Building a sustainable world

31 July 2020

8 minute read

By Damian Payiatakis, London UK, Head of Impact Investing

Urgent, global challenges present investors with some of the largest and fastest growing sectors of the economy. Those that catalyse the right solutions to these long-term trends may find attractive opportunities that can provide the satisfaction of making a positive difference to our world.

The world faces urgent social and environmental challenges. Climate breakdown, chronic and acute diseases, structural inequalities and resource scarcity to name a few. In addition to the risks, the challenges present opportunities for us as people and as investors.

Confronting these interconnected and complex issues, that are long-term in nature, will require trillions of dollars of investment – and much more innovative approaches to finding and financing solutions.

Investors face a unique period where there is urgency to act to help counter these sustainability dilemmas while also benefiting from commercially successful long-term solutions. And doing so in a more complete and thoughtful way across the range of these issues. Moreover, for the organisations, large and small, that provide commercial solutions to address them, they provide rapidly growing markets for their products and services.

Outward-looking, not inward assessment

This structural trend is different to investing in companies that are effectively managing their material environmental, social, and governance risks and practices. This, more inward-looking approach, is valuable to help an investor make a more informed judgment about where an organisation may be at risk, or could have an advantage relative to its peers.

However, to invest in line with this theme, investors should be looking for companies whose goods and services are directly addressing one or more of our societal challenges. The intention should be to invest to help catalyse solutions, not simply avoid detriment.

This is not to say that the internal operating practices of these companies should not also be assessed, but for investors the focus is on the outward, revenue-generating opportunities.

The intention should be to invest to help catalyse solutions, not simply avoid detriment

Rallying around global goals

It [UN’s sustainable development goals] will require an estimated $2.5 trillion in developing countries alone to deliver on these commitments

Given the range and scale of these issues, it can be difficult for investors to decide where the most significant challenges, and opportunities, lie. In 2015, the United Nations (UN) set out to do that. The UN Sustainable Development Goals (SDGs) committed 193 countries to social, environmental and economic targets for global development around seventeen shared goals.

The SDGs aim to promote prosperity while protecting the planet. These can range from improving access to healthcare, clean water and affordable clean energy to tackling social and gender inequality. Achieving these goals will require a unified effort from countries, companies, and citizens. Moreover, it will require an estimated $2.5 trillion in developing countries alone to deliver on these commitments.

Identifying investor opportunities

While the SDGs serve to rally and coordinate global effort, they were never designed specifically for investors. Investments in one sector or theme could benefit many goals – for example tackling food waste is primarily an aim of Sustainable Production and Consumption (SDG 12) though also has benefits for Zero Hunger (SDG 2) and Climate Action (SDG 13).

However, as broad, interrelated goals they are usefully supported by clearly defined measurement requirements and success metrics that can be useful for measuring and monitoring the outcomes that investments deliver.

Investors can find opportunities in all seventeen SDGs. For simplicity, we cluster them into three environmental and three social areas to look at the broader options to deploy capital for long-term growth at the same time as making a proactive contribution to our world.

Addressing climate change and energy needs

One of our foremost global challenges is to slow, and potentially reverse, the continuing rising global temperatures. As authors of the UN Intergovernmental Panel on Climate Change report, the world’s leading climate scientists warn that we need to act by the end of the decade to have the greatest hope of keeping the maximum average temperature rise to 1.5C.

No industries are likely to be immune from the physical and transition risks and effects of climate change. But seeing beyond this, some organisations are already working to develop products and services to adapt to climate changes or mitigate their effects.

Given energy production’s central role in carbon-based emissions, switching to cleaner energy technologies is critical. While one of the more established markets, considerably more investment is needed. For instance, an estimated $14 trillion of investment is required over the next 20 years for the energy transition if we aim to stay within the 2C trajectory.

Beyond energy needs, climate change requires further adaptation and mitigation efforts. In our Outlook 2020, we highlighted four other growth markets in a transition to a low-carbon economy — electric mobility, energy efficiency, water and waste management or agriculture.

Reducing environmental footprint

With growing populations and expanding economic development and consumption, the natural environment and its limited resources are under increasing strain. Should the global population reach 9.6bn by 2050, as some predict, to sustain current lifestyles would require the natural resources of the equivalent of almost three planets.

Furthermore, with two-thirds of the world’s population expected to reside in cities by 2050, increasing urbanisation would likely compound environmental pressures. With aging infrastructure in the developed world and incomplete infrastructure in the developing, issues such as water stress, waste management and air pollution create associated health and economic risks. In response, companies are developing a range of innovative solutions in responsible production and consumption; maximising value from resources and minimising their waste; and improved, and smarter, living in more sustainable cities.

Both consumers and companies are driving increased transparency in supply chains. Consumer demand for ethical goods and services is generating new products and even market categories. At the same time, the traditional linear “take-make-waste” approach seems neither sustainable nor economical — for consumers, producers and the environment. This has created both a circular economy movement and an increasing range of organisations utilising its principles and business models to generate new value. Finally, companies replacing or providing new infrastructure and services are experiencing rapidly increasing demand in line with growing urban populations.

Conserve biodiversity and ecological systems

In the 2020 World Economic Forum’s Global Risks Report, biodiversity loss and ecosystem collapse was named as one of the top five risks in terms of likelihood and impact in the coming 10 years. As a result of human activity, 75% of global land surface has been significantly altered; 66% of oceans are experiencing cumulative deterioration; and over 85% of wetlands have been lost.

While the primary reason for considering biodiversity issues is risk management, and although it is less visible or understood as an investment theme, there are a growing set of opportunities for private investment capital. In part, legislative drivers and changing consumer demands are creating new markets for organisations to attempt to profit from, through biodiversity-related goods and services and biodiversity conservation.

Most obviously, sectors such as tourism and recreation have direct links and value associated with conserving the natural environment. Similarly, agricultural products that have been harvested organically and/or sustainably should benefit from increasing consumer demand. Finally, marketplaces are available, or being established, in areas such as carbon sequestration, maintenance of water quality and supply, pollination, or biomass production.

Improve growth and employment

Sustained and inclusive economic growth can drive progress, create decent work and improve global living standards. These are central ambitions for both countries and individuals. The economic and financial shock caused by the pandemic has highlighted the disparity and challenges many workers face. As job losses escalate, the International Labour Organization estimates that nearly half of the global workforce is at risk of losing their livelihoods.

At a more fundamental level, education and employment are the foundation for socioeconomic mobility and key to escaping poverty. While progress has been made in school enrolment, nearly one-fifth of the children were out of school in 2018 and more than half of children and adolescents are not meeting minimum proficiency standards in reading and mathematics.

Investments in companies and projects that enhance human capital can foster economic growth and development, higher productivity, employment and innovation. For individuals in emerging countries, education increases social mobility and is among the most powerful means of substantially improving quality of life and wider societal gender equity. Even workers in the developed world who are, and will be, displaced by technology and industry transition, require re-training and new employment pathways to maintain, or improve, their economic circumstances.

Better health outcomes

We all aim to live long, healthy and happy lives. On average considerable global progress has been made towards these aspirations. However, for many, their lives are cut short or more challenging without access to healthcare and nourishment needed.

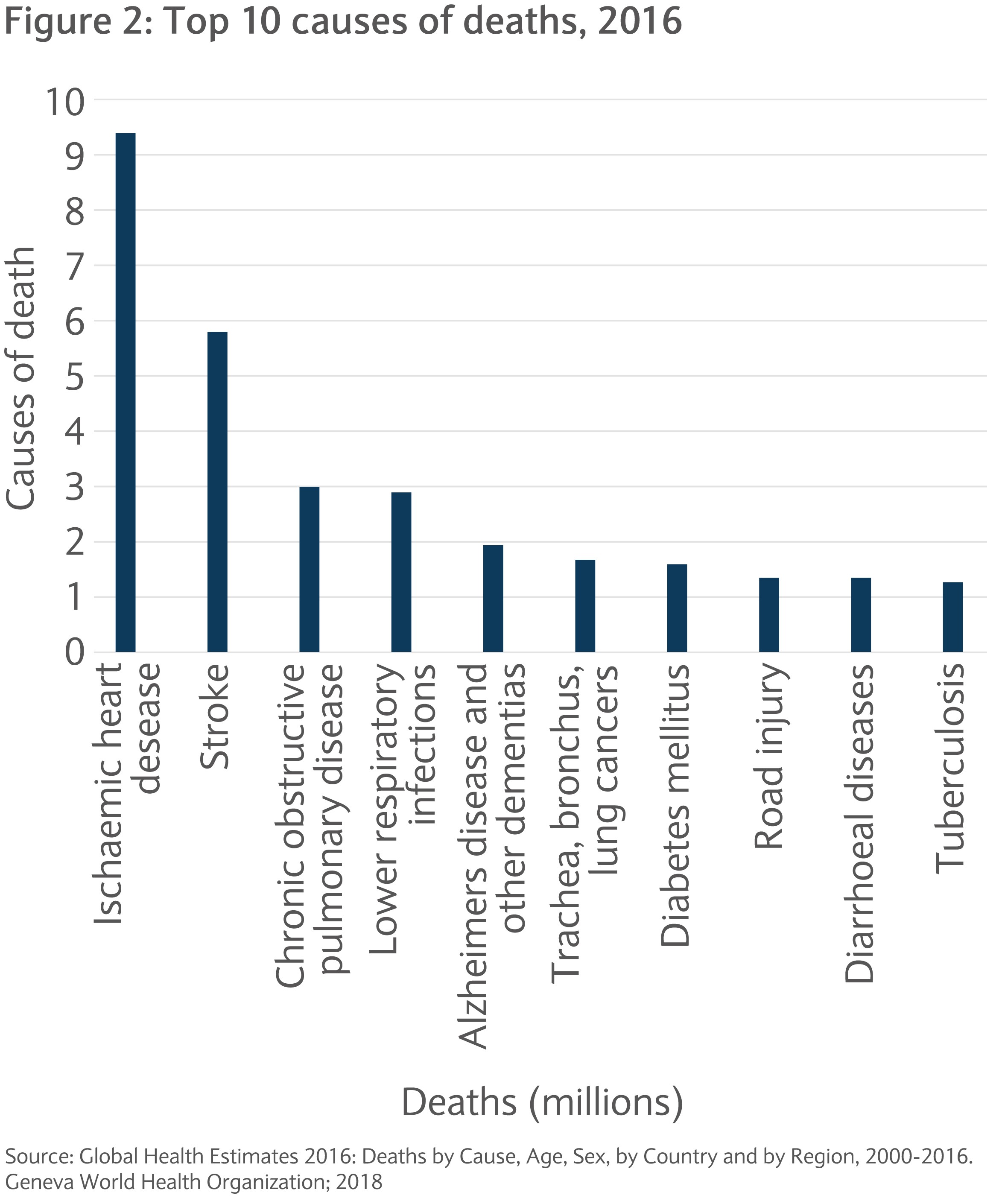

In terms of health, much of the focus has been on addressing many of the most common causes of child and maternal mortality. However, we face the increasing risk of pandemics and increasing prevalence of chronic diseases. The World Health Organisation estimated that of the 56.9m deaths in 2016, heart disease, stroke and pulmonary disease were the world’s biggest killers (see figure 2). Taken together, these account for about one in three deaths.

At the same time, hunger is a substantial and growing problem. Nearly 821m people (roughly 11% of the world’s population) suffered from chronic malnourishment in 2018. Global population growth means that food production needs to increase 70% by 2050 to feed everyone, yet increasingly diminished crop yields and constrained natural resources worldwide limit the potential for increase.

A wide range of promising companies and technologies are tackling these issues – from the most basic such as improved sanitation or food preservation, to the most innovative such as AI-led diagnostics or food distribution.

Promote equity, justice, and community

A prosperous and sustainable world is one that is peaceful and inclusive. Ongoing conflict, insecurity, weak institutions and limited access to justice continue to be great threats to this aim. Sadly, the number of people fleeing war, persecution and conflict exceeded 70m in 2018, the highest level recorded by the UN refugee agency (UNHCR) in almost 70 years. As well, women and many people from minority groups still face ongoing discrimination, violence, coercion, and inequality.

Addressing these issues may have not been on investors’ radar traditionally. However, there are a growing number of commercial organisations and projects that provide opportunities that had previously been left to governments, charity and international aid.

Often it means investing in activities at the core of the issues, rather than symptoms. For example, investing to address local unemployment and resource scarcity that drive many conflicts, rather than only seeking to end armed violence. Additionally, programmes and projects are arising to invest in refugees, enabling them to restart their lives and integrate effectively with new countries.

For many investors, gender-lens investing is the practice of investing for financial return through the lens of female empowerment. It deliberately incorporates the desire to make a difference in the lives of women and girls, takes into consideration the power of women’s leadership and the solutions to the challenges that women and girls may face.

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This communication:

- Has been prepared by Barclays Private Bank and is provided for information purposes only

- Is not research nor a product of the Barclays Research department. Any views expressed in this communication may differ from those of the Barclays Research department

- All opinions and estimates are given as of the date of this communication and are subject to change. Barclays Private Bank is not obliged to inform recipients of this communication of any change to such opinions or estimates

- Is general in nature and does not take into account any specific investment objectives, financial situation or particular needs of any particular person

- Does not constitute an offer, an invitation or a recommendation to enter into any product or service and does not constitute investment advice, solicitation to buy or sell securities and/or a personal recommendation. Any entry into any product or service requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding documents

- Is confidential and is for the benefit of the recipient. No part of it may be reproduced, distributed or transmitted without the prior written permission of Barclays Private Bank

- Has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.