Outlook 2021

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

19 November 2020

8 minute read

By Henk Potts, London UK, Market Strategist EMEA

China looks set to be the only major economy to expand in 2020. While US trade tensions will be key to sentiment and growth, the country is on track to become a more consumption-led economy.

China was first to feel the effects of coronavirus late last year and by February Wuhan had become the focal point of an emerging global health crisis. However, the country’s active and aggressive response has limited the impact on the state and helped to avoid a technical recession (or output shrinking in two consecutive quarters).

China’s centrally planned government introduced strict measures to reduce the spread of the virus. These included the cordoning off of infected provinces, forced isolation of suspected cases and introducing a stringent track and trace system. Authorities quickly closed schools and officials rigorously enforced a stay at home policy. The nation has seen less than 100,000 cases of COVID-19 and less than 5,000 deaths, according to John Hopkins University, an extraordinarily low figure given its population1.

After contracting in the first quarter, the world’s second largest economy returned to growth in the next one.

Recent data suggests that a persisting recovery through the summer and towards the year end. In the first nine months of this year output was up by 0.7%2.

Beneath the headline numbers, the true shape of China’s recovery is starting to emerge. Factory output has been the driving force behind the improvement in growth prospects. Industrial production is now back to pre-pandemic levels. Recent data has suggested that the V-shaped recovery has been broadening out with an acceleration in retail sales.

While fixed asset investment has been weaker than expected, property investment has outperformed despite policies to cool the sector. Export levels have improved over the past few months, up 9.9% y/y in September3, as its major trading partners have lifted coronavirus trade restrictions.

China’s policy response has been relatively restrained compared to other major economies. Although the People’s Bank of China has made cuts in selective banks’ reserve requirement ratios (RRR). In order to support the economy and with an eye on consumption, the central bank delivered a bigger than expected short-term liquidity injection in August.

However, future policy action is likely to be constrained. The stronger than anticipated recovery, along with concerns over creating asset bubbles and financial imbalances, has encouraged policymakers to consider withdrawing the stimulus, although policy rates and RRR are likely to remain on hold for some time.

There are a number of risks that could impede China’s growth prospects. As with other countries, activity remains vulnerable to flare ups of COVID-19. That said, officials have proved very adept at isolating and containing outbreaks.

Elevated debt levels could also restrain the country’s growth prospects. The Institute of International Finance estimates that China’s total corporate, household and government debt is more than 300% of GDP4. Authorities have tried to rein in borrowing growth in recent years, particularly in the shadow banking sector. However, slower expansion resulting from the trade war with the US and the economic ramifications of coronavirus, has led to a loosening in lending policy once again.

China is the world’s largest exporting nation with total exports estimated at more than $2.6 trillion in 20195, accounting for 18.4% of GDP6. As such it remains vulnerable to future travel restrictions, weaker global demand and geopolitical tensions.

The trading relationship between the US and China remains an important component of both sentiment and future economic progression. The review of the first phase of the trade deal was unexpectedly constructive and has provided a source of stability in an otherwise strained relationship.

China appears committed to instigating the key elements of the deal including greater protection for intellectual property rights, eliminating the forced transfer of technology and opening up local markets for US financial services companies. While the disruption from coronavirus has infringed on the state’s ability to buy an additional $200bn of US agricultural products, they have promised to ramp up the purchase rate.

The new Biden administration is expected to take a multilateral approach to American trade negotiations, which should help to alleviate some of the direct pressure on the relationship between the two superpowers.

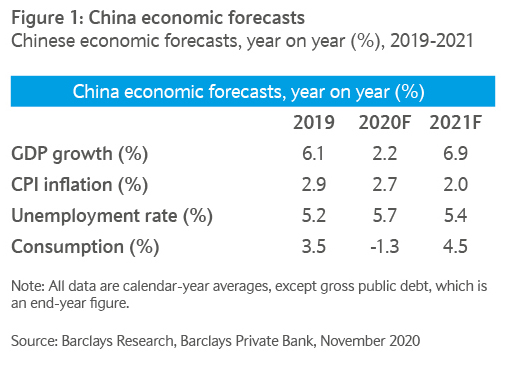

For the first time since the 1990’s China has not set an official growth target for this year, but we envisage it will grow at 2.2% and is likely to be the only major region to grow this year. Next year growth of 6.9% is pencilled in (see figure one).

At the fifth plenary session of the 19th Communist Party Committee, China unveiled its latest five-year economic and development plan. The strategy provides the outlook for China’s policy agenda and goals between 2021 and 2025. There are commitments to focus on the quality and sustainability of growth rather than the headline speed and to modernise supply chains and upgrade industry to focus on high-end manufacturing.

The leadership also wants to achieve higher quality employment and improving household income broadly in line with economic growth. Moreover, the state plans to develop new strategic industries, improve services and transportation as well as quicken energy and digitalisation developments. The fifth plenum places a high priority on innovation and technology self-reliance, boosting domestic demand and green growth.

Over the past four decades, China’s opening-up policy has created a private sector and resulted in a remarkable growth rate of 9.4%. China looks set to further transition away from its reliance on cheap labour and low-end manufacturing to focus on becoming a responsible, high-tech, domestic consumption-led nation. In turn, this could help propel it to be the world’s largest economy over the next decade.

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.