Market Perspectives June 2020

Financial markets have bounced further from March’s sell-off as more countries ease COVID-19 restrictions. But risks of another bout of COVID-19 infections and geopolitical tensions remain.

05 June 2020

7 minute read

By Alexander Joshi, London UK, Behavioural Finance Specialist

As lockdowns ease and social and economic activity resumes, many may have missed the strong bounce seen in financial markets. Many may still be scarred by March’s sell-off and cautious about investing again. What can such investors do to comfort themselves that long-term investing still makes sense?

Governments have begun to ease lockdown restrictions, allowing more of life and the economy to slowly restart. Meanwhile, financial markets have recovered strongly from the lows reached in March in anticipation of the easing and hopes of a vaccine.

While most people will be keen to return to many activities, investing their capital may, understandably, not be top of that list. With continued uncertainty around the pandemic and its consequences, including the impact on asset values, investors have understandable cause to hesitate.

Most investors will have heard the adage that it is “time in the market” and not “timing the market” that matters for long-term returns. But this can be easier said than done in the face of uncertainty. Investing always carries some level of risk. Without it, the reward would likely be meagre.

For individuals and families fearing being invested in markets, this article reviews the consequences of waiting. Furthermore, it looks at how to overcome some of the behavioural hurdles to investing during troubled times and take the plunge.

Investing is an emotional business at the best of times. Doing so when markets are crashing can be frightening. Sitting on the side lines may feel safer. More than that, waiting for a lower entry point may intuitively make sense – why pay more for something now if the price is expected to fall further? However, what happens if the expected downside scenarios don’t occur or portfolio returns are not as bad as anticipated? The cost of not being invested can be considerable.

While we may not be conscious of it, waiting to take action is an active decision to forego the potential returns from investing, in favour of an alternative. Holding more cash is a common decision for many. However, doing so can reduce wealth, when the effects of inflation are taken into account. Especially over a protracted period. In turn, holding too much cash may jeopardise meeting an investor’s long-term goals.

Waiting for lower entry points also requires a degree of accuracy to predict drawdowns and the bottom of a downturn that only hindsight can provide. Phasing in investments gradually over time, can ease the discomfort of buying securities when markets are particularly volatile. Furthermore, purchasing an investment along with a hedging instrument, can reduce investment risk and provide more emotional comfort.

Some investors may be willing to re-enter the market but only at the “right” level. This generally means waiting for markets to fall further. However, falls can affect our perception of risk and decision-making abilities.

In the aftermath of market sell-offs, investing can suddenly feel challenging. The aversion to doing something that we later regret can lead us to refrain from taking action. To overcome this bias, the first step is to establish what you think is an asset’s right value and discuss the pros and cons of this view with a trusted financial advisor. Then commit to a clear plan outlining the actions that should be taken. Delegating the execution can help to avoid some concerns.

The plan might include different eventualities, to add further emotional comfort. For example, setting rules and timelines for getting invested. Another approach may be to use a structured product that fits your views of the market. This acts as a useful commitment mechanism, by ensuring, ahead of time, that buying or selling of an investment happens at pre-defined levels.

Other investors may prefer to wait for a more normal year to continue with their investment activity. But what is a typical year in investing? While 2020 is highly unusual, not least due to the pandemic, every passing year is different from the previous one.

Investors often refer to historical averages and performance returns. An average year comprises, by definition, both good and bad periods. The reality is that almost no single year will deliver each asset classes' average returns.

By expecting a consistent return, an investor may be setting themselves up for an emotional roller coaster. Better than the average makes them feel happy, lower makes them sad. However, investors seeking to preserve and grow their capital aren’t investing in only year-long increments, but over many periods.

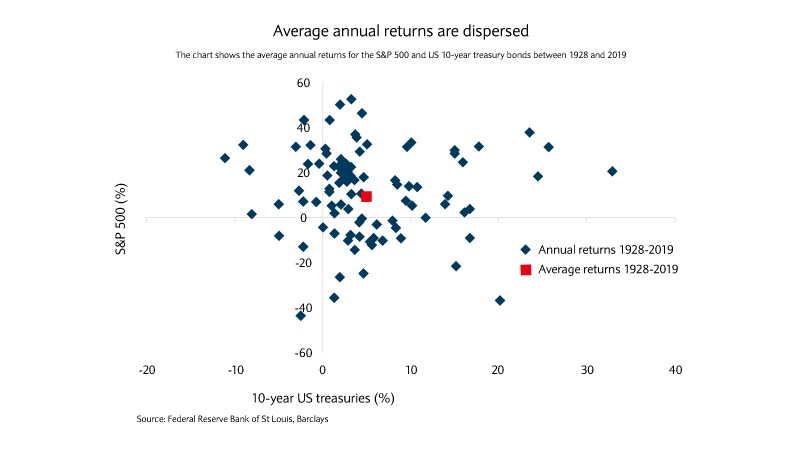

US annual equity and bond returns since 1928 are highly dispersed, with only a few annual returns that are close to the long-run average (see chart below).

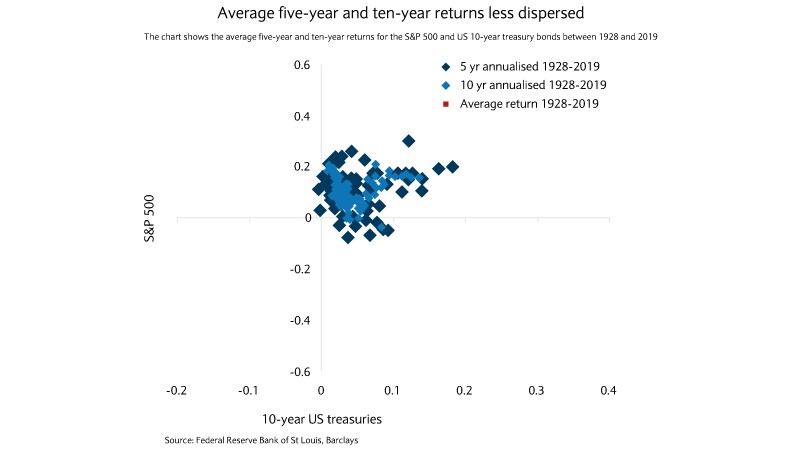

By judging and making investment decisions based on a given year can mean missing out on reaching the long-term average returns. Over a longer period, the dispersion of returns falls and become closer to the average (see chart below).

To overcome short-term biases, investors should regularly review their long-term goals and objectives. By keeping a long-term perspective, investors may be more comfortable investing when they know that the evidence is far stronger for long-term averages.

Additionally, we know the best and worst performing asset classes tend to change year to year. Being invested in a diversified portfolio, further increases the likelihood of meeting investment needs.

Good investing discipline involves being cognisant of, and planning for individual behavioural tendencies. Thinking long term and diversifying a portfolio reduces its volatility. By extension, the emotional toll that investing in challenging periods induces can impair decision-making. Talking through any concerns with an advisor, and planning around them, should improve the likelihood of investors staying invested and targeting long-term expected returns.

Financial markets have bounced further from March’s sell-off as more countries ease COVID-19 restrictions. But risks of another bout of COVID-19 infections and geopolitical tensions remain.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This document has been issued by the Investments division at Barclays Private Banking division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.