Market Perspectives May 2020

Financial markets have rebounded strongly from a vicious sell-off, following an exceptional policy response to the COVID-19 outbreak. But volatility is likely to be high for some time.

01 May 2020

5 minute read

By Gerald Moser, London UK, Chief Market Strategist

As the global economy heads towards a sharp recession and many risk assets suffer, distressed debt funds may offer a chance to buoy portfolio returns.

Investing in private markets can make sense during volatile times, with the opportunity a selloff offers for private funds looking to deploy cash. With a sharp, but likely relatively brief, recession beckoning, this is particularly true for a strategy like distressed debt.

This strategy focuses on acquiring a company’s debt at a fraction of its value and working with the company to restructure the overall debt. The acquired debt can be at any level of the entity’s capital structure. The debt may be regarded as distressed due to perhaps idiosyncratic reasons, a company may be overleveraged, suffer from a blow to its cash-flow, or an event affecting many companies like a global recession.

The COVID-19 outbreak has caused many businesses to halt operations. While a traditional recession usually results in a slowdown, the confinement measures put in place to contain the virus have brought activity in some sectors to a complete stop.

Despite the unprecedented fiscal and monetary measures announced globally in recent weeks, many companies will have burned through much of their cash reserves and find it much tougher to service their debt. The tough times are reflected in public markets, with US high yield spreads reaching 1,100 basis points in March. Based on historical data, this suggests that default rates could increase towards 10% from 3% in the first months of 2020.

Default rates could increase towards 10% from 3% in the first months of 2020

Around 35% of assets under management, for the distressed debt funds tracked by financial data provider Preqin, are held in cash. This amounts to $65bn of cash ready to be deployed.

Anecdotal evidence suggests that institutional investors’ appetite for distressed debt funds is increasing as opportunities arise in the sector. Downturns not only offer opportunities in public markets but also in private ones. This is particularly true for distressed debt funds.

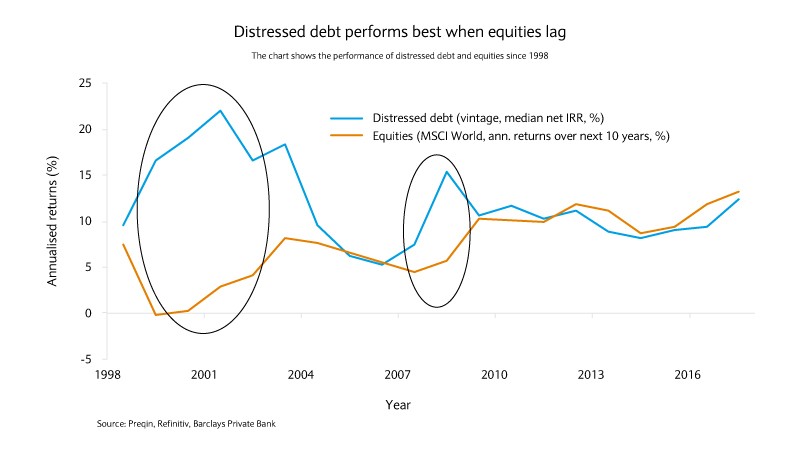

While the median net internal rate of return (IRR) for such strategies is usually lower than other private equity or private debt alternatives, the severe crisis seen in 2008 helped distressed debt provide the best net median IRR across all private capital strategies, according to Preqin data.

Distressed debt funds can provide welcome diversification to a portfolio in periods of stress, when many asset classes move in lock-step with each other. While traditional portfolios tend to suffer during global recessions, distressed debt assets can prosper during economic downturns.

The distressed debt index is negatively correlated, or moves in the opposite direction, with global equity and commodity indices, two asset classes that are typically impacted the most during a downturn. The performance of equities and commodities since the COVID-19 outbreak confirms this vulnerability.

Financial markets have rebounded strongly from a vicious sell-off, following an exceptional policy response to the COVID-19 outbreak. But volatility is likely to be high for some time.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This document has been issued by the Investments division at Barclays Private Banking division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.