Guide to Giving

Our 12-chapter ‘Guide to Giving’ features inspirational case studies and key concepts to help you navigate the world of modern philanthropy.

Philanthropy

26 February 2024

Please note: This article does not constitute advice. Barclays Private Bank does not endorse any of the companies or individuals referenced in this article.

At its heart, philanthropy is private wealth used for public good. The word ‘philanthropy’ derives from the Greek ‘philo’ or ‘love’, and ‘anthropos’ or ‘humankind’. These origins capture the essence of giving as an outward expression of love for humanity.

This remains an important concept today, but there is an increasingly common view that philanthropy creates most benefit when it goes beyond personal values and seeks the greatest possible social good.

In this Guide, we use the terms ‘philanthropist’ and ‘donor’ interchangeably to indicate someone who allocates significant private wealth towards the funding of charities or social purpose more broadly. Please see our glossary for an explanation of other terms.

Today, there is a drive towards more strategic and thoughtful giving, often with longer-term goals, characterised by research and collaboration with others to address the root causes of significant societal and environmental problems.

Philanthropy may focus on ‘classic’ giving – making donations (or grants) that have no financial return. There may also be the gift of ‘tools’ beyond finance, such as time, skills and connections. Or philanthropists may act as ‘social investors’, offering finance on different terms to achieve specific social goals.

One of philanthropy’s most important characteristics is that it has more freedom than government, corporate or investment funds. The pool of philanthropy is smaller, but it can do what other forms of capital cannot.

Philanthropy can fill gaps and flow quickly to less popular or neglected areas, test and innovate new ideas, build evidence and influence policymakers. It can also act swiftly in an emergency and support organisations or ecosystems that need traditional investment or large-scale funding, but which are currently unattractive to other funders.

Creating impact with your philanthropy relies on taking the time to truly understand what the world needs and how your unique contributions could help to make a change.

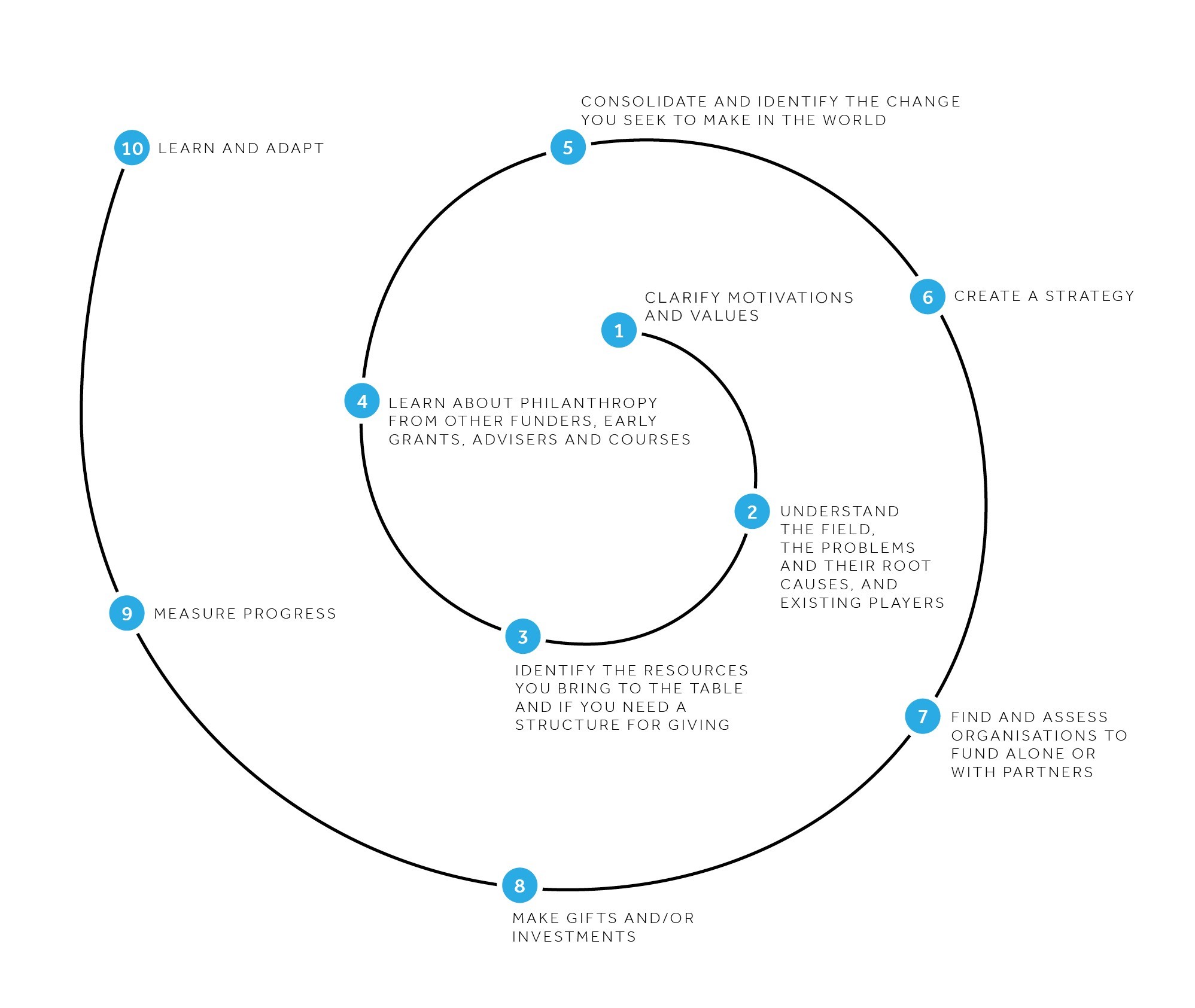

Philanthropy is an extensive topic that begins with a personal spark but expands to understanding the world around us. It often takes time, effort and the right mindset to become an effective philanthropist.

For new donors, working through a period of self-reflection, learning and research is likely to be the best way to begin. For the more experienced donor, regularly revisiting your intentions and refreshing your knowledge will help you to sustain a more rewarding and impactful experience.

Truly effective philanthropy is so much more than a series of financial transactions. Having the most impact begins with understanding yourself and all that you bring to the table. As a philanthropist, you will often wield more power and resources than those you are seeking to support, so another key question is: how will you responsibly use those to the greatest societal benefit?

The practice of modern philanthropy calls on you to thoughtfully interact with the communities and causes that you care about, leaving them better than when you entered the picture. It challenges you to think beyond monetary gifts to the broadest value you could bring and invites you to consider the voices you are including around the decision-making table.

Consider all the small but significant ways that you will interact with those around you. It is unlikely that you will get things done alone; rather you will be most effective working in partnership with others.

If you can comprehend and cultivate self-reflection and learning, you are halfway there.

It is our genuine hope that this Guide will help you take positive steps forward on that exciting road ahead.

The Barclays Private Bank ‘Guide to Giving’ has been created to introduce you to the world of thoughtful, effective and modern philanthropy.

Whether you will give alone, as a family or couple, or as part of a foundation, we offer an overview of key issues that any philanthropist should consider as they create, and put into practice, their giving strategy.

Importantly, we do not advocate for any one approach. We instead aim to help you consider your motivations and the resources you have to offer, find out how to educate yourself on what the world needs, and lay the groundwork to chart your unique path towards positive impact.

To that end, we share key concepts, tools, questions and examples to inform, inspire and build your confidence in giving. Case studies are provided throughout, which bring to life inspiring stories of philanthropy in a wide variety of forms.

We intend for this Guide to be a catalyst for reflection and further learning. We have designed each chapter to be read as a standalone section and encourage you to dive into those that call to you.

Source: Barclays Private Bank, February 2024

We hope the good practices shared in this Guide may help speed up your journey towards effective giving and lessen the impact of any challenges that lie ahead. However, it may not be possible to avoid mistakes altogether. In fact, the lessons you learn from your failures may well be the fuel for your greatest personal achievement.

Effective philanthropy entails a mixed bag of discovery, learning, steps forward and course corrections. It evolves as we all do, sometimes gradually, and sometimes at speed. Progress will depend on your drive, along with your openness to learning along the way. Understanding your blind spots will be just as important as understanding what sustains you during difficult times. There are many possible paths, but only you can identify the right way for you.

Source: Barclays Private Bank, February 2024

Our 12-chapter ‘Guide to Giving’ features inspirational case studies and key concepts to help you navigate the world of modern philanthropy.

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(I) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.