Outlook 2021

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

19 November 2020

11 minute read

By Gerald Moser, London UK, Chief Market Strategist and Nikola Vasiljevic, Zurich Switzerland, Head of Quantitative Strategy

In the shadow of coronavirus, bloated government debt levels, low rates and expensive equity valuations, prospective investment returns are likely to be low. What might investors do to position portfolios for a post-pandemic world?

It is impossible to take a view on 2021 without first reviewing this year and its unprecedented events. The economic shock caused by the effects of the pandemic saw far from a typical slowdown. It was much more brutal and sudden than that.

Normally, growing imbalances in some parts of the economy would trigger a readjustment. Depending on the size of the imbalances, it could take six months to two years to reach equilibrium. This time the contraction did not begin with an imbalance, but stemmed from stringent restrictions imposed to tame the COVID-19 pandemic. This meant that relatively stable economies came to a halt almost overnight.

The shock was broad based but disproportionally affected the services sectors compared to a traditional recession which tends to hit manufacturing and industrial production more. Considering the large size of the services sector in developed economies and the sector reliance on labour rather than capital, this shock resulted in a sizeable increase in unemployment.

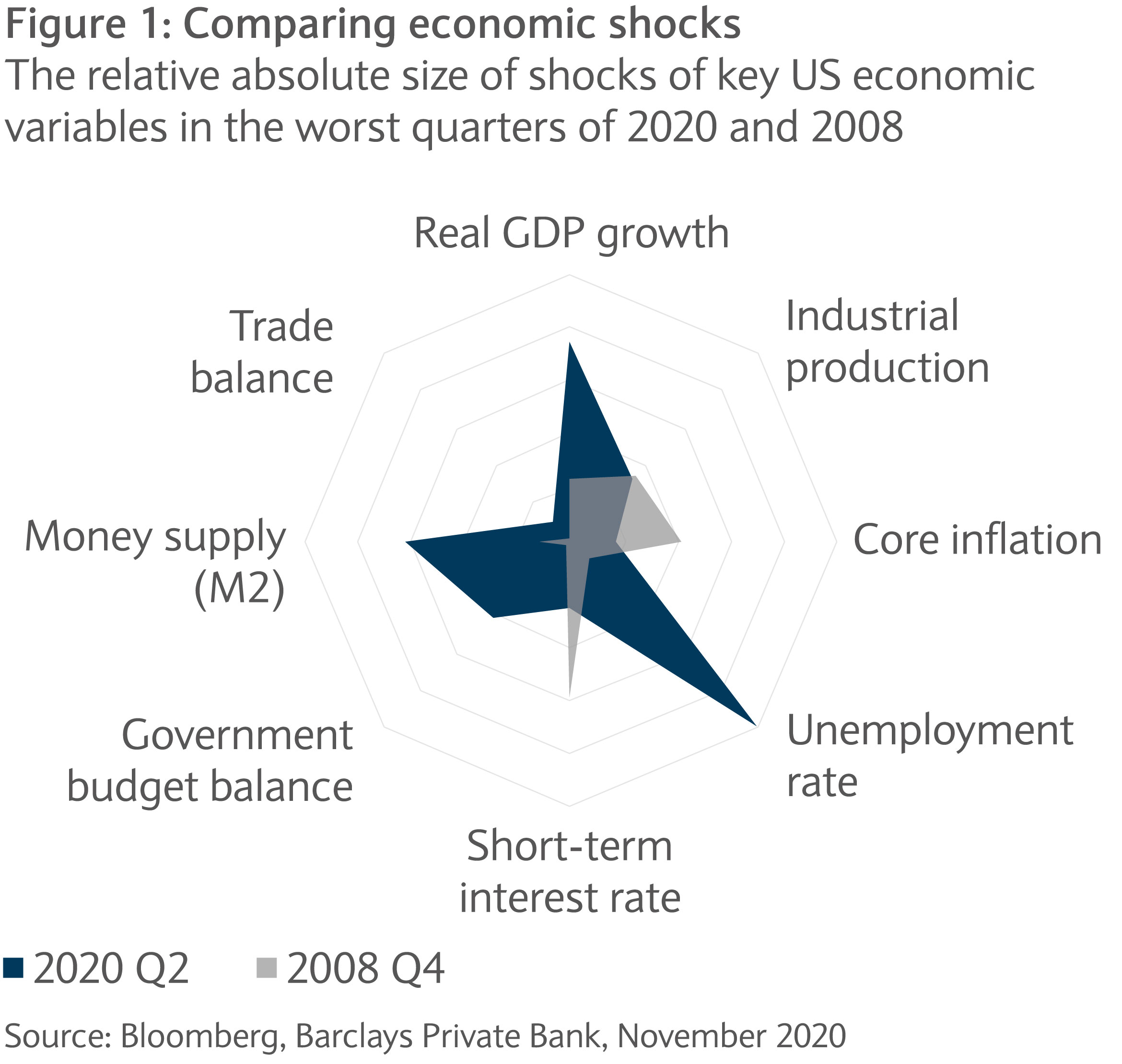

To give an order of comparison of what happened in the second quarter of 2020, we compare key US economic variables in that quarter to the weakest quarter of the 2008 crisis, widely considered the worst shock in living memory at the time (see figure one).

The impact on unemployment in this year’s quarter is striking in magnitude, though it is the mirror image of the record contraction in real gross domestic product (GDP) growth. With interest rates already at very low levels, one other noticeable difference with 12 years ago is the very swift expansion in quantitative easing by central banks, resulting in an increase in the monetary supply.

With rising unemployment and lockdown measures, the impact on society was also much larger than anything we have experienced since World War Two. It has profoundly changed lifestyles and social behaviour of many individuals, and completely altered their routine.

While many effects of the pandemic are expected to be transitory and fully contained in the medium and long term due to the exogenous nature of the shock, there are other changes which are likely to be structural.

Despite many countries reporting high infection numbers and preparing for new restrictions and lockdowns at the time of writing, a solid, and initially fast-paced, economic upswing is likely once the world finally claims the victory in the battle against the virus. There is not much question around this, the only unknown is around the timing of this recovery.

While many effects of the pandemic are expected to be transitory…there are other changes which are likely to be structural

But after the rebound, and the economy recovers some, if not all, of this year’s lost ground, some areas of the economic landscape are likely to look different from before the pandemic. Inflation risk is a particular case in point.

Over the past three decades, globalisation has increased competitiveness and lowered market costs. Global supply and value chains have immunised open economies from inflation outbursts. Rising populism and geopolitical tensions over the past few years, coupled with falling cost differentials between the developed and emerging economies, increasing inequality in developed countries and the potential fragility of supply chains, could eventually boost inward-oriented economic models.

This focus on domestic demand is likely to be the main feature of China’s next five-year plan that should be ratified in the first half of 2021. More broadly, most of the fiscal stimulus in developed countries announced in the wake of the COVID-19 outbreak contains incentives to onshore some of the supply chain and increase domestic manufacturing capacities.

Another legacy from the pandemic crises will be elevated government debt. While the second wave of coronavirus cases that northern hemisphere countries face is likely to push the debt/GDP numbers even higher, it has already increased by around a fifth in the developed world and tenth in the developing world1.

At current rates and yield levels, the cost of servicing government debt is lower than it was a year ago, even though debt levels have increased. And while the increased duration offers some protection against a dramatic increase in interest payments in the short term, it increases the vulnerability of economies in the long run. This is particularly true for emerging markets where central banks often don’t have enough credibility to implement quantitative easing and have to balance the cost of debt with the need to lure capital flows to finance the debt when setting interest rates levels.

Awakening of inflationary pressures would likely push interest rates higher, which in turn would raise concerns regarding sovereign debt and fiscal stability. That said, we stress that this is only one potential macroeconomic risk scenario which has low probability over short and medium term. However, given its increasing likelihood and far- reaching consequences over a longer time horizon, it is important to keep this in mind when thinking about 2021 and beyond.

Finally, technological change and sustainability are two topics which have benefited from the crisis. Social distancing has led more activities, whether work or leisure related, to move online. The pandemic has accelerated the process of digitalisation and virtual experience. This has implications for real estate, transport, retail and leisure among other sectors. Events have put more emphasis on the fragility of our economic system, with its sustainability being more and more questioned. Almost all fiscal spending announced this year has a sustainable bias attached to it and the momentum behind sustainable investments is likely to grow ever stronger.

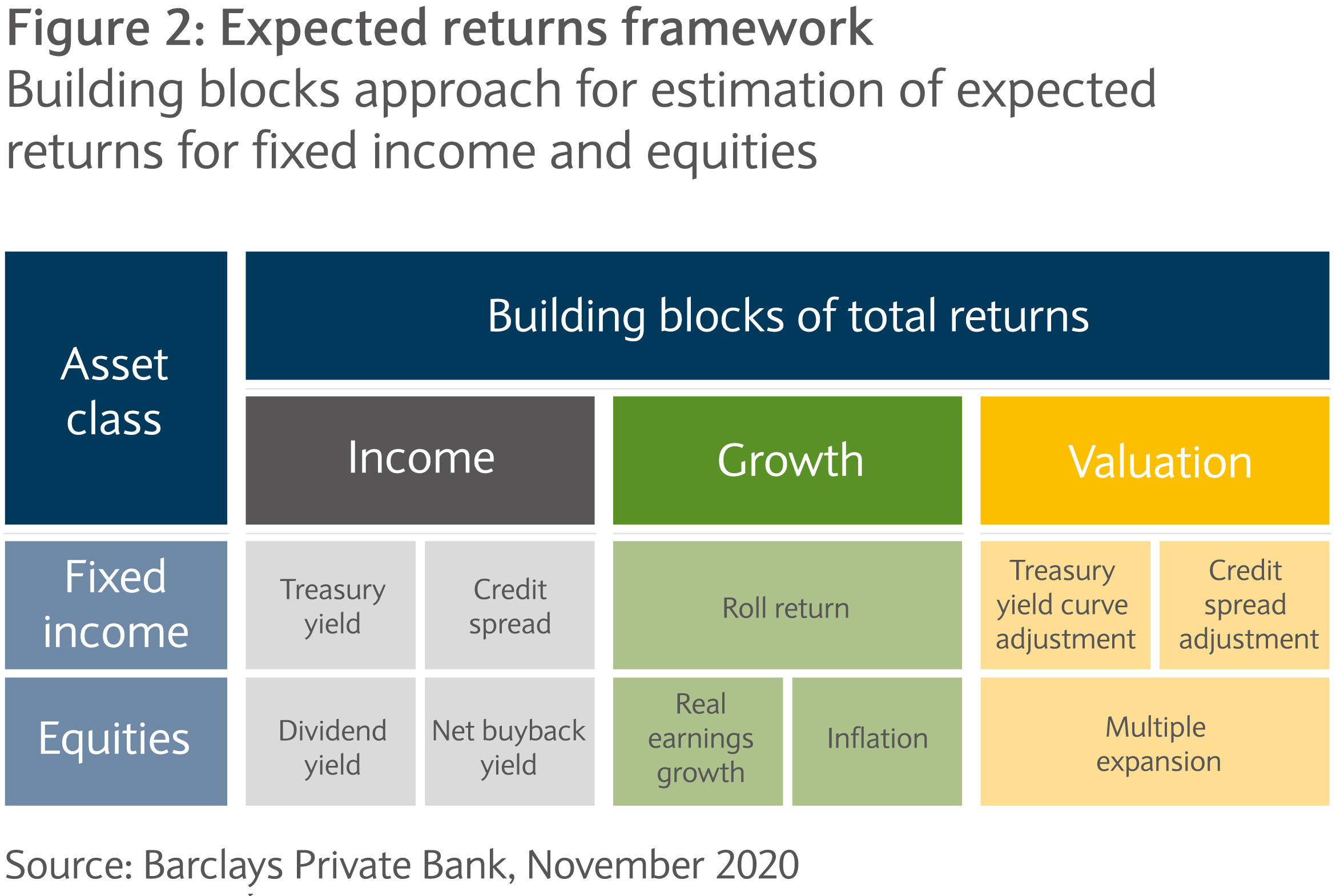

While next year should be calmer than this, with more chance of a vaccine becoming available then, uncertainties around the aforementioned structural changes may keep volatility more elevated than before the pandemic. This could affect asset performance. But before assessing prospects for each asset class next year, it is worth considering their long-term return expectations to focus on investment prospects and reduce the influence of the short- term market noises (see figure two).

Long-term anticipated total returns can be estimated by adding three fundamental components: income, growth and valuation adjustments. Growth, inflation, fiscal and monetary policy are among the key drivers. A summary of the building blocks is provided in figure two.

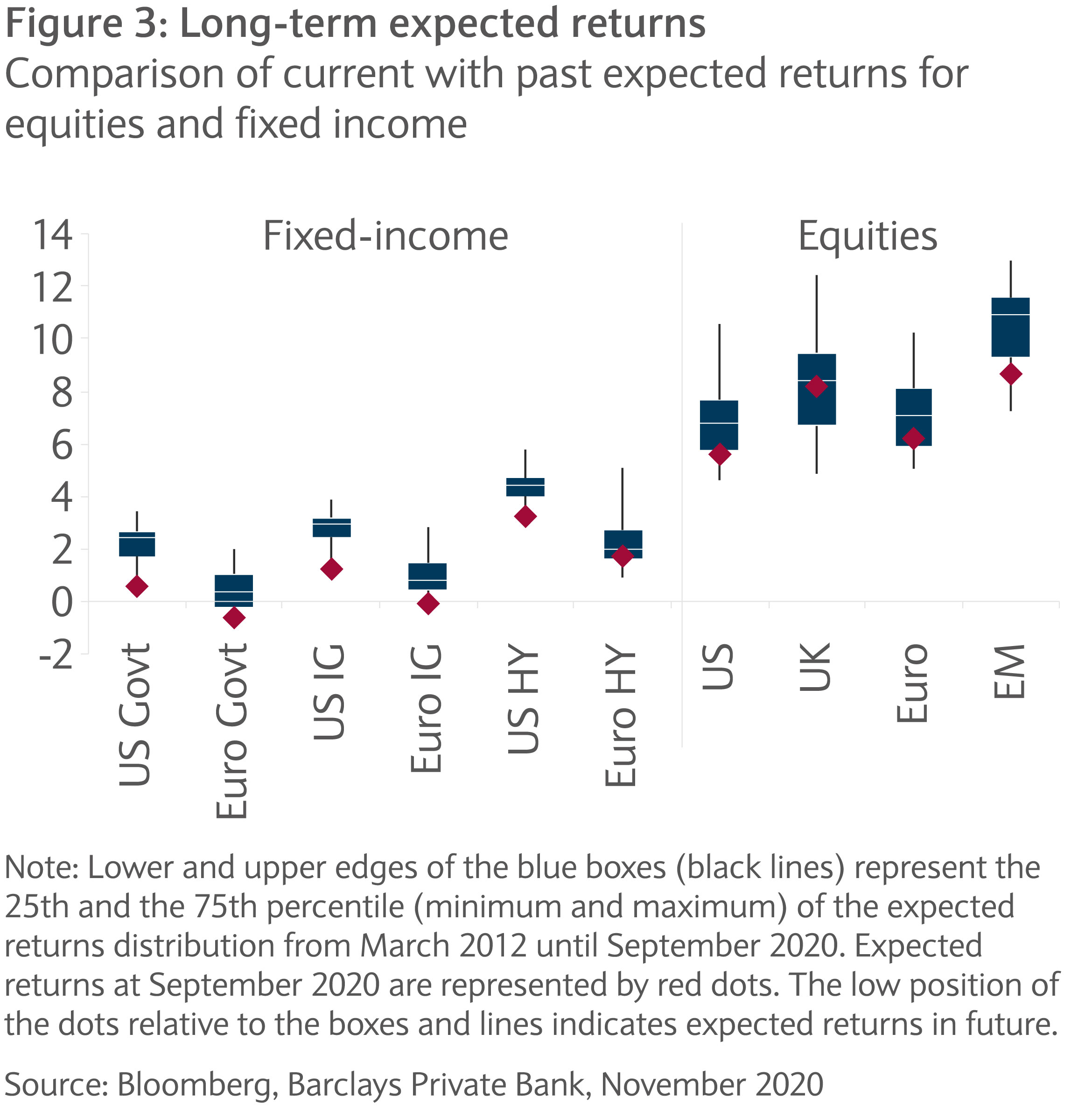

In an investment world characterised by record low interest rates and high equity valuations, the total returns for the core asset classes over the next five years are expected to be lower than the corresponding past realised returns (see figure three).

The expected returns for developed market bonds are at the historical minimum due to extremely low yield levels in many countries. Since the income component is the single most important building block for fixed income assets, it is not surprising that falling yield are heavily weighing on bond returns. For example, the nominal yields on 30-year government bonds in the eurozone and Switzerland are negative. Consequently, the expected returns for both government and investment grade bonds are below zero.

In the US and UK, expected returns remain positive, however recent downward shifts of the yield curve have compressed them below 1%. European and US high yielding bonds offer more attractive returns of about 2-4%. Nevertheless, when adjusted for inflation, the returns for lower quality bonds are also hovering a meagre 1% above zero. Finally, if we consider a scenario in which inflation risks discussed above materialise, fixed income assets could post even lower realised returns.

Equities are also expected to be under pressure, primarily due to stretched valuations. Historically elevated cyclically adjusted price-to-earnings ratio indicates a likely multiple contraction over the next few years, though it is unlikely to materialise meaningfully in 2021 as central banks should remain accommodative. But even if the full reversion to mean for valuations seen in the previous decade is unlikely, due to persist low rates and the changing composition of benchmark indices – with technology’s share in the market portfolio steadily increasing – some adjustment looks likely over the next five years.

However, dividends and net buybacks of shares are expected to provide a stable income yield. Overall, our analysis indicates that developed market equities could offer nominal returns of 5-7% annually over the next five years. Emerging markets will likely provide a risk premium of 1-2% on top of that.

While anticipated returns may be historically low, equities offer a decent investment opportunity due to their growth component. Compared to bonds, equities can act as a hedge in case of inflation and, with a thorough selection process, can still offer returns closer to historical returns.

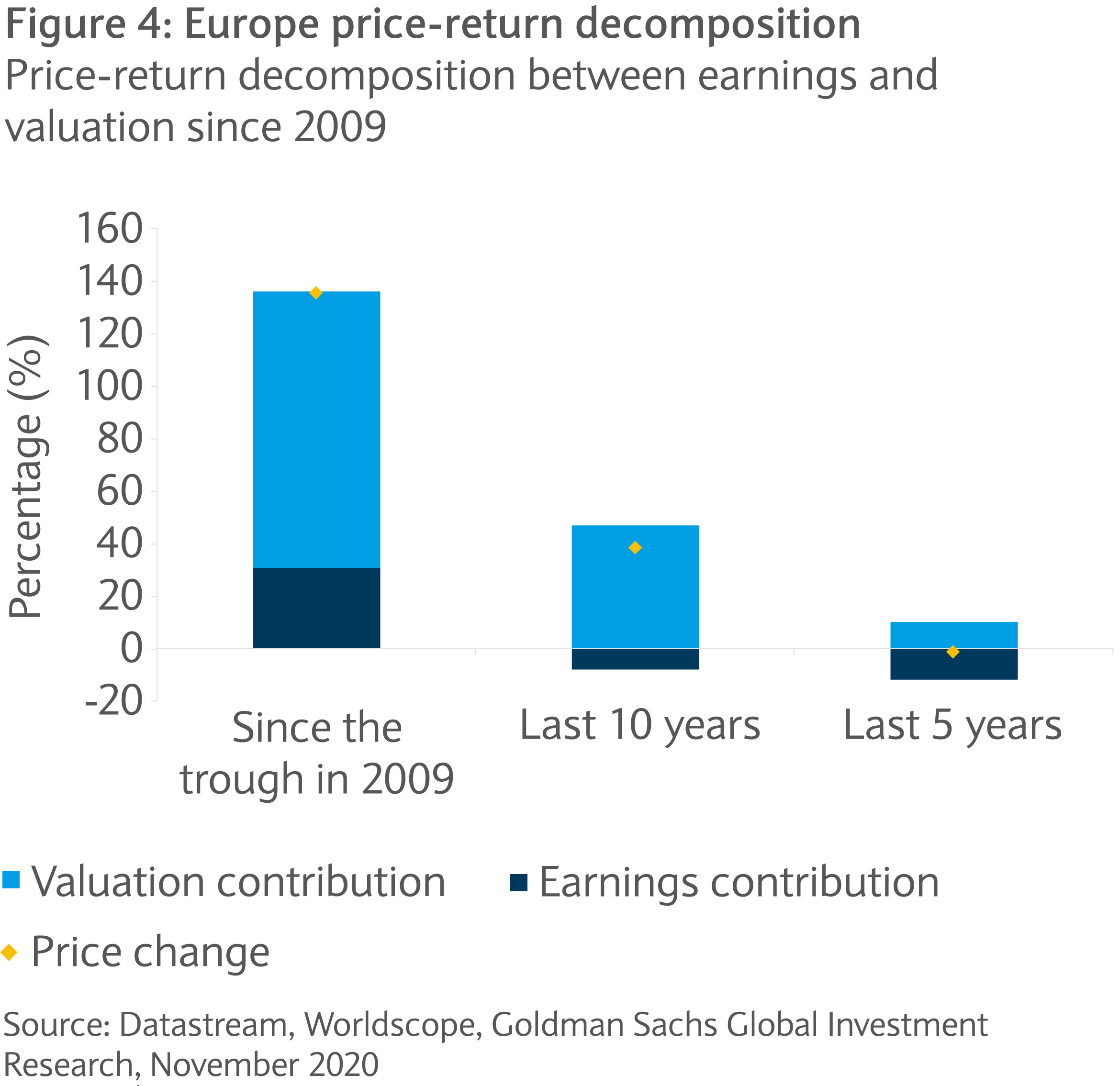

The return numbers mentioned previously are at the index level, but when valuation is no longer the main driver of performance, the importance of single-stock investing appears much more evident (see figure four).

Looking to next year, central banks seem unlikely to tighten monetary conditions, but there is not much room for expansion either. In that sense, the valuation expansion in equities in recent years, aided by lower rates and an expanding liquidity pool, is unlikely to be a key driver. The onus for returns is now on growth, making it more important to look for where growth is still happening.

We believe that a focus on quality selection and exposure to secular growing trends are the appropriate way to invest in equities. We highlighted four themes where we see incremental growth over the next few years: 1) Globalisation reversion, 2) Building a sustainable world, 3) Smart everything and 4) Demographic shifts. In 2021, we think that the sustainable rhetoric will be front and centre while smart everything is also likely to continue to benefit from infrastructure spending post pandemic.

In 2021, we think that the sustainable rhetoric will be front and centre while smart everything is also likely to continue to benefit from infrastructure spending post pandemic

The low levels of volatility seen prior to the pandemic are unlikely to be repeated soon. While uncertainty levels should decrease compared to last year, somewhat elevated uncertainty may persist due to macro developments, geopolitical risks and the potential structural changes mentioned previously. This means that portfolio construction and, more precisely, the need for diversification becomes more important.

The diversification benefits of bonds have eroded in the low-rate environment. With income return prospects weak and limited capital appreciation potential, the attractiveness and effectiveness of a classical 60-40 portfolio – 60% invested in equities and 40% invested in bonds – have faded. Such a portfolio will likely exhibit lower returns and elevated volatility relative to the historical figures. Therefore, a carefully tailored multi-asset portfolio seems needed more than ever to address the issue of lower return and higher volatility.

Due to inflation risk concerns, inflation-linked bonds could be one of the most important additions to a fixed income bucket which is nominal in nature and as such is unprotected from unexpected spikes in inflation. Credit and illiquidity premia could help to boost expected returns in the fixed-income space.

More broadly, private markets should continue to play an ever increasing role in a well-diversified portfolio as opportunities remain plentiful in both equity and debt universes. A high-volatility and low-return environment could also favour hedge funds. The asset class has suffered in the past decade from relatively low volatility and high returns in public markets. But with lower returns for most asset classes, notably fixed income, hedge funds could again be an attractive option to diversify a portfolio.

Depending on the strategy, hedge funds tend to be more or less correlated to equity markets. But even more so than in public markets, the dispersion in the hedge fund investment universe has increased. This means that active investment approach in this space is of paramount importance for investors looking to generate alpha.

Finally, gold continues to appeal as a solid diversifier in a portfolio. With real rates low, and even negative in some places, the precious metal should continue to offer protection in case of rising volatility without being a drag on performance in quieter periods. Its strong relationship with real rates should also offer protection against positive inflation surprises.

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.