Unemployment to shape the recovery

07 May 2020

4 minute read

No positive economic surprises

The first-quarter (Q1) growth numbers in the US and Europe have started to reveal the extent of the impact the COVID-19 pandemic is exerting on the global economy. While the European economy only started to be affected by the pandemic in March, when a range of confinement measures were adopted across the region, the impact has been enormous.

European gross domestic product (GDP) in the first three months of the year fell by 3.8%, quarter on quarter (qoq), the worst quarterly contraction on record. The virus outbreak hit the US a few weeks behind Europe and Q1 GDP “only” fell 1.2% qoq. But with containment measures in place for April and into May in both areas, Q2 GDP figures are likely to be far worse.

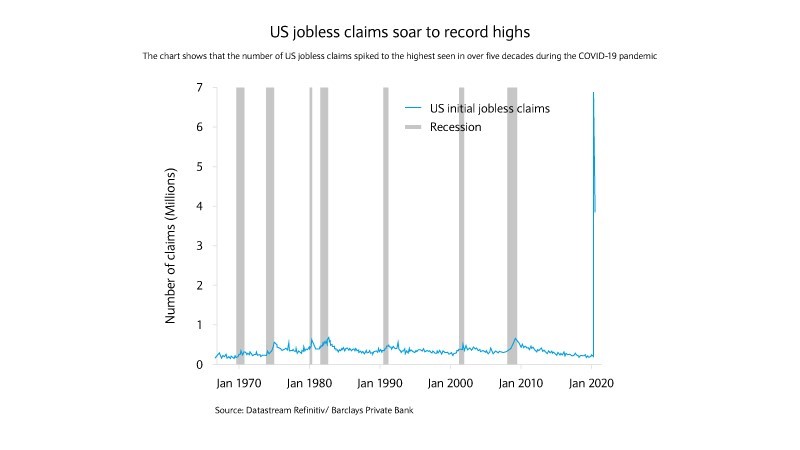

April’s purchasing managers’ index indicators, released this week, confirmed the bleak picture, hinting that the economy was contracting more sharply than recorded before, in most countries. Contrary to a traditional recession, services were more affected by the pandemic’s economic effects than manufacturing. This feeds into the labour market – and confirms the dire employment landscape which the weekly US jobless claims have been painting since early April.

High unemployment to leave its mark

Sizeable fiscal measures were taken by governments around the world with aim of supporting businesses and preventing job losses from rocketing. However, we are likely to see unemployment levels whip to a multi-decade high from a multi-decade low in a matter of two months.

While households started this crisis in a position of strength, with healthy savings rates, it is likely that the uncertainty will push savings rates even higher, for those that can afford it, while many others will be cutting spending. This makes it very difficult for the economy to bounce back rapidly.

With strategies to lift quarantine measures still exerting pressure on parts of the economy, the crisis is set to be longer than initially expected. More than that, consumers are unlikely to return to their previous spending habits as long as the risk of a second wave of COVID-19 infections remains present.

Implications for financial markets

The equity market is probably one of the most forward-looking financial markets as equities have an infinite duration. Compared to credit, where the duration of a security is fixed, equities seem to be pricing a more buoyant outcome to the pandemic. The focus is firmly on expecting a return to normal at some point in 2021. While this outcome is possible, the economic data, notably in the employment market, suggest that the damage inflicted could take longer to unwind.

From a risk-reward perspective, better opportunities seem to exist in credit markets in the short-term than in equities. Furthermore, equities are usually more affected by geopolitical tensions than credit. There are increasing signs that the crisis could be the catalyst for renewed verbal confrontations between the US and China, especially as the former’s administration investigates China’s early response to the virus outbreak. Our preference for opportunities in credit lies with the high yield bonds, where the risk/reward seems the most attractive.

Having said that, opportunities can be found in equities. Any crisis provides openings for some companies to increase their market share or develop new business offerings. That said, we believe that the opportunities available in equities are better captured through active management at the company level. In that light, quality, low-leverage and cash-flow-focused businesses appear attractive.

Related articles

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This document has been issued by the Investments division at Barclays Private Banking division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.