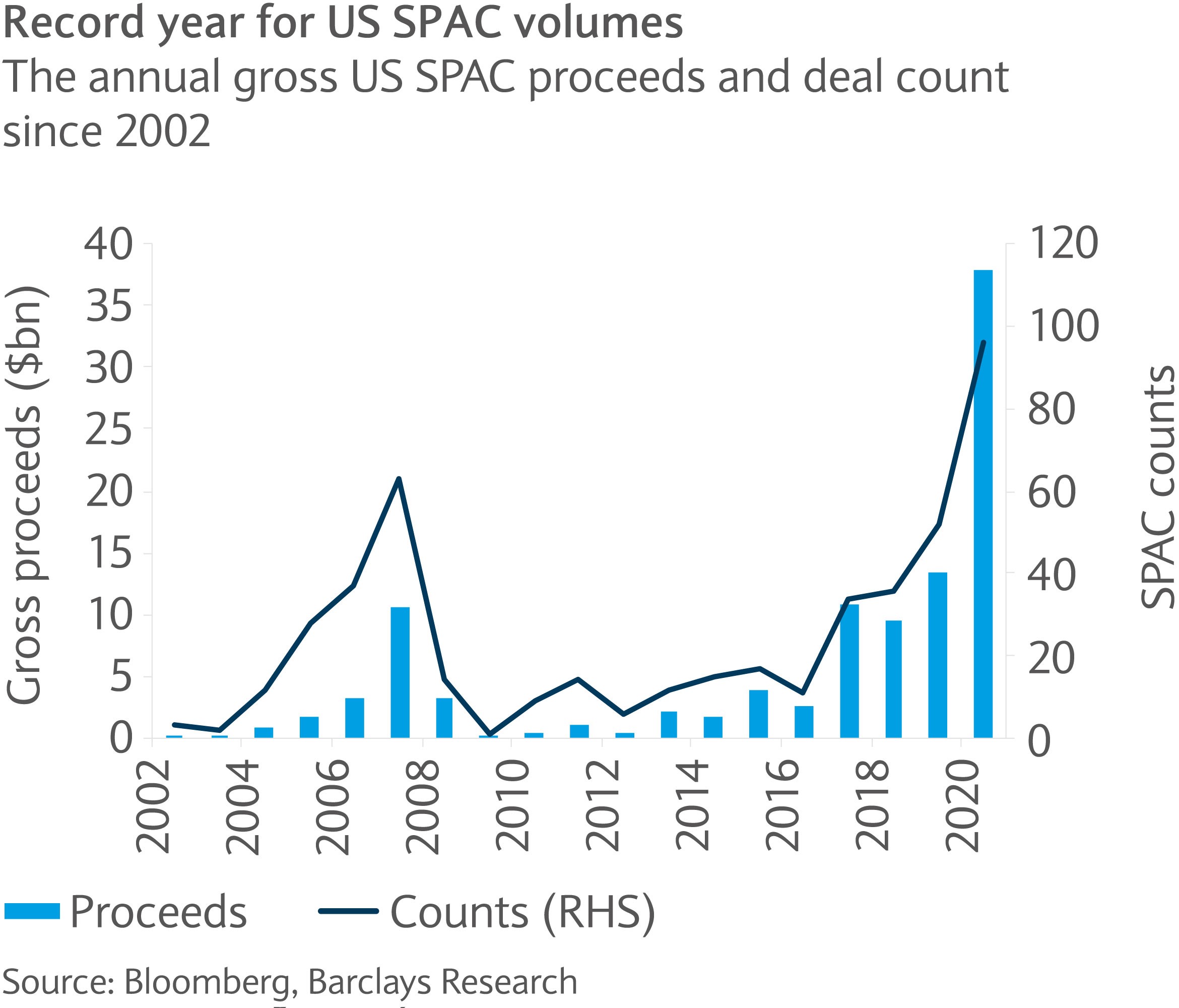

The initial public offering (IPO) landscape is being shaken by special purpose acquisition companies (SPACs). Such companies have seen a surge in activity this year, raising $40bn of IPO proceeds and dwarfing 2007’s record annual tally in the process (see chart).

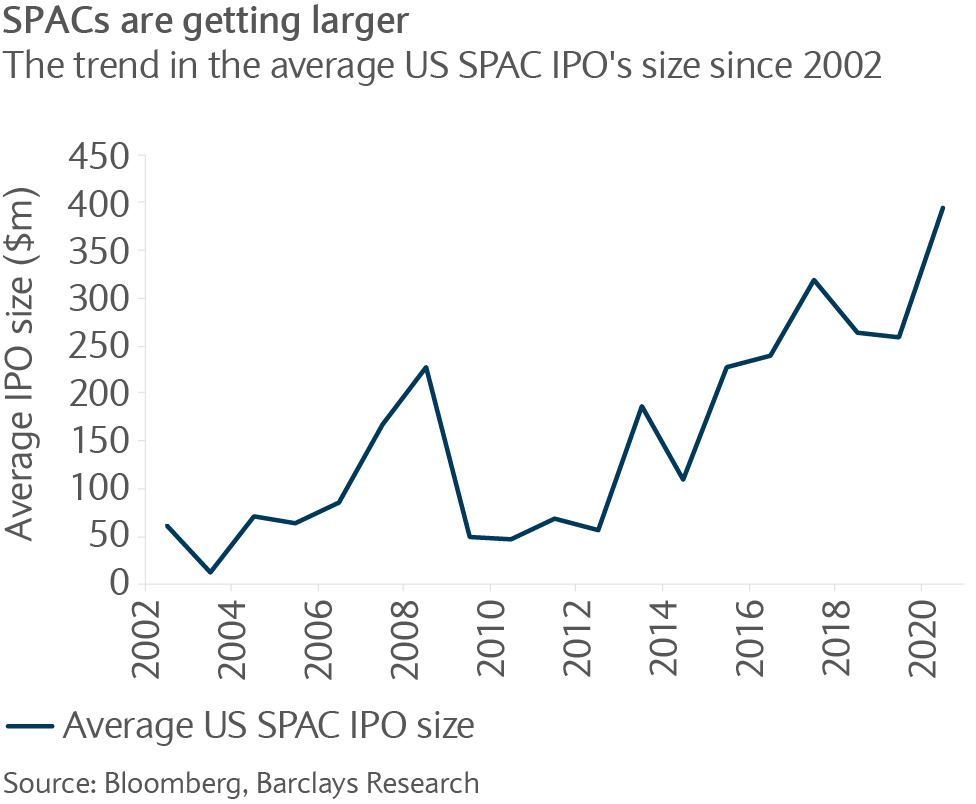

In addition to the acceleration in proceeds raised by SPACs through initial public offerings this year, the average SPAC is becoming larger (see chart).

With around $45bn of IPO proceeds currently looking for a target (including last year’s SPAC proceeds that have not yet been invested), it is likely that SPACs will be more of a feature for financial markets in the near-term. In this report, we take a closer look at their structure.

A SPAC is a publicly listed entity created with the purpose of acquiring an undisclosed operating company. Ultimately, the SPAC will take the target company public through a “reverse merger”. They are a specific type of “blank cheque” company, so-called because the particular acquisition target is unknown to investors at the time of the initial investment. The sponsor of the SPAC, commonly a private equity firm or asset manager, raises money in an IPO and uses the proceeds to make the merger or acquisition, called a “de-SPAC” transaction.

The proceeds raised are placed in a trust account and invested to earn interest, generally in US Treasuries, providing some protection for the investors while the sponsor searches for an attractive deal.

Following the announcement of a merger or acquisition, the SPAC will usually hold a vote where public investors decide whether to back the deal or not, as shareholders’ approval is generally required for the transaction to be completed. Following the vote, investors can choose to redeem their investment or keep the shares, providing an option to exit if they do not like the deal target. In general, the process is capped at two years – the SPAC must complete an acquisition over that period or liquidate the trust and return money to investors.

The SPAC raises money from investors by selling “units”, which are composed of a share of stock and a warrant (or commonly a fractional warrant). The shares are generally priced at $10 and the warrants are typically struck 15% out of the money (or $11.50) with a 5-year term and an $18 forced exercise.

Warrants are used as compensation for investors buying into a “blind pool”, so not knowing the acquisition target, giving the option to purchase more shares and increase their ownership in the target company following the merger completion. Potential value creation is completely dependent on the ability of the sponsor to identify a target (typically private) company and negotiate the purchase.

In general, the SPAC sponsor is compensated with 20% of the outstanding shares (founder shares, also called sponsor promote) in exchange of a small capital commitment. The SPAC also purchases private warrants. That initial sponsor’s investment is used for offering expenses and working capital. This is the sponsor’s capital at risk of being lost if a deal is not found along with the potential upside forsaken from the equity stake and private warrants.

There are a couple of significant differences between US and European SPACs. First, the sponsor’s “promote” is not treated the same way. In a US version, the sponsor’s promote is not contingent upon meeting any financial targets. However, the sponsors of some recent SPACs have put their equity promote into an earn-out that is only received if the company achieves certain performance objectives, further aligning the financial incentives of the sponsor and shareholders.

In a European version, the sponsor usually never receives a 20% equity compensation upfront. In this case, the SPAC sponsor only earns a promote if the company achieves certain return targets.

The second important difference between US and European SPACs lies in shareholders’ commitment. In a US version, investors have the right to evaluate the pending purchase and elect to hold or redeem the initial investment at cost (plus accrued interest) two days before the shareholder vote. In a European SPAC, investors essentially give a blank cheque as they own the shares regardless of whether they like the acquisition or not.

The ultimate objective for a SPAC is to find an attractive merger target and take the company public. There are generally three main routes to going public in the current environment: an IPO, a direct listing or a SPAC.

In the first option, a traditional IPO process, new shares are created and sold to the public. However, the pricing process, costs and lengthy timeframe involved can make this an inefficient way of taking certain companies public. This is one of the reasons that led to more focus on direct listings, where no new shares are created and existing shares are listed without involving underwriters.

Until recently, regulations did not allow companies using a direct listing to raise new capital, limiting the appeal of this process for companies in need of cash. That said, this could change in future direct listings.

In contrast to a typical IPO, a SPAC transaction takes less time and documentation. This is because there are no financial considerations or assets to evaluate at the time of the IPO, as the transaction just involves a shell company raising money for a future acquisition. As a result, SPACs are most often used in times of stress and volatility to avoid the typical time, risks and uncertainty associated with traditional IPOs.

Furthermore, in the traditional IPO process issuers are prohibited from including any forward-looking guidance. As a result, prospective investors are required to evaluate the merits of an issue based on backward-looking results and their own expectations. By contrast, the SPAC due diligence process allows a target company to present forecasts and enhances the ability to acquire early-stage companies or those with complicated business models. This can be especially attractive in industries that lack meaningful comparisons in the traditional IPO market.

With disrupting companies emerging across several sectors in recent years, the SPAC process can offer an attractive solution to list those businesses. Indeed, most of the targets in the US were in the technology or industrial sectors, based on data since January 2018 from investment bank Goldman Sachs.

The shorter execution period is a positive for both sponsors and sellers and there is no uncertainty around pricing discovery, the price being agreed between the sponsor and seller.

For public investors, the ability to redeem the investment, in a US structure, offers some protection. And contrary to the IPO, where allocation is never guaranteed, a SPAC guarantees participation in the deal. This mitigates the blind pool risk and the opportunity cost of potentially receiving the return on treasuries should no deal take places in the following two years.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.