Outlook 2021

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

19 November 2020

7 minute read

By Henk Potts, London UK, Market Strategist EMEA

With output contracting sharply, a renewed surge in COVID-19 infections and uncertainty over a Brexit trade deal with the EU, can the UK economy bounce back next year?

This was supposed to be a seminal year for the UK economy as it left the European Union (EU) on 31 January and entered into an 11-month transition period. Its fortunes were expected to be determined by the negotiations surrounding its future trading relationship with the 27-country bloc.

While the UK’s medium-term growth prospects will be influenced by the shape of any deal, COVID-19 now defines the UK’s growth profile.

The UK has been particularly hard hit by the pandemic, registering a record number of deaths in Europe and the worst second-quarter contraction of any major economy in the bloc. The decline was widespread. The peak to trough decline in gross domestic product (GDP) between February and April was 25.6%. Hospitality saw the biggest drop in productivity and business investment.

The UK labour market is projected to be one of the biggest casualties of the economic disruption. The long- awaited pick-up in unemployment started to show in figures released in August and are projected to accelerate aggressively over the next few months. Figures from the Office for National Statistics (ONS) show UK job cuts jumped the most on record in the three months through August. The most disturbing element was the sharp drop in the number of employees on payrolls in September compared to March.

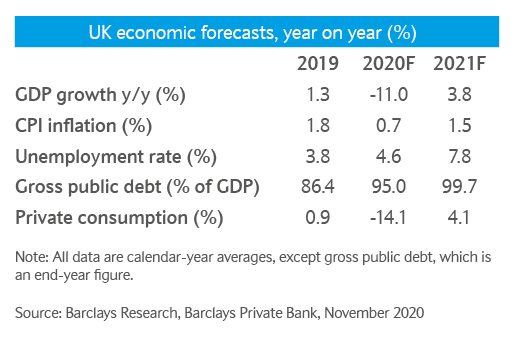

In September, the UK’s unemployment rate rose to 4.5%, the highest since 2017, according to the ONS. The worst is expected to come as the furlough scheme is eventually replaced by the less accommodative jobs support scheme. We believe that the unemployment rate may peak at over 8% in the next few months. That said, the labour market should recover in 2021. We expect the unemployment rate to be 7.6% by next December, still higher than at the start of the pandemic when the rate was 3.9%.

Policymakers, along with other countries, have responded to the economic challenges by aggressively loosening monetary conditions and unveiling a wide-ranging fiscal package.

The dramatic fall in output prompted the chancellor to open the spending taps and turn his back on a decade of austerity. The government injected hundreds of billions of pounds into the economy, primarily aimed at tackling the fallout from the outbreak. The funds have been channelled through accelerated infrastructure projects through the recovery phase, loan guarantees to businesses and furlough schemes to help stem soaring unemployment claims.

The expansive actions have seen an unmatched rise in peacetime borrowing. As a result, we predict UK debt to surge from 86% of GDP last year to 95% in 2020.

Since the start of the pandemic, the monetary policy committee (MPC) has cut interest rates to a record low of 0.1% and ramped up its bond-buying programme to £895bn. The Bank of England has extended the timeframe for purchases until the end of next year. The potential for an extensive contraction, lacklustre inflation expectations and continued Brexit uncertainty, has encouraged the MPC to signal that it was prepared to add yet more stimulus and would consider negative interest rates.

We anticipate that the central bank will reduce the bank rate to zero, lower the capital requirements for banks and offer even more dovish guidance. In order to encourage lending, especially to small and medium-sized enterprises, a cut in the Term Funding Rate to -50 basis points may also be on the cards. Given the broad range of unintended consequences the introduction of a negative bank rate remains unlikely, but is still possible if the UK’s growth profile dramatically deteriorates.

Boris Johnson’s Conservatives came to power in December 2019 pledging to “Get Brexit Done”. Nevertheless, the path to a comprehensive trade agreement has been far from smooth, with a number of areas of contention delaying definitive progress. The UK and EU continue to clash over a number of areas including fishing rights, state-aid rules and regulations, level playing field commitments and the Northern Ireland protocol.

Despite the negative mood music, we still think that a trade deal is achievable. As such, the most likely outcome is expected to be a very thin trade deal. In practice, while this prioritises trade in goods, it is likely to mean restricted market access for services since the UK would be signing up to fewer obligations.

Failure to secure a deal would put further pressure on the UK economy and businesses. A no-deal Brexit would likely result in companies having to comply with trade barriers, tax changes as well as talent pool and regulatory restrictions. On the positive side, there are signs that the UK has been making early progress on trade agreements with countries outside the EU. Although Europe is the UK’s most important trading partner.

There have been signs of a fragile recovery as the UK economy reopened, after April’s low point. Mobility indicators show higher public transport use and driving activity. Electrical power load usage has rapidly recovered from the spring low, activity in the housing market has been robust and retail sales volumes have also been rebounding.

However, we have become less constructive around the prospects for the UK economy and expectations of a quick normalisation have faded. A resurgent virus and the associated intensification of containment measures, along with rising unemployment, higher precautionary savings and at best a thin trade deal with the EU, creates a gloomy backdrop.

We anticipate that output will contract by 11% in 2020 followed by a softer recovery. We forecast growth of 3.8% year on year in 2021, partly reflecting the deep contraction.

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.