Market Perspectives June 2020

Financial markets have bounced further from March’s sell-off as more countries ease COVID-19 restrictions. But risks of another bout of COVID-19 infections and geopolitical tensions remain.

05 June 2020

7 minute read

By Damian Payiatakis, London UK, Head of Impact Investing

In the face of a pandemic, the case for sustainable investing has been reinforced with its increase in popularity and performance with a period of extreme volatility.

Before the pandemic, sustainable investing was often seen as an innovative approach that was becoming more visible and used by investors. Since this year’s elevated volatility and economic uncertainty set in, sustainable strategies' popularity has accelerated and widespread outperformance in the first quarter has been seen relative to traditional equity indices.

It’s critical to acknowledge that the concept of sustainable investing varies considerably in meaning, messages and motivations. While the lack of consistency and language and labels used can be confusing, the underlying premise is simple.

Investment decisions should factor in the impact of how companies operate and of the goods and services they produce. This can be valuable both financially, to protect and grow capital, and to see how investors’ capital makes a positive contribution to the world.

Among the unexpected consequences of COVID-19, the increased asset flows and performance of sustainable investments, most obvious in listed financial markets, may be one of the few positives.

As the pandemic disrupted markets at the start of the year, investors allocated $45.6bn to sustainable-focused funds in the first three months of the year, according to investment researcher Morningstar1. This, during the same period, when global outflows reached $384.7bn for the overall fund universe.

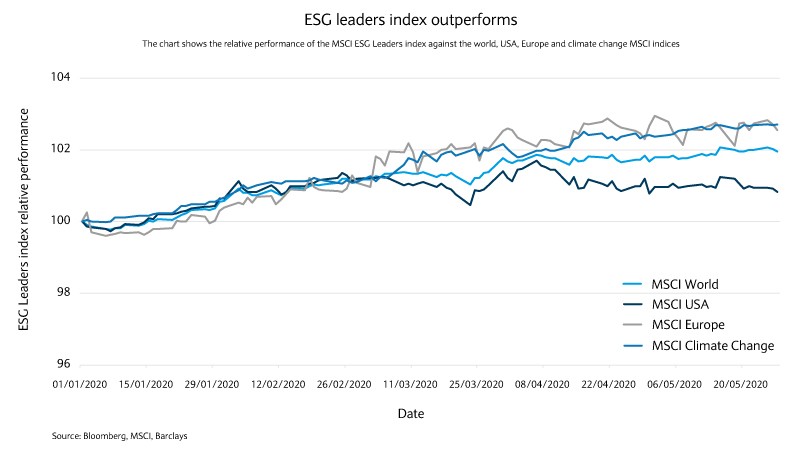

At the same time, sustainable strategies broadly have outperformed during this period (see chart), even if they didn’t always preserve wealth for investors.

As a starting point, Morningstar analysis found that 51 of 57 sustainable indexes, or 89%, outperformed their broad market equivalents2. Separate analysis found that the performance of 70% of sustainable equity funds was in the top half of their respective Morningstar categories3.

Furthermore, BlackRock research found 94% of a globally-representative selection of widely-analysed sustainable indices outperformed their parent benchmarks during the first quarter of 20204.

Naively some might assume these investment strategies were simply underweight the energy sector to achieve this relative performance. While some environmentally focused funds benefited from this difference, most are sector-neutral. Sustainable investing, practiced across sectors, industries and asset classes, on balance, simply performed better than traditional investing during the first three months of the year.

Sustainable investing… on balance, simply performed better than traditional investing during the first three months of the year

Underlying the increased capital inflows and favourable investment returns seen this year is something else — a growing realisation of the value of sustainable strategies.

Generally, one argument for sustainable investing has been that companies with more effective operating practices would perform better in the long run.

Academic evidence supports these assertions. Industry testing had further demonstrated that companies with better sustainability practices tend to have a lower cost of capital, higher profitability and lower exposure to unexpected and extreme risks (or tail risk)5. Yet a general suspicion has lingered about whether considering impact compromises financial performance.

Additionally, the argument for sustainable investing extended to bear markets. There is a belief that companies with more flexible production, human capital practices and corporate governance will navigate these periods better than peers.

The challenge has been sustainable investing has broadly emerged following the last crisis, with a clear acceleration only in the last three to five years. So the recent downturn is the first opportunity to trial these views in practice and at scale. As the above evidence indicates, sustainable strategies have performed in line with these arguments.

Of course, the usual caveats for performance must be acknowledged. Not all sustainable funds have outperformed their peers. The time period under review is not conclusive, and may not reflect future ones. Not all sustainable investors use the same approach or have the same skill. Taking these, and others, into account, sustainable strategies have successfully withstood this initial test. Moreover, the relative outperformance of sustainable strategies further refutes the myth of underperformance relative to traditional ones.

The relative outperformance of sustainable strategies further refutes the myth of underperformance relative to traditional ones

When delving into performance, the benefit can be attributed to selection of companies with better sustainability practices and forward-looking opportunities. Investors who have gleaned insight from non-financial to inform their decisions have been better able to identify more resilient and effective companies during the crisis. Primarily, they have begun to effectively use environmental, social, and governance (ESG) data and ratings to inform their decision-making.

While environmental issues have tended to be the primary interest, the pandemic has brought focus to social issues as a key operational issue. The majority of companies effectively managing the health and safety of their workers, supply chains and labour relations seem to be performing better financially. As well, they are earning recognition and reputational benefits that will serve them after we overcome this pandemic.

Sustainable investors are looking within and beyond the crisis to identify structural trends that may offer attractive investment opportunities. In the following decade, meaningful areas of interest for long-term investors might include the transition to a low-carbon economy, enabling technology (artificial intelligence, 5G, the internet of things), demographic shifts, “conscious consumerism” and the more effective health and living practices.

Companies with business models and products/services addressing these structural topics are positioned for long-term growth. Sustainable investors are benefiting from identifying these companies as the ones relevant for, and accelerating the move to, the next economic cycle.

The growth in sustainable investing is likely to be reinforced through, and after, the pandemic. Companies are increasingly likely to be judged on their response and treatment of all stakeholders. Fiscal stimulus packages look set to include support for green and social initiatives as the proposed “Next Generation EU” plan demonstrates. Forthcoming regulation will ensure more attention and transparency around companies’ climate and social actions.

In the end, the short-term performance and flow figures from the start of the downturn can’t be seen as conclusive. However, they indicate the seeming growing belief in the benefit of sustainable investing and a long-term change in how we invest.

Financial markets have bounced further from March’s sell-off as more countries ease COVID-19 restrictions. But risks of another bout of COVID-19 infections and geopolitical tensions remain.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This document has been issued by the Investments division at Barclays Private Banking division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.

Investors Back ESG in the Crisis, May 2020, MorningstarReturn to reference

How Did ESG Indexes Fare During the First Quarter Sell-off, April 2020, MorningstarReturn to reference

Sustainable Funds Weather the First Quarter Better Than Conventional Funds, April 2020, MorningstarReturn to reference

Sustainable investing: resilience amid uncertainty, May 2020, BlackRockReturn to reference

The Journal of Portfolio Management, July 2019, MSCIReturn to reference