Onshore wind energy faces administrative headwinds

Compared with offshore wind, onshore wind offers lower costs and wider installation, but a more complex and lengthy permitting process. Onshore wind also has a lower capacity factor (so on average it generates less energy per turbine) than offshore counterparts (ranging from 50-300% more MW), due to more variable wind conditions and smaller turbines.

There are more than 2,500 operational onshore wind farms, with a total capacity of 14.2 GW, in the UK. However, growth has slowed considerably since 2017 when the government established three-part approval, which effectively stopped most new capacity addition. As a result, the UK only added 0.3 GW of onshore energy in 2021 for example.

One barrier was removed in 2021 to allow windfarms to bid to supply electricity to the grid again. The others are not addressed by “wholesale changes” in the new strategy. Instead, it only opened the opportunity for consultation with local communities wishing to bring forward new projects.

The EU added 11 GW of onshore wind capacity to reach 173 GW at the end of last year. However, as WindEurope has analysed, this is less than half of what is needed to stay on track under its ‘Fit for 55’ package. So rather than setting new or additional targets, the EU’s REPowerEU strategy added explicit plans to accelerate the permitting process to reduce the cost, complexity, and time to add existing planned capacity.

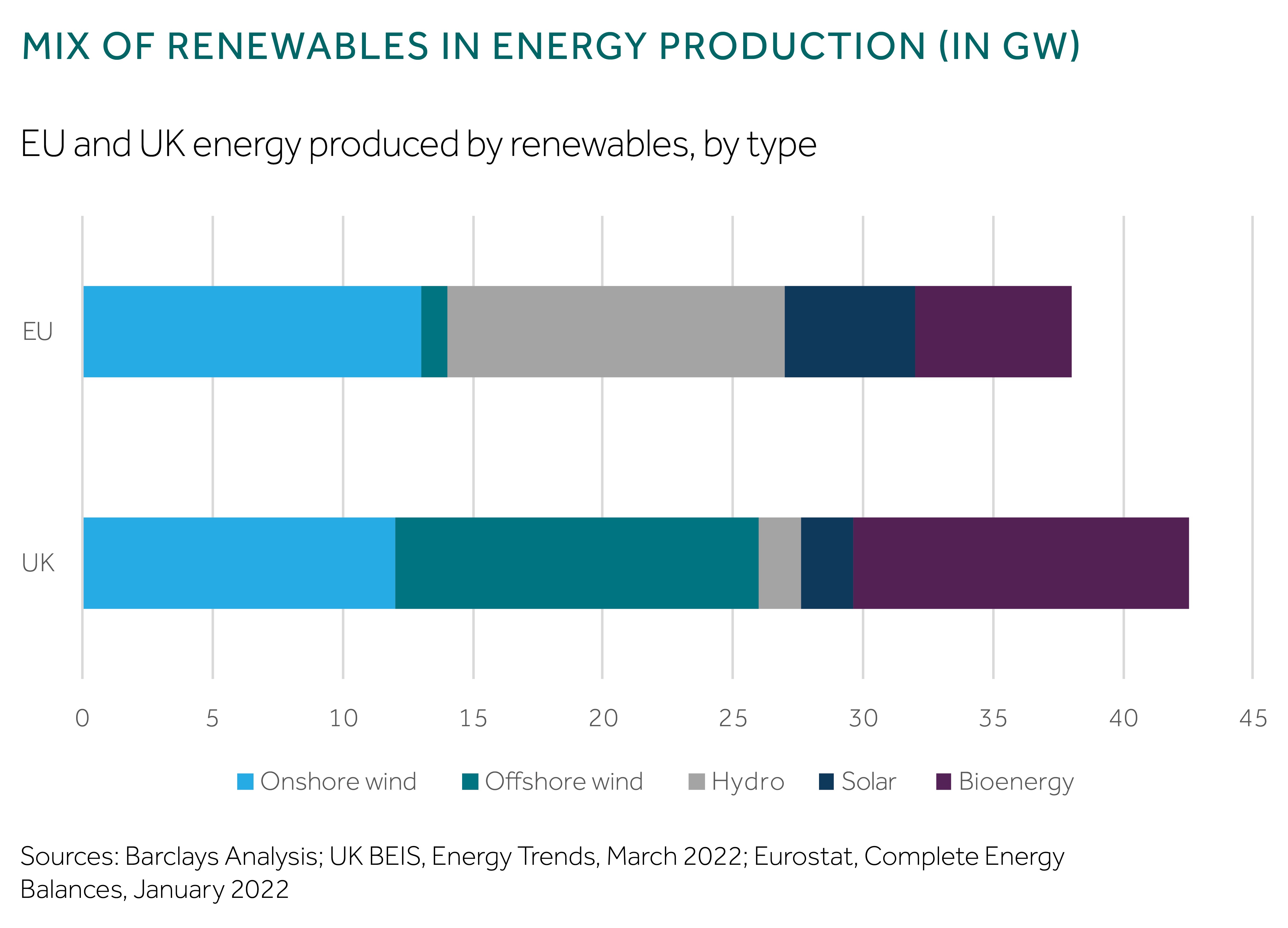

For investors, onshore wind shares a similar technological foundation to offshore, and the current cost issues around commodity and input prices, and supply-chain disruption. But the permitting process remains a central challenge to expand capacity. However, given installed costs are considerably lower, if proposed governmental amendments to permitting are successful, industry growth could rapidly accelerate, making it a much more attractive market (see chart).