Spotlight on secondary private markets

29 March 2023

Please note: This article is intended for readers with a solid understanding of investments. Private markets are often complex, illiquid and bring higher idiosyncratic risks than public markets, and so are typically only suitable for sophisticated investors. This communication is also general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person.

Investors are increasingly turning to private markets for diversification and returns in the uncertain macroeconomic environment. The secondary private market is evolving and growing rapidly, but is less widely understood compared to its primary counterpart. Here we offer an overview of current secondary market trends, and factors worthy of potential investors’ attention.

Evolution of the secondaries market

Once a relatively niche segment characterised by distressed sellers and limited buyers, the secondaries market is now an established market with a growing and diverse range of participants, strategies and buyer/seller motivations.

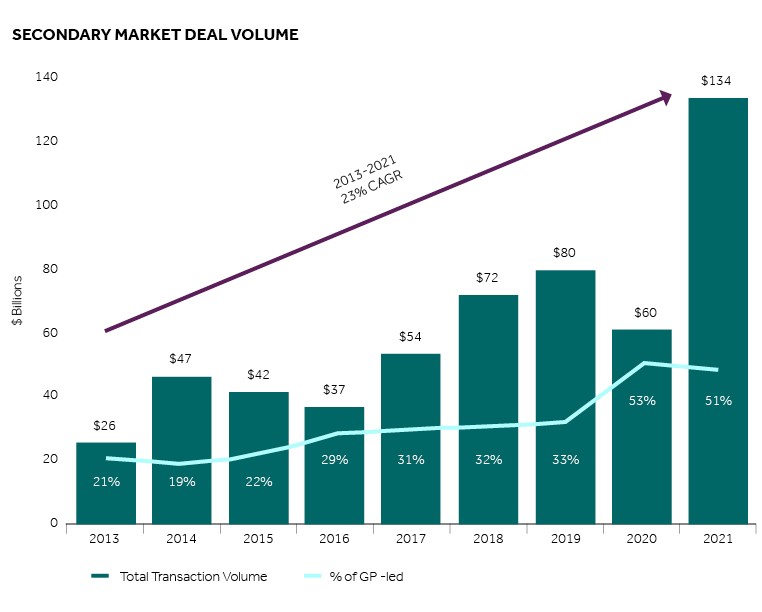

Secondary deal volume grew from $26 billion in 2013, to a record $134 billion in 2021, which equates to a compound rate of 23% per year1. Volumes in 2022 remained high at $108 billion, the second biggest year on record, but slowed during the second half amid public market volatility and lower market pricing2. Nonetheless, the upward trend is expected to continue in 2023 and beyond, as the market continues to develop3. Some estimates project deal volume to double over the next five years4.

Source: HarbourVest, Evercore Secondary Market Survey Results, December 2021

Growth in secondary market opportunities has been fuelled in part by strong demand in the primary private markets, which have raised $3.2 trillion of capital over the past five years5.

There’s also been a shift in perception around the role of secondaries. Whereas trading in the secondary market was traditionally seen as a potential sign of financial troubles, it’s now broadly accepted as an essential component of private markets – and a valuable source of liquidity for wide-ranging needs.

Understanding changing market dynamics

In brief, secondary market funds, or secondaries, buy an existing interest or asset from primary fund investors, known as limited partners (LPs). General partners (GPs) who manage private markets funds, may also initiate deals in order to transfer one or more assets from one vehicle to another. These transactions vary in structure and complexity, and cover a range of strategies, including private equity, debt, real estate and infrastructure.

LP-led activity: active management and the ‘denominator effect’

Traditionally, secondary market transactions were initiated by LPs looking to sell their commitments in a private markets fund ahead of maturity – and they remain core to the market today. However, LPs are increasingly using secondaries more strategically, to actively manage their portfolios and meet a wider range of needs – including rebalancing, portfolio repositioning, reducing non-core managers or strategies, as well as generating liquidity.

Current public market volatility is also driving LP-led activity. Some LPs are looking to de-risk, while others are suffering from what’s known as the ‘denominator effect’. This occurs when disproportionately weaker performance from an LP’s listed market investments causes their private markets allocation to increase as a percentage of their total portfolio. Where these allocations breach investment policy or regulatory limits, LPs are turning to the secondary market to reduce their exposure. Pension funds and insurance companies are among those affected, with the former representing 65% of secondary sellers in H1 20226. For buyers, this may present opportunities to acquire high-quality assets at an attractive discount.

GP-led transactions: extracting value for longer

In recent years, there’s been a clear increase in GP-led deals, which accounted for more than 50% of all secondary deal flow in 2020 and 2021 (as shown in the chart above)7 – although this dipped to 48% in 20228. Often more complex in nature, these transactions include creating continuation funds, which allow GPs to hold onto strong-performing assets for longer, while returning capital to their original investors as required – a topic we touched on in our previous article Trends in private markets.

GPs are also using secondaries as an alternative to traditional exit routes, as macroeconomic uncertainty has seen exit activity slow and the IPO market grind to a halt. In this environment, secondaries can offer GPs both liquidity and flexibility around when to sell. For buyers, they can be an opportunity to access seasoned assets with a proven track record, where the GP sees potential to extract even more value.

What’s the appeal for investors?

The secondary market offers some potential benefits (and risks) for investors that differentiate it from the primary market.

Accelerated returns

In a typical primary private equity fund, it can take five years or more to deploy capital raised, and several years before investors receive any distributions. Investor returns can therefore be negative during the initial years, as they commit capital and pay manager fees/costs – known as the J-curve effect. Secondary funds typically acquire stakes at a later stage in the process (around years 5-7) when assets are often already entering the distribution phase, meaning investors could receive pay-outs from the outset.

Source: HarbourVest, Barclays Private Bank. Cash flow profile presented for illustrative purposes only. Data shown does not represent the performance of any HarbourVest or Barclays Private Bank fund/account. March 2023

More visibility

Primary fund investors commit capital without knowing exactly where the manager will invest, and so take on some degree of ‘blind pool’ risk. Whereas secondary fund investors know which assets they’re investing in from the outset, and can assess the manager’s track record to date – which can be especially valuable in very challenging markets as we saw last year. For continuation funds, which are typically created after a primary fund has reached maturity, the track record is even longer.

Diversification

Secondary investments are subject to different dynamics than primary market, and so can provide diversification within a broader allocation to private assets. Many secondary funds will invest in a range of managers and portfolio companies, across different vintage years, regions and sectors, allowing investors to build a diversified exposure.

Why consider secondaries in the current environment?

Supply-demand dynamics in the secondary market are currently skewed in favour of buyers. While there has been an increase in buyers looking for secondary opportunities, the market remains under-resourced and under-capitalised, with supply considerably outpacing demand.

Secondary ‘dry power’ (i.e. capital already raised) would run out within less than a year if current volumes are maintained (compared to almost three years for the buyout market), as shown in the chart below. Dry powder is also relatively concentrated across a small number of buyers – some estimates suggest around half of secondary dry power has come from just four buyers9.

Source: HarbourVest, Evercore Secondary Market Survey Results (Secondary data), Preqin (Buyout data), June 2022

In a market where more sellers are competing to secure funding, buyers are increasingly able to be selective on which assets they buy, as well as negotiate attractive discounts. For example, discounts in the LP portfolio market are at their highest level since at least 201610. Secondary investors can benefit immediately from these discounts, as well as any longer-term value creation.

What about potential risks?

Secondary market transactions can be complex, particularly in GP-led deals involving fund restructuring, and so require careful, extended due diligence – especially where conflicts of interest between GP and LP could arise. Meanwhile, negotiating discounts with LP sellers, especially in challenging markets, can take time and skill. Investing with an experienced manager with the relevant expertise and market access can reduce this risk.

Private market investments are by nature less liquid than public markets, including secondaries, and there is no guarantee of returns. Diversifying across managers, vintages and strategies can help spread risk and build a more resilient portfolio exposure.

Please note: Past performance and simulated past performance are not reliable indicators of future results The value of investments can fall as well as rise and you may get back less than you invested.

Related articles

Disclaimer

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.