Outlook 2021

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

19 November 2020

10 minute read

By Julien Lafargue, CFA, London UK, Head of Equity Strategy

With muted equity returns on the cards next year in the shadow of the pandemic, a focus on active management and tilt to high-quality companies has much appeal.

This has been a truly exceptional year in, and outside of, financial markets. Equities saw the fastest bear market and an equally rapid recovery, followed by a contested US presidential election. This volatility, associated with a sharp valuation re-rating, left investors hesitant with many preferring to adopt a “wait and see” approach.

On paper, 2021 should be an easier year than this one with mostly positive catalysts on the horizon. However, there seems limited room for significant, broad-based, upside. The new decade may require a nimble approach from investors to make the most of equity markets.

With the COVID-19 pandemic triggering a collapse in earnings, markets have relied on multiple expansion to rebound. At the peak, the S&P 500 traded above 23 times forward earnings on a par with the levels reached during the dot-com bubble in the early 2000s. This level was clearly unsustainable and prompted many pundits to call for a correction.

Instead, as we expected, equities “grew into the multiple” as forward earnings started to take into account the recovery anticipated in 2021. As a result, the index is now trading at around 20 times forward earnings, a level that while elevated looks justified.

The index is now trading at around 20 times forward earnings, a level that while elevated looks justified

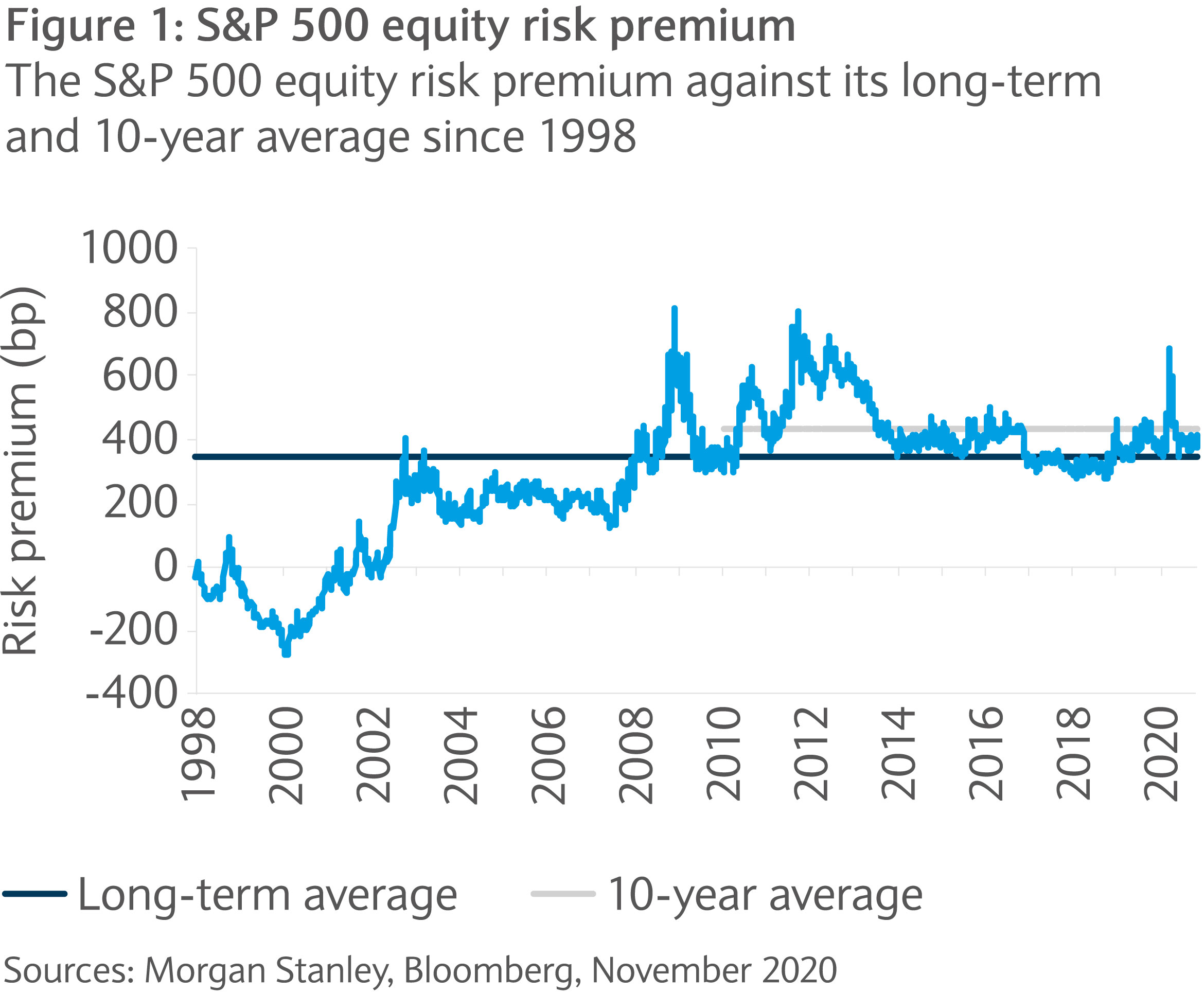

Indeed, while valuations remain significantly higher than their historical average, they appear fair when taking into account the level of interest rates. At 400 basis points, the equity risk premium (the spread between the earnings yield and the risk-free rate) is bang in line with its 10-year average (see figure one). As long as interest rates remain anchored at low levels, there seems little reason for the multiple to contract significantly.

At the same time, the market already expects no interest rate hike for at least three years. As such, a dovish surprise is unlikely, making further multiple expansion improbable. With earnings looking like recovering strongly next year, our base case calls for modest multiple contraction.

Without re-rating, equity returns should be mainly driven by earnings growth and shareholder income. On the latter, after a pause in recent months, companies are likely to return to rewarding shareholders next year in the form of higher dividends and buybacks. While it may take a couple of years to fully recover to pre-pandemic levels, 2021 is likely to be a much more supportive environment for income investors. However, with a lengthy road to recovery ahead, we believe that the focus should on the sustainability of the dividends rather than their absolute levels.

The consensus expects equities to deliver close to 30% year-over-year earnings growth in 2021 (see figure two), leaving earnings per share 5% above 2019 levels. While this may seem optimistic, this year highlighted that many companies can quickly adapt to a challenging environment. Should a vaccine be widely available, governments continue to support economies and buybacks resume, we would not be surprised to see 2021 earnings coming close to match those seen last year. However, wide discrepancies in the pace of the recovery can be expected at the sector and stock level.

The combination of modest multiple contraction, solid earnings growth and a boost from buybacks should allow equities to return mid-to-high single digits next year. As an example, assuming the S&P 500 can deliver earnings per share of $170 in 2021 (versus $165 in 2019) and its price- to-earnings ratio remains around 19 times, the index’s fair value would lie in the 3,500-3,700 points range.

For the above base case to materialise, positive COVID-19 pandemic developments are needed (with a vaccine becoming available in the second half of 2021 looking more likely after early data from potential candidates). In addition, central banks must continue to take a prudent approach, maintaining their accommodative stance, and governments should signal more fiscal easing. Any deviation in either timeline or stance could have an impact.

The main wildcard appears to be the science around COVID-19 treatments. While early results have been promising, disappointment could be severe should a vaccine fail to materialise. However, hope will likely remain high until the very last study has proven ineffective and as such any correction on this ground should be relatively short-lived.

Even if US and emerging market equity indices have strongly outperformed their European and Japanese peers over the past twelve months, both still look relatively attractive. They seem to offer the most appealing sector mix and potential for growth over the medium term.

The eurozone remains a value play which we would either trade in and out or focus solely on stock picking (rather than investing passively). The UK market, on the other hand, remains hostage to Brexit trade negotiations with the EU. Fortunately, as time passes, whether there is a hard or soft deal, should be welcomed by markets’ participants as visibility increases.

We doubt there is much merit in the growth versus value debate. While value’s long-lasting underperformance will be regularly interrupted by bouts of outperformance as investors tentatively price a “return to normal”, in the current environment undervalued stocks look unlikely to deliver sustainable superior performance.

For this reason, we maintain our preference for “quality” as an investment style. Indeed, in our opinion, companies focused on strengthening their balance sheets and free cash flow generation appear best placed to outperform over the medium term, whether they belong to the growth or value bucket.

The post-pandemic recovery is evolving into a K-shaped one with wide divergences

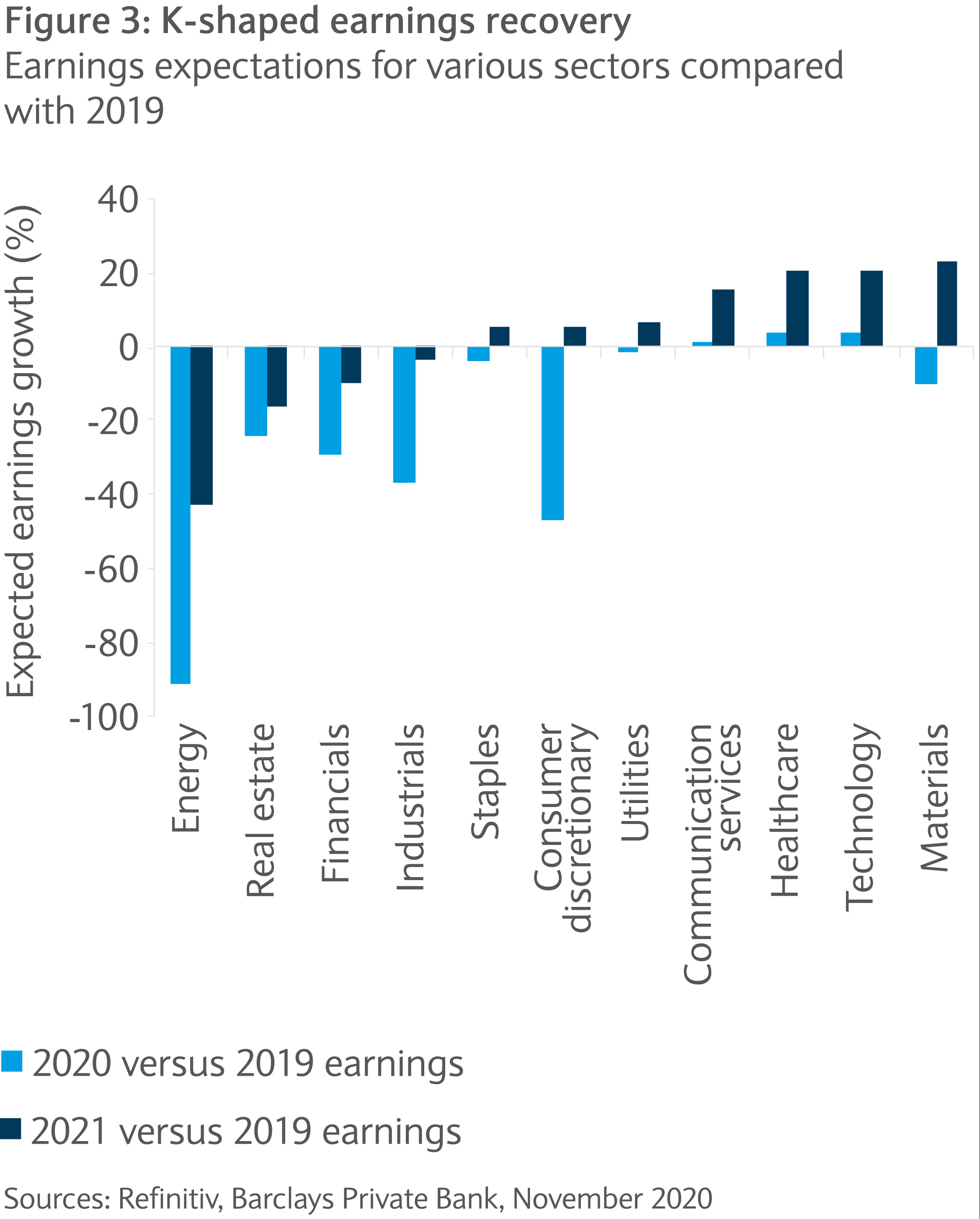

The post-pandemic recovery is evolving into a K-shaped one with wide divergences emerging between winners and losers. Consensus earnings expectations best reflect this gap with technology and materials anticipated to grow earnings by around 20% in the 2019-2021 period (see figure three) while profits in energy or real estate could remain significantly below their 2019 levels for years to come.

While projected earnings growth numbers are no indication of future returns, it shows the pessimism surrounding certain sectors of the economy. This leaves plenty of room for positive surprises and possibly sharp moves higher for these unloved stocks but, for long-term investors, it also highlights the risks associated with going against fundamentals. Active management still appears to be key to unlocking additional returns.

At the sector level we have consistently maintained a preference for technology (in its broad interpretation), healthcare, consumer-related industries (with a focus on disrupters) and industrials (with a technology tilt). With the exception of industrials, all of these sectors (defined according to MSCI’s GICS methodology) appear to have performed better than the overall market index at the global level. Going into 2021, we see no reason to drastically change this view. While a more volatile year may lie ahead, with leadership likely to change hands, for now we maintain our preferences unchanged, especially for long- term investors.

While a more volatile year may lie ahead, with leadership likely to change hands...we maintain our preferences unchanged

Environmental, social and governance (ESG) factors are becoming increasingly important. These were (and remain) a key driver of our cautious stance on 2020’s worst performing sector: energy. Investors will probably continue to shy away from sectors and stocks exhibiting poor ESG credentials. While companies will most likely address these challenges over time, all else equal, flows will likely continue to favour better-rated stocks and avoid those subject to any controversy. As such, ESG considerations seem worth paying attention to when investing.

After a challenging year, the outlook for next appears more constructive for equity markets. While valuations remain an obstacle for many investors, stocks, on aggregate, look fairly valued in the context of low rates. With little room for further multiple expansion, we expect more muted returns, reinforcing the importance of taking an active approach.

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.