Market Perspectives April 2024

As equity markets hit new highs and rate cuts near, find out our latest views on global themes, trends and events influencing investors.

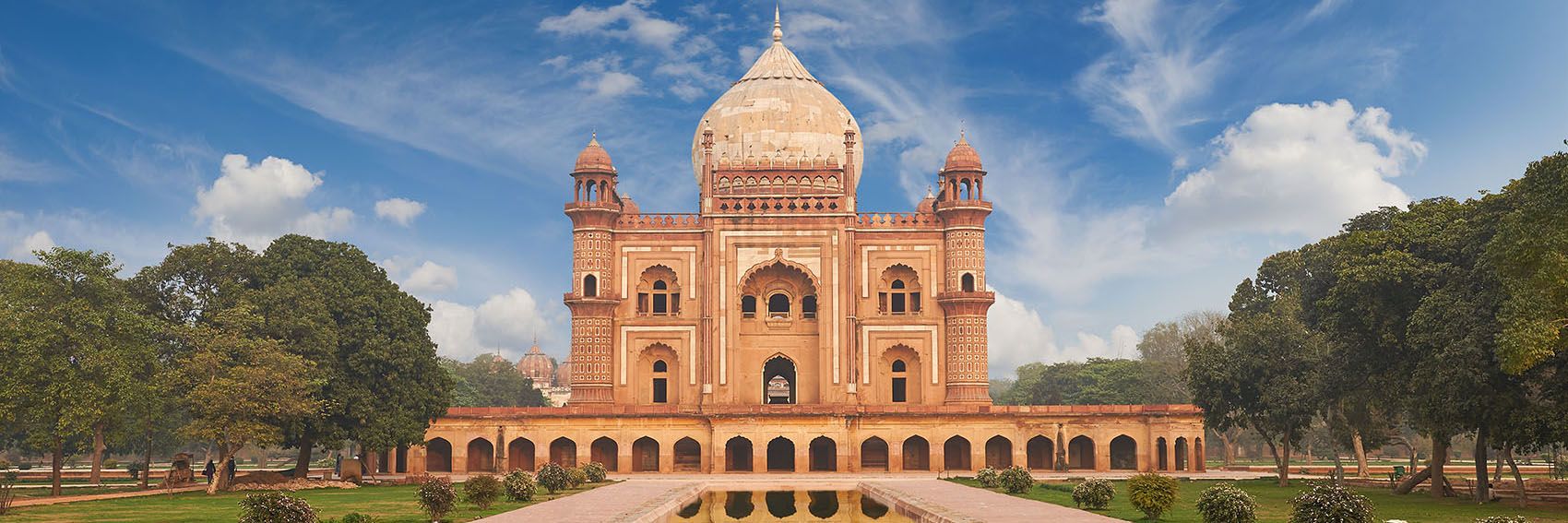

Indian Multi-asset portfolio allocation

05 April 2024

Narayan Shroff, India, Director-Investments

Please note: This article is more technical in nature than our typical articles, and may require some background knowledge and experience in investing to understand the themes that we explore below.

All data referenced in this article are sourced from Refinitiv Datastream unless otherwise stated, and are accurate at the time of publishing.

India might be the strongest growing leading economy for now, but external factors could throw it off course. For now, heightened geopolitical tensions and considerable global economic uncertainties, not least on when the US Federal Reserve (Fed) could cut interest rates, are the main headwinds.

However, with inflation now under control in developed markets, the Fed’s March policy stance was more dovish than some expected. The central bank’s ‘dot plot’ projections point to perhaps three cuts in 2024, though these are not official Fed forecasts.

India’s gross domestic product expansion of 7.7% last year topped other top-ten economies and continues to purr along at a similar momentum in 2024.

Growth has been driven largely by fixed-capital formation, indicative of much investment activity, which points to a continuation of India’s recent momentum. More broad-based investment is likely needed for a boost. In this respect, a gradual uptrend in private sector capital expenditure (capex) is warranted.

The current account deficit is expected to remain stable this year, led by strong services exports and benign global commodity prices. Furthermore, steady domestic currency levels and improving forex reserves augur well for a stable external account.

On the flipside, the government's final consumption spending has moderated, as has its growth in the private sector. This could prolong the recovery of demand in, already muted, rural consumption. Focus on fiscal consolidation could further weigh on growth in capex spending by the government.

Possible near-term risks include an adverse monsoon season that may affect the inflation trajectory and market volatility triggered by elections. Globally, disruptions to shipping in the Red Sea are hitting supply chains.

For now, the markets are building in another victory for the incumbent Indian administration in April and May’s general elections. However, there is more uncertainty over how big the winner’s majority will be.

Once the elections are over (results are due to be announced on 4 June), investors’ focus will likely turn to the next budget (in June or July) and on the direction of travel for fiscal discipline and quality capex.

We retain an equal preference for large and other-sized companies. That said, mid- and small-capped stocks might witness higher volatility relative to larger businesses, however the risk/reward appears favourable for this segment over the long term.

In the near term, markets will continue to be focused on election outcomes and earnings for fiscal year 2024. While equity valuations are better than those for global markets, they are only slightly higher when compared to their long-term average. In addition, political stability, consistent reforms, strong earnings growth, and more inflows into domestic securities bode well.

The domestic cyclical growth theme seems a particularly strong driver of potential performance. Sectors like power, manufacturing, infrastructure, capital goods and select consumer discretionary segments appear especially well placed.

Indian bond markets have been calmer than their peers this year. Strong demand from local and foreign investors has supported rates, even though US rates have edged up by 30 basis points in 2024.

While monetary policy is unlikely to be relaxed in India as well, the rate-cutting cycle will probably be gradual as growth continues to be buoyant. Additionally, lower gross borrowing announced in the interim budget, as well as overseas buying, on the back of the country’s inclusion in JP Morgan and Bloomberg emerging market bond indices, and strategic allocations should buoy demand for domestic government bonds.

Cash (up to 12-month papers) offers accrual yields of around 7.5%. The scope for yields to drop further limits the upside from a capital gains perspective, until the trajectory for rates is clear.

With healthy spreads, the 3-5 year segment of the market appears well placed from an accrual perspective. Additionally, AA and A-rated credit offers better yields still from a risk-reward perspective, considering the lower credit risk in light of issuers’ stronger balance sheets.

Private markets tend to perform well when economies are humming, as seen in India, and can play a role in portfolio diversification and potentially improve risk-adjusted returns, both across private credit and private equity. One area in this segment of the market is warehousing, given the strong demand and limited investment options available in local public markets.

With US inflation expected to head to target in the coming year, real interest rates are likely to dive lower while gold prices could head higher. In addition, expectations of rate cuts should weigh on the US dollar, with strong central bank demand positive for the gold price, due to heightened geopolitical uncertainty.

As equity markets hit new highs and rate cuts near, find out our latest views on global themes, trends and events influencing investors.

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(I) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.