Outlook 2021

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

19 November 2020

7 minute read

By Henk Potts, London UK, Market Strategist EMEA

After the turmoil of coronavirus, soaring unemployment and a rancorous presidential election, a period of renewal and steady growth may lie ahead.

The US economy has battled through a difficult year as activity was ravaged by the coronavirus at the same time as social unrest and a divisive presidential election. The strict lockdown measures imposed due to the virus halted economic activity for a time. Second-quarter gross domestic product (GDP) contracted at its fastest pace on record, shrinking by 31.4% quarter on quarter (q/q) on an annualised basis1.

Despite this, the economy roared back at record speed in the third quarter, expanding by 33.1% q/q1. The surge in activity was driven by the relaxation of restrictions, stimulus fuelled consumer spending and sizable gains in exports. The US housing market boomed, with residential investment climbing at its fastest pace since 1983. Business investment has been particularly upbeat, registering an astonishing 70% q/q improvement. This corporate spending partially reflects the requirement to address the challenges and protocols created by the pandemic. It also suggests that companies are confident enough to commit to capital spending plans.

The presidential election was much tighter than many pollsters predicted and the “Blue Wave” failed to emerge. While the balance of power in the US Senate will ultimately be determined by run-off elections in Georgia in January, Republicans are expected to maintain control.

The close race and split legislature could crimp the new administration’s ability to fully implement its domestic policy agenda. Aggressive tax hikes may need to be tempered, the regulatory risk overhanging the technology sector is expected to ease and a tighter, more focused stimulus package is anticipated to be agreed.

We still, however, expect Joe Biden to push ahead with his broad policy objectives including measures to invigorate the middle class, commitments to affordable healthcare and developing workers’ rights. The president-elect is also expected to place a greater emphasis on global policy areas such as climate change, international institutions and the promotion of shared values.

Personal consumption is the primary driver of the US economy, comprising around 70% of GDP2. In March access to services was significantly reduced due to business closures, social distancing and stay-at-home orders. The huge increase in unemployment caused by the pandemic also slashed disposable income for many households, the most important determinant of consumer spending. With less income, households cut back expenditure with consumer spending slumping by 33% in the second quarter.

A mixture of re-opening economies and pent-up demand helped retail sales and consumer confidence rebound through the summer. Retail spending was also supported by the stimulus of the Coronavirus Aid, Relief and Economic Security (CARES) Act, which paid households $267bn during March and April. Consumer spending surged 41% in Q3. The Consumer Confidence Index recovered to 101.3 in September3, up significantly from August, although the index is significantly lower than the February level of 130.74.

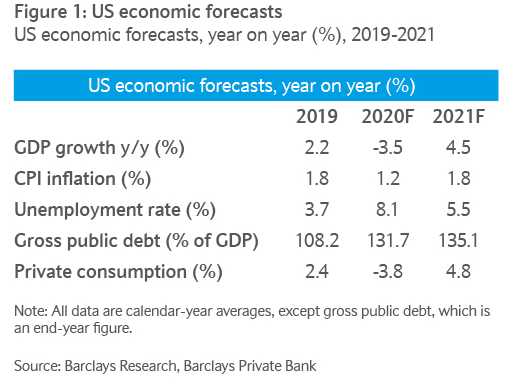

The strength of the labour market directly filters through to consumption levels. Before the pandemic the US unemployment rate was at a multi-decade low of 3.5%. The locking down of the economy triggered a surge in job losses, with the unemployment rate hitting 14.7% in April5, the highest since the Great Depression. The labour market has since experienced a rapid recovery, although it seems to be losing some momentum now. We expect the US unemployment rate to finish this year at 6.5% and at 5% by the end of 2021.

The increase in unemployment and consumer debt from the pandemic will keep consumer spending suppressed among some groups for a significant amount of time. Although, we do expect private consumption growth of 4.8% in 2021, which would recover most of the contraction from this year.

The US Federal Reserve (Fed) has aligned its forward guidance with its aim to achieve maximum employment and 2% average inflation. The central bank has effectively vowed to keep rates close to zero through 2023, as its preferred core inflation measure is projected to remain below 2%, with no period of overshoot over the next three years. For 2021 we estimate that the US core personal consumption expenditures price index will average 1.5%.

The aggressive policy measures and framework review demonstrates that the Fed is willing to do whatever it can to support the US economy. Fed Chair Jerome Powell stated they still have additional ammunition if required including lending tools, its balance sheet and further forward guidance. Given the risks to the recovery and potential fiscal shortfall, the Fed is likely to increase its monthly bond- buying programme, from the current $120bn level, and include a broader range of securities.

With the US economy facing the biggest economic downturn since the Great Depression, a considerable increase in stimulus has been unavoidable. The bulk of this has come from the CARES Act. The largest rescue package in the country’s history, amounting to more than $2 trillion6, the legislation is aimed at protecting citizens from the public health and economic impact.

As a result of the measures, US public debt has rocketed to 132% of GDP this year from 108% in 2019. An additional stimulus package may also follow early next year, possibly of the order of $500m, putting further on the already record budget deficit.

The immediate US growth profile still remains uncertain and will inevitably depend upon the ability of authorities to tame the virus and push ahead with additional fiscal stimulus.

The outlook for 2021 suggests a year of steady recovery as companies rehire workers, consumer spending rebounds and activity is supported by overwhelming monetary and fiscal policy. From the low base of 2020 we forecast that the US economy will grow by 4.5% next year.

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.