Market Perspectives July 2020

Financial markets have had a very strong second quarter, despite geopolitical tensions and fresh outbreaks of COVID-19 in US and German states and in Beijing.

03 July 2020

7 minute read

By Gerald Moser, London UK, Chief Market Strategist

If the global financial crisis is a guide, deep valuation discounts and distressed sales sparked by the pandemic may be about to offer attractive opportunities in private markets.

The COVID-19 pandemic has triggered sharp, downward, repricing in public financial markets, while decisive fiscal and monetary stimulus has stabilised public markets for now. But the impact will also be felt in private markets.

We previously highlighted that the pandemic is likely to generate many investment opportunities in distressed debt. The secondary market is another segment which should benefit from the liquidity shock.

A secondary investment mitigates some of the risks typically associated with private market investment

Secondary investing involves buying pre-existing investor commitments to private capital. A secondary investment mitigates some of the risks typically associated with private market investment. For example, secondary funds limit the “blind pool” effect as most of, if not all, the capital has already been called and invested. Also, because part of the capital has already been invested, the so-called J-Curve effect can be mitigated.

Secondary investment most often happens when the fund is close to breakeven, as distributions to investors start to match and even outpace capital calls. As such, the return on investment tends to be more certain than for primary fund investment and the duration might also be shorter.

According to private markets researcher Preqin, only 1.6% of global secondary funds have historically returned less than the initial investment, rising to 20.4% for global buyout and venture capital ones. Finally, secondary private equity commitments are often available at a discount to their net asset value (NAV).

Those mitigating factors, compared to a traditional private market investment (“primary investments”), usually come at a cost. Despite the discount to NAV, returns, as expressed as a multiple of the capital invested, are lower for secondaries as the investments are typically at more advanced stage than for a primary fund. But the COVID-19 crisis might provide attractive opportunities in the secondary market.

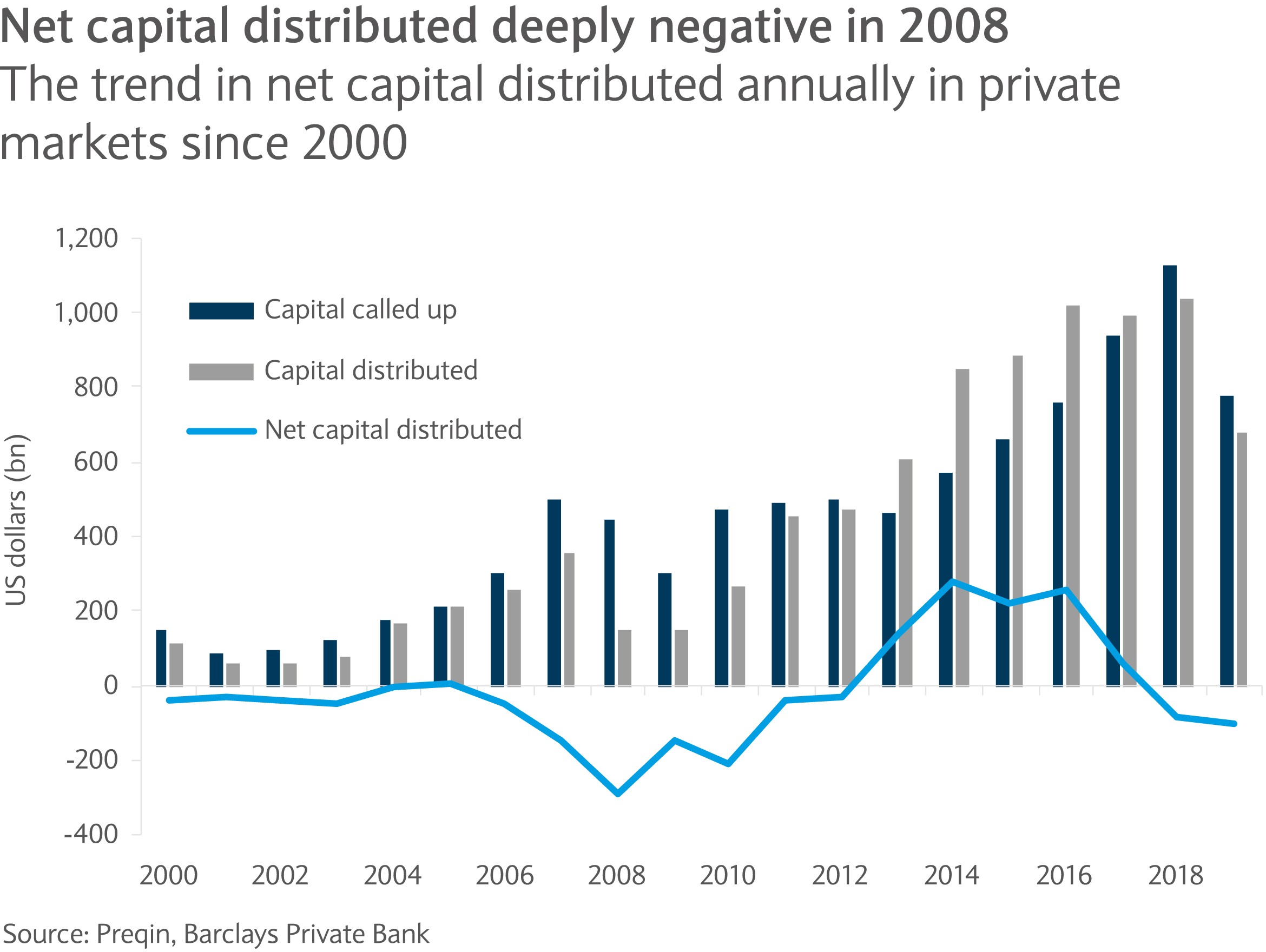

Every crisis is different. That said, lessons learnt from the global financial crisis in 2008 are likely to be relevant this time around. In 2008, the net capital distributed across private markets went deeply negative. According to data from Preqin, limited partners (LPs) had to collectively pay in around US$300bn that year (see chart).

Some of that capital was called to take advantage of attractive investment opportunities. However, most often general partners (GPs) needed the capital to shore up companies in their portfolio or pay back credit facilities. And with few exit opportunities, this resulted in a large negative net capital for LPs. After several years of positive net capital distribution, the current crisis is likely to result again in a deep negative net capital distribution for LPs.

For some investors caught off guard and with too much exposure, the need for liquidity might be exacerbated. The excessive use of leverage or aggressive over-commitments, notably in the most rewarding but also riskiest parts of private markets like venture capital or leverage buy-out, are the most likely reason to try and sell private market exposure. For those reason, the number of distressed sellers should increase and should result in opportunities in the secondary market.

At the height of the global financial crisis…secondary pricing was as low as 40% of the NAV. Two years earlier, pricing was around NAV

Using 2008-2009 as a template suggests that pricing should become attractive in the pandemic. At the height of the global financial crisis, in the first half of 2009, secondary pricing was as low as 40% of the NAV. Two years earlier, pricing was around NAV.

Distressed sellers under pressure to liquidate some position and gain liquidity are more likely to offer large discounts to encourage a sale. This is likely to occur again in the latest market shock. But equally, as in 2008-2009, transaction volume may fall in the short term. That said, private markets exposure in institutional portfolios has significantly increased over the last ten years, so the overall opportunity set may actually be bigger than it was in the global financial crisis.

Transaction volumes are likely to be low until updated valuations are available to reflect how much asset values have been damaged by the crisis. As such, the secondary market is likely to see a surge mostly in 2021 and 2022. But if, as we believe, the aftermath of the global financial crisis is a good blueprint, pricing is likely to remain attractive for a couple of years in secondaries.

While any discount might not be as steep as in the midst of the crisis, transactions would still take place at a much more attractive level than the historical average (see chart).

Financial markets have had a very strong second quarter, despite geopolitical tensions and fresh outbreaks of COVID-19 in US and German states and in Beijing.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.