Outlook 2021

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

19 November 2020

10 minute read

By Alexander Joshi, London UK, Behavioural Finance Specialist

In the era of COVID-19 the outlook for the world, and investment returns, looks like being radically different than seen of late. At a time of heightened uncertainty, we look to help investors plan for the future from a behavioural perspective.

We may be entering a world of lower returns and weaker growth rates. However, it can be difficult to change our expectations. What can investors do to avoid being disappointed by the long-term performance of their investment strategies?

Most people can attest to a time they were expecting a gain in some domain, but the outcome was not as large as expected. Despite still being a gain, there can be a feeling of disappointment because it is below expectations; the deviation from the expectation can matter more for utility than the outcome itself.

For investors the implication is that having realistic expectations is important for when it comes to reviewing performance. Investing can be as much about emotions as well as the financials, particularly during difficult market conditions, so it’s important that you are satisfied with your investments. Not being so can make it harder during difficult times to stay invested.

More importantly, at a time when many investors will be reviewing performance and planning for the year ahead, misplaced expectations can drive allocation decisions that have long-term implications and may put investment objectives at risk.

Our past can influence and bias our expectations. Imagine you are selling your home. An emotional attachment to an asset, or anchoring around a particular price level, can influence the price a seller will accept, even when conditions have changed since the purchase. Indeed, the seller might not buy a similar house for the price being asked for theirs.

The above is an example of the endowment effect, where people’s maximum willingness to pay to acquire an object is typically lower than the least amount they’re willing to accept, to give up that same object, when they own it.

Behavioural biases, like those inherent in the endowment effect, affect our expectations of anticipated performance in ways which may lead to decisions that may harm our long- term interest. Below we outline some common biases.

Heuristics are mental rules of thumb that allow people to solve problems and make judgments quickly and efficiently, but can lead to cognitive biases in decision-making.

People often overweight information that can be readily available in our minds. When reviewing the performance of a portfolio the more emotive aspects may come to mind, such as a particularly strong narrative like a pharmaceutical company performing particularly well during the pandemic.

The economic data will probably be less likely to appear in your mind at the time, especially when what is important is the outlook, which is difficult to imagine. The likely outcome is an overweighting to the past when making decisions, which can make it difficult to reset for the future.

Anchoring: Ask a room full of people to recite the last four digits of their phone number, then quickly estimate the value of a rare trombone. We have a tendency to anchor on an initial piece of information when making subsequent judgements. When reviewing portfolios and looking ahead, there is a natural tendency to anchor around past performance and then revise future expectations up or down. Combine this with the availability bias and this effect tends to be stronger if an investor has experienced those returns for a long time.

Mean reversion: Ask a gambler at a roulette table who’s faced a few reds in a row, they might say a black is due soon. But why? Because we expect mean reversion. There can be an acceptance that after a period of particularly strong returns may come some poor ones. Conversely, after a long run of lower returns, an improvement might be anticipated. However, returns don’t need to revert to the mean.

Investors will be used to seeing the above disclaimer and intuitively understand that because an investment has performed strongly in the past, does not guarantee this to continue in the future. Knowing this doesn’t change the fact that when you are used to experiencing a trend in the past, it can be natural to expect it to continue.

Humans do not generally like uncertainty. Creating narratives and extrapolating into the future helps us to deal with this (see The dangers of extrapolation in October’s Market Perspectives). Strong narratives for continued strong returns may be hard to adjust if a portfolio is made up of high-quality companies with a strong business case (or cases that may appear superior since the pandemic began). So why should an investor expect lower returns?

While narratives may make investing exciting, there are many other determinants of investment performance. And many of them point to an environment of lower returns.

High cash rates and investment returns may be features of the past decades for now. A confluence of economic and business trends drove these exceptional returns and some of them, such as globalisation, may be on the retreat or have run their course. Total returns are unlikely to match those of previous ones. Low growth and interest rates are features expected in such a world.

Bond yields, already at historically low levels, have fallen further this year in response to sizeable policy action from central banks to support the economy in the face of the coronavirus pandemic. The banks cut interest rates and expanded their balance sheets with enhanced bond buying, putting further pressure on near zero or negative yields in developed markets.

The US Federal Reserve does not even seem to be thinking about raising rates and yields of close to zero are likely to persist until at least 2023. The Bank of England has cut rates to 0.1% and continues its substantial asset-purchase programme, which it increased in response to the second English lockdown, and is considering how negative interest rates might be implemented as needed. Further accommodation is likely as more restrictive containment measures are implemented across Europe.

The European Central Bank, which has maintained negative rates for the past five years and that stand at -0.5%, plans to run its Pandemic Emergency Purchase Programme until June 2021. At €1.35 trillion1 the programme is larger than that seen in the euro crisis early in the last decade.

As a reminder, with negative interest rates commercial banks are charged interest to keep cash with a central bank, rather than receiving interest. The aim is to feed that cash through the financial system. There is no such thing as a free lunch, and therefore something has to give.

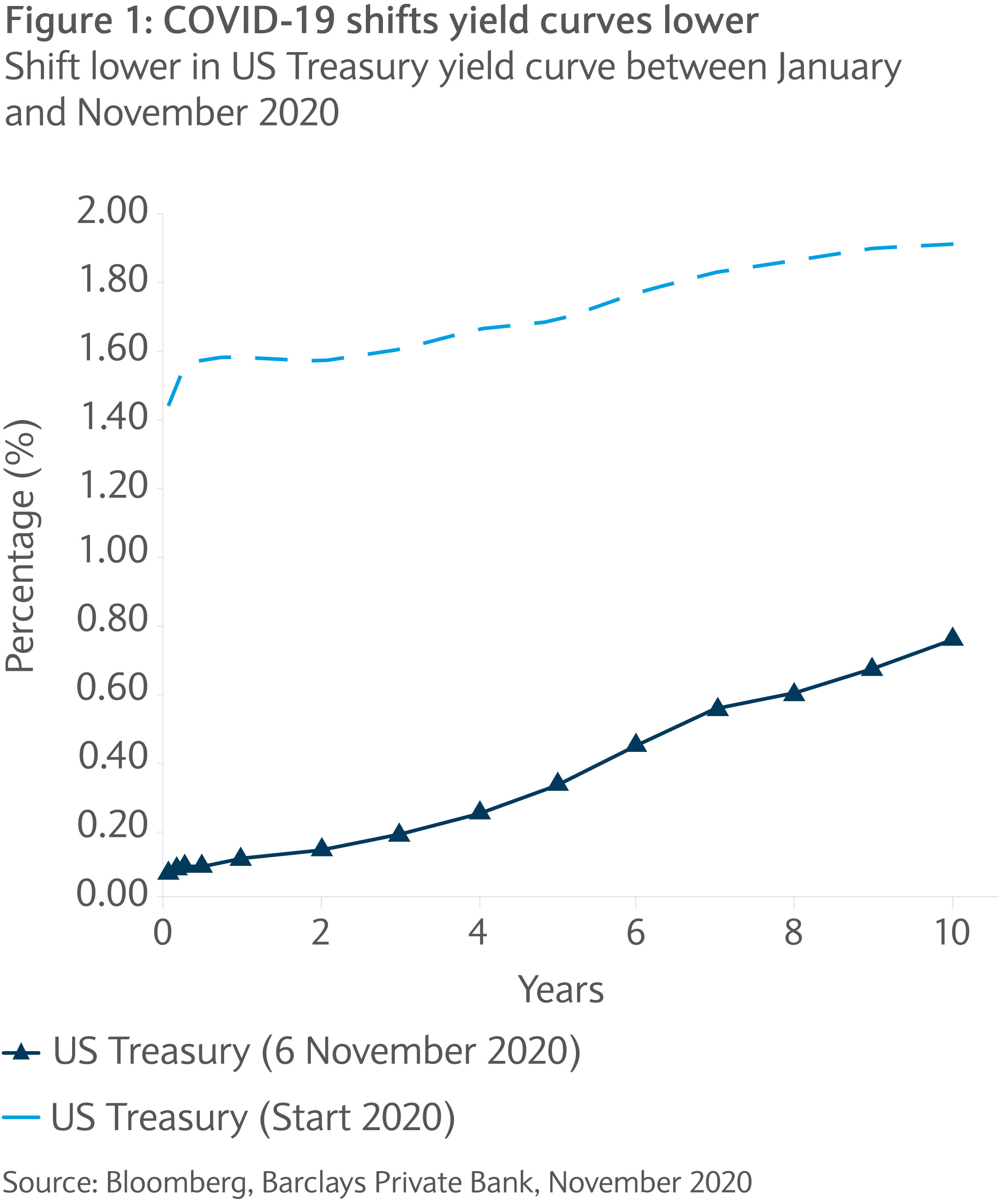

While rates at the long end of the curve may be quite volatile for much of 2021, there are signs that short-end rates are likely to stay low (see figure one). This suggests preparing for a prolonged period of low yields and potentially managing liquidity differently.

The message is clear; a resetting of expectations for risk and return is required. Recent returns look unlikely to be repeated over the medium term for low or risk free rates. While resetting expectations is important in trying to avoid disappointment, a lower-rate environment could suggest a need for a change in investor behaviours. Investors may need to work harder to make returns.

The implications of a lower-rate world for reaching existing investment objectives might mean investors need to put more capital to work in financial markets. Additionally, and more importantly, active management of that capital may be preferable to achieve desired returns.

Those saving sufficiently for retirement under historically low rates may be caught short in an era of lower returns. This could require more cautious drawdown strategies with less money withdrawn each year. A lower return era looks like being one involving individuals saving more for retirement, retiring later or consuming less during retirement.

Investors should consider how their objectives would be affected by negative deposit rates or two-year bond yields. While it may not be a base case, those expecting such a scenario might want to hedge against it.

Although the elevated uncertainty seen this year may fall next year, uncertainty is a staple part of investing. Events will continue to occur which spark bouts of heightened volatility. Despite the modest expected returns in asset classes such as fixed income, diversified portfolios of high-quality companies can protect and grow wealth in different investment environments, for long-term investors remain attractive.

Despite the modest expected returns in asset classes such as fixed income, diversified portfolios of high-quality companies can protect and grow wealth

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.