Global Outlook 2023

As investors near the end of a tough year, full of twists and turns, our bumper Outlook 2023 takes a look at prospects for financial markets next year.

14 November 2022

Dorothée Deck, London UK, Cross Asset Strategist

After a sharp sell-off in equity markets, the long-term prospects for the asset class look much better. However, with a recession potentially in the cards, soaring inflation, and geopolitical tensions, increased selectivity in portfolios may be needed.

It’s been a tough year for equity investors as economic growth expectations are slashed across regions, while inflation forecasts and policy rates have been revised higher. Will 2023 be any better for financial markets?

With the US Federal Reserve (Fed) and other major central banks tightening monetary policy amid a slowing economy, unsurprisingly, the risk of a global recession has increased. A consensus of economists puts the probability of a recession in the next 12 months at 60% in the US and 80% in Europe. Barclays’ economists now expect advanced economies to contract next year (to -0.2% in 2023 from +2.5% in 2022), but global growth to remain positive, albeit very weak (see Global economy to keep its head above water).

US bond markets have flagged for a while that a recession is likely towards the second half of next year. Yield curve inversions have been reliable indicators of them in the past, with recessions typically starting 14 months on average after inversions. The 2s10s US yield curve turned negative in July, reaching a 40-year low of -63 basis points (bp) in early November.

The key question for investors is around the timing, depth, and duration of the next recession. Equity market performance in such periods, and the time it takes for investors to recoup their losses, depend on the severity of the downturn.

Unfortunately, recessions are difficult to predict, and they vary enormously in duration and magnitude. The current environment is particularly hard to assess with inflation running at multi-decade highs in leading economies and the geopolitical situation adding further uncertainty, there are few historical precedents.

The most severe recessions tend to be the ones triggered by a financial crisis. Encouragingly, we do not see any major imbalances in the economy for now. US consumer and corporate balance sheets remain healthy, large excess savings provide some cushion, and the labour market remains strong. Therefore, if a global recession materialises, we believe it is more likely to be mild and short-lived.

At current levels, the market seems to be discounting a mild recession, in line with our base case scenario. This view is based on the level of economic activity and earnings growth we believe is reflected in equity prices at present.

If we were to see an average recession, we believe that global equities could decline by a further 10% or so. This would be approximately 33% below the January peak levels on the MSCI All Country World Index.

i. Activity level discounted by equities

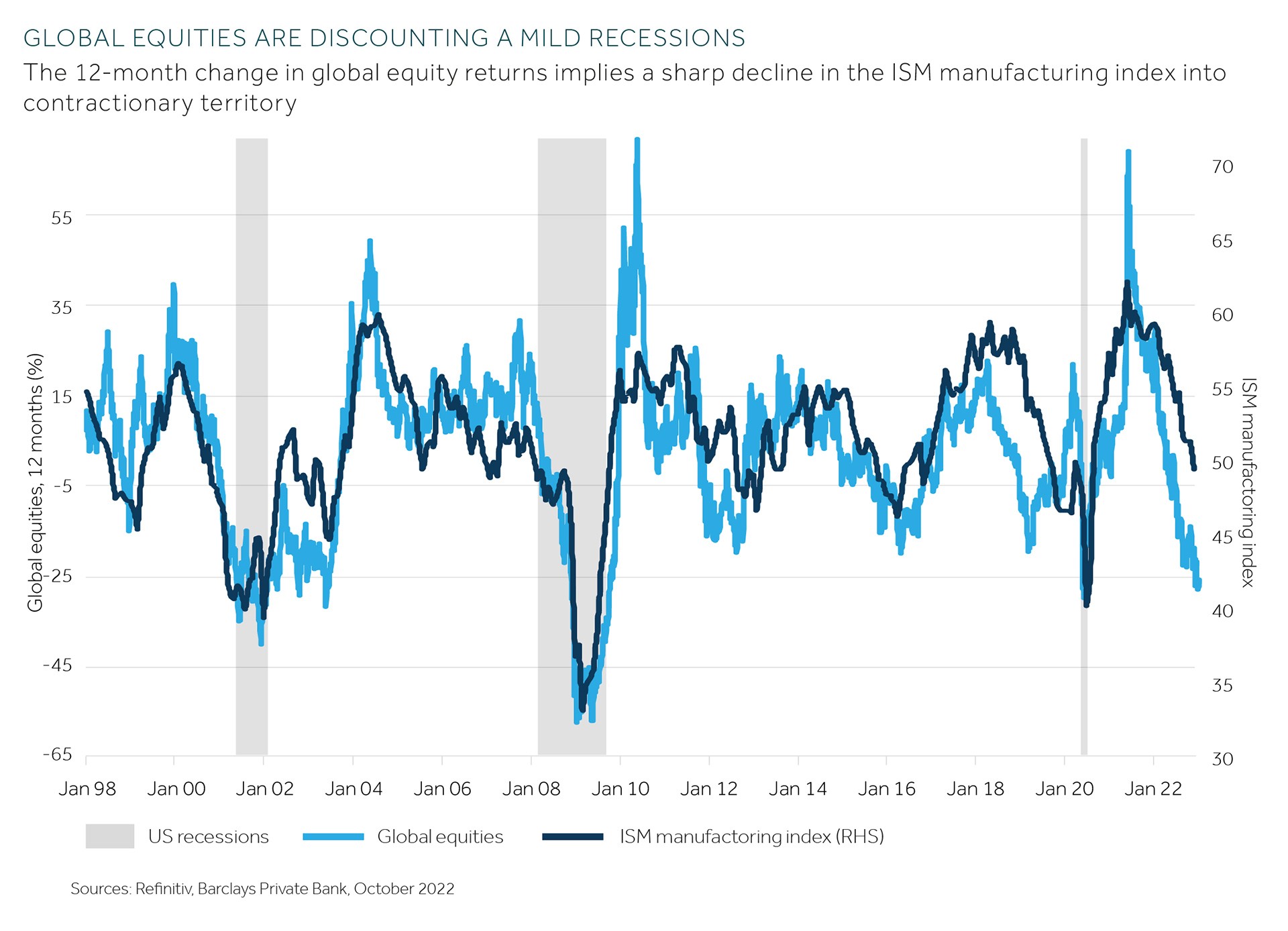

At current levels, global equities seem to be discounting an ISM Manufacturing Index of around 42, in contraction territory, compared with 50.2 in October (see chart).

This compares with an average trough in the ISM manufacturing index reading of 39 in previous bear markets, which would be consistent with a further 10% dive in global equity prices.

In a more severe contraction, the ISM manufacturing index could drop below 35, similar to the troughs in the index seen in recessions in 1973 and 2008, which would imply a plunge of at least 20% from current levels.

ii. Earnings growth discounted by equities

On our numbers, the equity market is currently discounting around a 14% year-on-year tumble in global earnings by May, broadly in line with the 13% decline projected by our top-down earnings model.

In previous recessions, global earnings have fallen on average by 20% year-on-year, though crashed by as much as 35% in 2009. We estimate that a 20% decline in earnings would justify a 10% further downside to global equity prices from current levels.

iii. Market drawdowns seen in previous recessions

Our estimate of a -10% downside risk to global equity prices in an average recession scenario would be consistent with the average drawdowns seen in previous recessions.

At the time of writing, the MSCI All World Country Index is down 23% from its January peak. In the past 50 years, global equities have declined by 36% on average around recessions (from peak to trough). These drawdowns ranged from -15% in 1980, to -60% in 2009, and they lasted 12 months on average.

For equity markets to bottom, certain conditions generally need to be in place:

Two of those conditions appear to be in place, but they may not be sufficient, on their own, to trigger a sustainable rebound:

For markets to look beyond heightened levels of volatility, we will need to see signs that economic activity has troughed and that central banks’ hiking cycle are coming to an end.

Historically, rate cuts have been a key catalyst for equities to rebound. But we do not expect a dovish pivot soon, unless something breaks — in which case, obviously, markets may struggle. Until clarity emerges, we do not exclude more rallies, similar to the ones we saw in March and from mid-June to mid-August, which were violent but short-lived.

In the next six to 12 months, equity markets are likely to remain highly volatile, and risks appear tilted to the downside. Price action will likely be driven by surprises around economic growth, inflation, and labour markets, as well as central bank commentaries.

We expect markets to be very myopic and oscillate between risk-on and risk-off periods, in a wide range. Geopolitics will also be a major driver of short term price action. However, as mentioned earlier, given depressed sentiment and cautious positioning, sharp rallies and violent rotations are possible.

On a more positive note, equity markets’ long-term prospects have perked up in recent months, following their sharp de-rating. As highlighted in Cyclically-adjusted PEs as a guide to equities’ long-term return potential, cyclically-adjusted price-to-earnings (PE) multiples are now consistent with global equity returns of 9% annualised over the next decade, including dividends, in line with the returns generated in the past 20 years. While implied returns vary by region, the message is generally positive for long-term investors who can withstand bursts of volatility.

Given the near-term uncertainty, we maintain a balanced positioning. We see merits in having some hedges in place and in using option strategies to reduce downside risk. We also encourage increased selectivity at both the sector and the stock level.

i. Defensive sectors are too expensive

Following the substantial rerating of defensive sectors in the past year, as recession fears gained traction, the sectors appear expensive, especially in the context of a risk-free rate of 4%. Indeed, defensives are now trading at a 46% PE premium to cyclicals, globally, much higher than the average premium of +18% in the past 20 years. This is two standard deviations above the long-term average (see chart).

Attractive investments can still be found, but on a very selective basis, at the stock level, or in some regions as opposed to globally. Given this year’s surge in yields, we generally see better opportunities for defensive positioning in the fixed income universe at present.

ii. Value versus growth

Equity performance has been primarily driven by stocks’ sensitivities to rising real yields this year. Value plays have been more resilient in the market sell-off than the more expensive growth stocks, with long duration cash flows. The MSCI World Value index has outperformed growth by 38% (and the market in general by 17%) since November 2021, as US real yields surged by close to 300bp.

While most of the rise in yields seems to be behind us, value stocks could still perform well into next year. Indeed, we believe that their relative performance does not fully reflect the higher yields, and they continue to trade at a large valuation discount relative to growth stocks, and the market in general.

iii. Banks

In keeping with the value tilt at the sector level, we see interesting opportunities in banks and energy.

Banks should be one of the main beneficiaries of rising yields. Since the start of the year, the relative performance of banks has disconnected from US 10-year yields (see chart).

This disconnect reflects market concerns over recession risks, and the negative impact one would have on banks’ profitability, given their sensitivity to the business cycle.

We continue to expect the disconnect between the relative performance of banks and yields to narrow. Net interest margins may surprise positively, and loan-loss reserves have already been built up in anticipation of worsening asset quality. Banks are also better capitalised today than they were during the global financial crisis. As we get more clarity on the shape and magnitude of the slowdown, we think the sector could re-rate further and catch up with the recent rise in yields, despite rising recession risks.

And finally, valuations and earnings revisions are supportive. Within the MSCI World index, banks are trading at a -42% discount to the market, based on forward PEs, versus a -26% discount on average in the past 20 years. They also offer a superior dividend yield (4.7% forward 12-month dividend yield for MSCI World Banks versus 2.3% for the broader market).

iv. Energy

The energy sector should continue to profit from high fuel prices and offer some protection against escalating geopolitical tensions. While global demand for oil and gas would be at risk in a recession, energy prices should be supported by tight supply in the coming months. The EU’s embargo on Russian oil supplies will take effect in the next few months, and the OPEC+ group of oil producers recently announced production cuts starting in November.

Despite surging so far this year (the MSCI World Energy index is up 52% while the broader market is down 21%), the sector continues to trade at a significant discount versus the market, based on forward PE multiples (1.4 standard deviations below 20-year average). Energy shares also offer a superior dividend yield (3.6% for the next 12 months compared with 2.3% for the market).

v. UK equities

While we are neutral on European stocks against their US peers, we see opportunities in UK equities.

European shares trade at a steep discount relative to the US. However, we do not see a catalyst in the near term for the discount to narrow, as Europe enters a recession and the conflict in Ukraine rages on.

On the other hand, UK stocks appear better positioned, due to the over-representation of value and commodity sectors in the UK market (financials, energy, and basic materials). We particularly like large-capitalisation (large-cap) names, which tend to derive much of their revenues from overseas, and should benefit from the weak sterling.

At the same time, valuations are supportive, with UK large-cap stocks trading at a -40% forward PE discount to the broader market, versus a -13% average discount over the past 20 years.

Finally, sentiment on UK assets appears very depressed, following September’s mini-budget announcement and political crisis, and UK equities have seen the worst outflows on record year-to-date. We believe the appointment of market-friendly Rishi Sunak as the new prime minister should help calm markets and lift sentiment.

vi. At the stock level

Beyond sectors or geographies, we believe that the bulk of the opportunities will materialise at the stock level. Here, we would focus our attention on companies exhibiting the following characteristics:

A diversified portfolio of stocks exhibiting the above characteristics should help investors to reduce downside risk, generate income, exploit market dislocations, and tap into long-term structural trends.

As investors near the end of a tough year, full of twists and turns, our bumper Outlook 2023 takes a look at prospects for financial markets next year.

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.