Market Perspectives May 2023

Welcome to our May edition of “Market Perspectives”, the monthly investment strategy update from Barclays Private Bank.

Fixed income

09 May 2023

Michel Vernier, CFA, London UK, Head of Fixed Income Strategy

Please note: This article is more technical in nature than our typical articles, and may require some background knowledge and experience in investing to understand the themes that we explore below.

For the first time in a while, it hasn’t been the US Federal Reserve (Fed), or other central banks, that have dominated the news in the bond market. Instead, the focus has been on banks and their respective bond holdings in the aftermath of the recent banking sector shocks.

First, it was drama at US regional banks Silicon Valley Bank (SVB) and Signature Bank in March, followed by the bank run and troubles at Credit Suisse in Europe. Indeed, the chapter does not seem to be finished, shown by May's government-led takeover of distressed First Republic Bank by JP Morgan.

In light of increased uncertainty, the earnings reporting of banks presented in the last two weeks have been of particular interest.

The events translated directly into higher spreads of bank bonds and the entire investment grade corporate bond market, over similar government debt in March. Despite a subsequent tightening of spreads since their peak, levels remain relatively wide by both historical standards and when compared to bond spreads in other sectors.

Corporate bonds issued by banks deserve particular attention, given that banks remain a large provider of funding to their respective economies and because bank bonds make up much of the corporate bond market. In the US bank bonds constitute roughly 25% of the broader US investment grade corporate index, according to Bloomberg. While in Europe they account for as much as 33% of the market. For both, this is more than double the weighting of the next largest sector.

Bank scrabble

In order to monitor the financial health of banks an ever-increasing pool of abbreviations are used. It feels like one could combine almost any random number of letters and there would be a good chance that it would represent a specific financial measure or piece of legislation that the abbreviations represent. Good luck, such abbreviations are not accepted on a scrabble board.

The range and proliferation of measures and abbreviations may terrify some investors, as they illustrate the complexity of the industry. But, for those who know what to look for, the trove of data in the abbreviation soup can help investors to spot quickly potential trouble ahead.

On the back of the Silicon Valley Bank (SVB) distress, investors quickly looked at the bank’s liquidity coverage ratio (LCR). The measure LCR shows a bank’s high quality liquid assets (HQLA) in relation to a stressed 30-day outflow.

Substantial deposit outflows exposed SVB’s weak strategy and overly softened regulations in the US, especially concerning liquidity level monitoring among smaller banks.

Contrary to the EU (2,200 banks) or UK in the US only the largest banks (14 banks) follow stricter LCR ratios. This more relaxed strategy is likely to become stricter in the near future.

Deposit outflows

While the initial wave of deposit outflows was caused by uncertainty and stress, a subsequent wave was driven largely by money searching for higher yields in money-market funds.

Recent data from the Fed confirms this trend. Instead of large sudden outflows among smaller banks, more contained, but gradual, outflows among larger banks can be seen. A trend which may continue in the coming months.

European and UK banks witnessed outflows during March but to a much lower extent. In addition, the sector in Europe and the UK maintains a healthy liquidity coverage ratio of around 160% on average, according to ECB data, compared to 118% in the US. Still, as seen with Credit Suisse, at an individual level, weaknesses get exposed that might lead to sudden larger liquidity outflows. And as so often, a liquidity crisis can lead to a solvency crisis.

Bond holdings on bank balance sheets

The sudden deposit outflows in the US revealed the link between liquidity and capital resilience. In the case of SVB, liquid holdings had to be sold to fund the substantial deposit redemptions.

The sale of the bond assets exposed large losses on its so-called available-for-sale book (AFS). In the absence of the necessary fire sales these losses would have not been shown on the balance sheet. The reason for this is that smaller US banks are not required to show any mark-to-market losses on such categorised holdings which can lead to an overstated core equity tier 1 ratio (CET1).

Larger US banks, and the large majority of European banks, have already reported such unrealised losses in the respective reporting and as such their CET1 capital position has been lowered in the wake of the lower-trending values on their bond holdings, caused by higher interest rates. Losses on an AFS portfolio can be easily identified by the accumulated other comprehensive income (AOCI) ratio.

Looking to the future, it is expected that smaller US banks will also be captured by stricter rules over the current true level of their core equity ratio. While this will likely lead to more transparency and resilience, it will probably lead to higher funding costs for respective banks.

Events in March were an example of when a liquidity risk was translated into capital risk. Credit Suisse's first-quarter results showed that outflows hit a $69 billion in just three months1. Furthermore, the bank was quickly running out of ammunition, with the LCR plunging to 144% in the final quarter of 2022, compared with 192% in the third-quarter of 2022.

The Swiss regulator intervened in order to prevent a possible default and to protect the bank’s deposit holders and senior debt holders. The action should have provided comfort for bond investors, but the novel approach taken to the restructuring raised fears among debt investors about the pecking order within the capital structure. Instead of writing down the value of equities ahead of bond holdings, the Swiss regulator chose to wipe out so-called AT1 bonds (additional tier 1 bonds).

These deeply subordinated bonds consist of write-down features. As such, a total wipe-out, write-down event should not have been a surprise. The challenge is that even though the bonds are subordinated to all other debt in the capital structure of a bank, they are supposed (at least in most jurisdictions) to be considered senior to equity (no creditor worse off principle).

Naturally, the intervention quickly sparked a wider sell-off in European TLAC (total loss absorbing) or MREL (Minimum Requirement for own funds and Eligible Liabilities) bonds. This wider category does not only consist of subordinated bonds, but also conventional senior bonds.

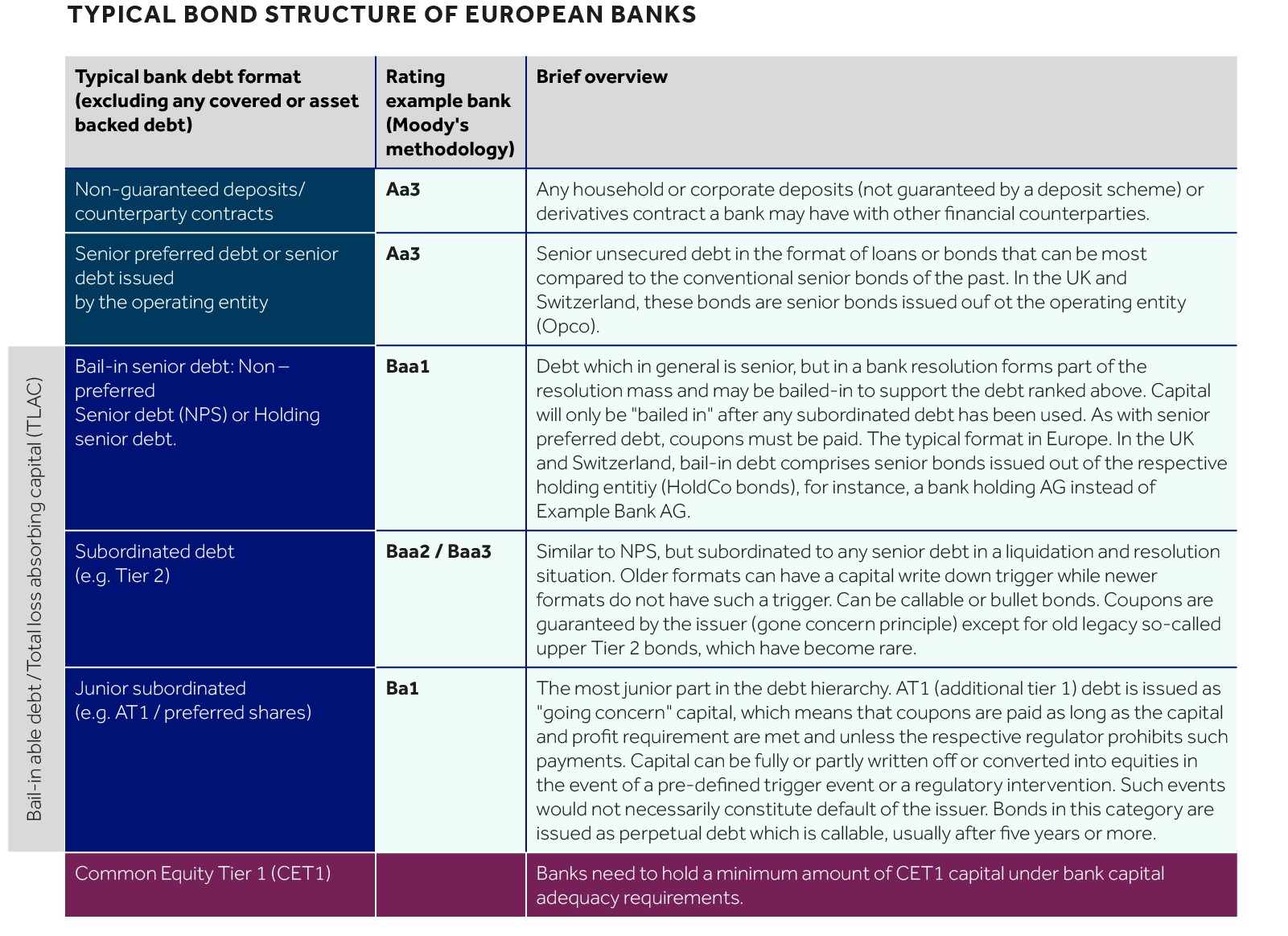

A new breed of senior bonds, introduced in the aftermath of the great credit crisis in 2008-09, can be used to absorb losses so as to protect the value of deposits and true senior bonds (see table). While the events highlight how complex banks’ capital structures can be, at the same time the subsequent re-pricing of bonds has led to yield opportunities.

The following table shows a typical bond structure of a bank as shown first in our publication in July 2020.

The good news is that a large spill over from the events into a crisis has not materialised and is unlikely in our view. But, as covered in Credit cycle in the wake of the incoming rate tide and as investigated in Tighter credit conditions call for increased selectivity, financial conditions have tightened substantially, which shifts the focus to banks’ loan books.

Given the large dependency on finance, the large leverage and lower asset valuation the commercial real estate (CRE) sector has quickly come into focus as a potential challenge for bank balance sheets.

CRE loans on European bank balance sheets amount to roughly €1.4 trillion which comprises of around 6.4% of the total loans, according to the European Banking Authority. This compares to roughly 20% of CRE exposure for US banks, according to Bloomberg. As the majority of CRE loans are paid back in bullet at the redemption date, which could pose large challenge to the sector as rates rise and financial conditions tighten.

While bigger US, and especially European, banks are the main provider of credit to the sector, the proportion of the loans compared to the overall loan book of banks seems manageable. Analysts at Barclays Investment Bank calculate that a CRE loan loss rate of 5% would reduce the CET1 ratio by roughly 61 basis points (bp) in Europe.

The very limited capital impact is also a result of a more conservative approach. Firstly, LTV (loan-to-value) has fallen from 67% in 2010 to 50% in 2023. Secondly, regulators often impose a minimum weighting of 100% in risk-weighted assets (RWA), as seen in the UK, and this forces banks to maintain more equity capital (CET1) to reflect the risk related to the CRE sector.

Overall, CET1 ratios among European banks seem comfortable, averaging 15.3% at the end of 2022, which compares to 13% in 2015 and much lower equity ratios ahead of the credit crisis in 2008 (see chart).

It seems unlikely that the headwinds coming from tighter financial conditions and the recent banking turmoil will lead to broad capital risk within bank. Still, the circumstances will be most visible in NII (net interest income: interest earned on liabilities after costs of interest from funding). A lower deposit base could potentially lead to lower base for loan growth if banks do not opt to change their funding mix.

At the same time, the room for a change the funding strategy may be limited, given higher interest rate costs and the need to put more expensive capital aside to support the growth in the balance sheet.

The earnings headwinds may still be sufficient for elevated spreads going forward. That said, bank-bond spreads seem to reflect the considerable uncertainties and can offer attractive opportunities, in our view.

Spreads of European senior bank bonds have retreated from last October’s peak levels, and during the 2020 pandemic, at around 260bp. But at 164bp, spreads still sit well above the average seen over the last 10 years of 120bp, or 110bp over 20 years (see chart). Moreover, the spread of senior bank bond spreads is 130% of those seen for non-financial corporates (which is mostly represented by the broad industrials sector).

By comparison, during the last 10 years, bank spreads were only 90% of the level seen for non-financial corporate bonds and only 50% during the last 20 years (a timeframe which includes the great financial crisis).

Investing in the broader corporate bond market by default involves exposure to bank bonds, given their large presence in the market. Rather than avoiding bank bonds altogether a consideration of bank bonds of higher quality issuers can lead to overall higher yield premium, which supports our preferred strategy to “lock in yields” (see The road to normalisation for bond investors?) in the bond market.

Welcome to our May edition of “Market Perspectives”, the monthly investment strategy update from Barclays Private Bank.