Outlook 2021

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

19 November 2020

7 minute read

By Jai Lakhani, London UK, Investment Strategist

Producing desired returns in a low-return world with traditional 60-40 equity-bond allocations can be challenging. In searching for a diversified, uncorrelated asset mix, alternatives may be an answer. Is it time to up positions in hedge funds and private markets?

Investors are continuously told that the only free lunch is diversification. While this seems simple enough as a concept, execution can be contentious. Investors, in particular retirement fund allocators, have traditionally followed a 60-40 equity-bond mix, that is 60% to equities and 40% to bonds.

Historically, the two asset classes have been negatively correlated (enhancing diversification) and have navigated portfolios through rocky shores. As discussed in August’s Market Perspectives, the 60-40 portfolio – based on S&P 500 and US aggregate bonds – delivered an attractive annual total return of 8.5%, with volatility of 8.8%, from 1992 until 2019. During the same period, equities averaged 9.8% a year but at the cost of substantially higher volatility of 14.4%.

We expect government bond returns to be flat or negative over the next five years

In recent years, sluggish growth, disinflation and an aging population increasing appetite for fixed income has driven rates down. Combined with very accommodative monetary policy and firmly negative real cash rates, we expect government bond returns to be flat or negative over the next five years.

What’s more is that the world order is still struggling to come to terms with handling the pandemic, let alone adapting to a COVID-19 environment. Despite this, equity valuations rebounded. With equity valuations elevated, this could mean that equities also experience limited returns as all of it has to come from growth in earnings.

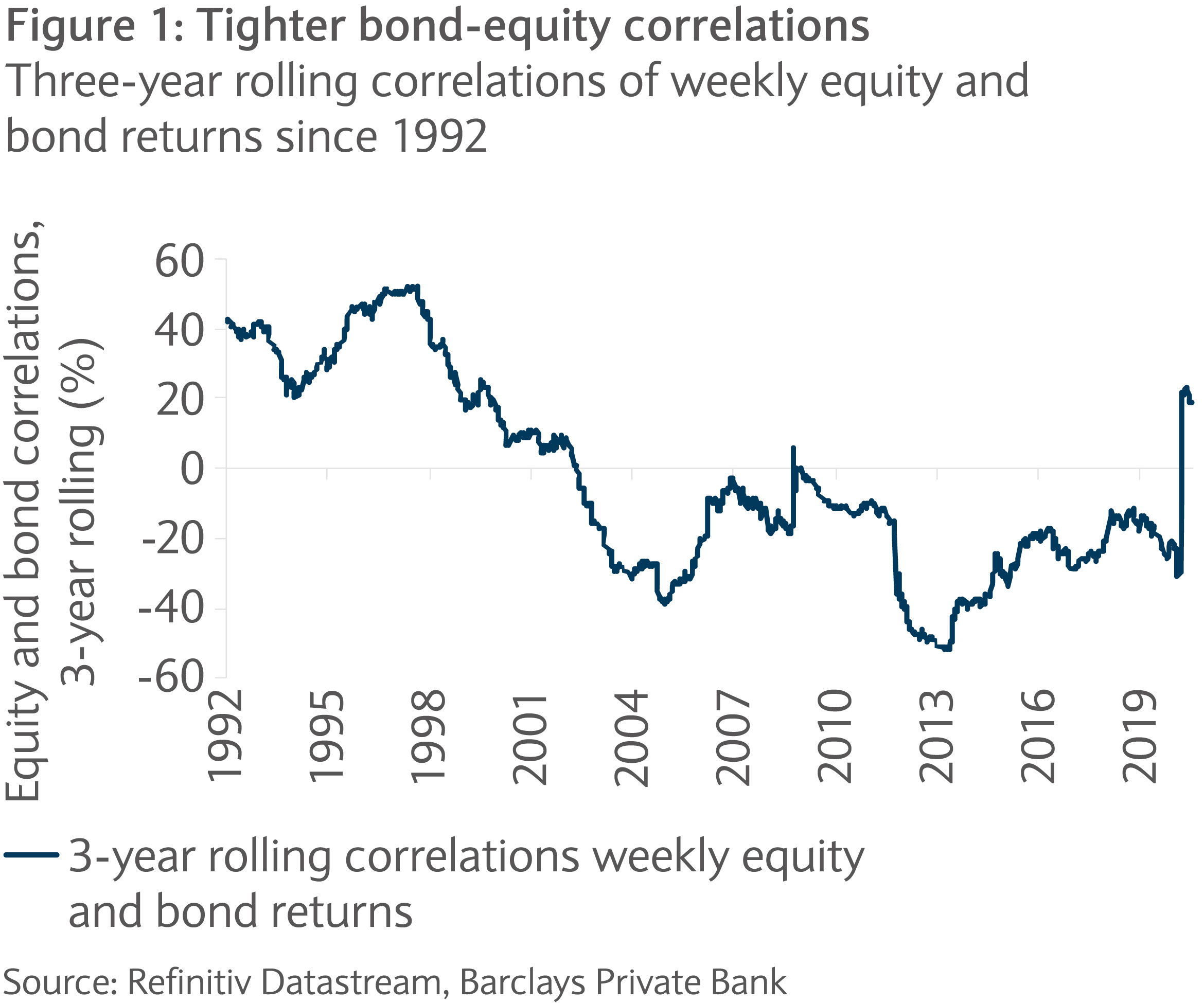

Over the past seven years the tighter correlation between the two asset classes has eroded the diversification benefits of a 60-40 portfolio (see figure one). With both rates and inflation likely to remain lower for longer and market volatility heightened, it may be time to question the effectiveness of said allocation.

A narrow lens would suggest moving more of the portfolio from fixed income to equity. While this could mean longer term higher returns, it suggests more heightened volatility. Two additions to the allocation may help shelter portfolios over the next decade, other things being equal: hedge funds and private markets.

A portfolio allocation to hedge funds could evolve with a spectrum of macro-financial regimes while enhancing diversification gains.

Different hedge fund strategies have more or less correlation with equities. The macro strategy is a case in point (see figure two). But other strategies would also show such properties.

While hedge funds offer returns uncorrelated to stocks, this does not mean they replace fixed income in the portfolio allocation. They too can at times struggle when markets are in the red and there is a high premium on manager selection.

Another addition to help successfully diversify a portfolio is private markets. Adding private markets to the 60-40 portfolio has shown historically higher returns and lower volatility.

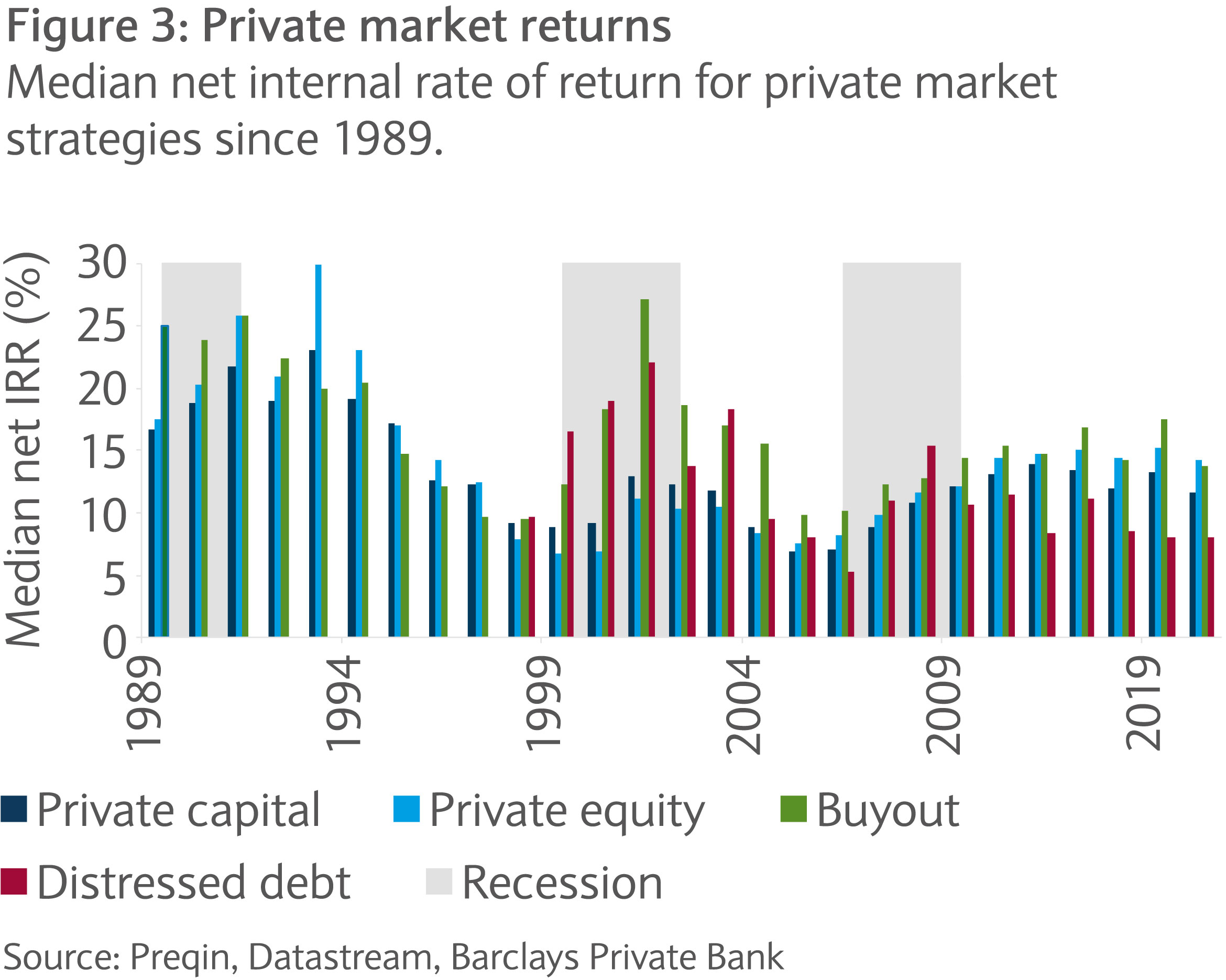

One of the main reasons for this is that during periods of increased volatility in markets, private equity managers have an opportunity to acquire high-quality companies at attractive valuations. It is unsurprising that some of private equity’s strongest vintages have come from investing during economic downturns and adding this to a portfolio could help smooth the cycle (see figure three).

Deployed funds are usually focused on individual company characteristics and more bottom-up as opposed to top- down. There is much to be said to accessing innovative companies at an early stage and tapping into growth. Investments are also made over a long-term horizon which not only means investors receive an illiquidity premium, but it also means such investments are more immune from temporary risk sentiment moves.

The next decade will likely entail lower returns and more frequent episodes of heightened market volatility. In this environment, the 60-40 portfolio could come under increased pressure. Asset classes and strategies that offer increased diversification, uncorrelated returns and suit investors over a longer time horizon may be worth considering.

The next decade will likely entail lower returns and more frequent episodes of heightened market volatility

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.