Commodity markets: A short and long-term perspective

29 July 2022

By Dorothee Deck, Cross Asset Strategist at Barclays Private Bank

Please note: Reference to commodities in this article is not an opinion as to their present or future value and should not be considered an investment recommendation, investment advice or a personal recommendation.

As global uncertainty and high inflation continue to occupy investors’ thoughts, the potential for a recession and subsequent negative impact on demand, are being felt in commodity markets.

Since the 9 June 2022 and as at 15 July 2022, broad-based commodity prices have declined by 18%. Based on the S&P GSCI Commodity price index, the decline has been driven mainly by energy (-19%), industrial metals (-22%), and agriculture (-19%). Shining a bit brighter are precious metals, down only 9% over the period.

Given the role that commodities can play in hedging a portfolio against inflation and geopolitical risk, could this price decline be a timely opportunity for investors looking to add more ballast?

The near-term view

We believe that commodity prices are likely to remain very volatile, as long as the growth and inflation outlook remains highly uncertain.

Price action will probably be driven by the news flow coming out of Europe and China – the war in Ukraine and subsequent regional energy crisis, continue to be sources of concern. In parallel, China’s lockdown policy is hindering global supply chains, while its fiscal policy is subject to intense speculation.

Against this backdrop, we now take a closer look at the drivers and detractors for energy, industrial metals, and precious metals.

Energy

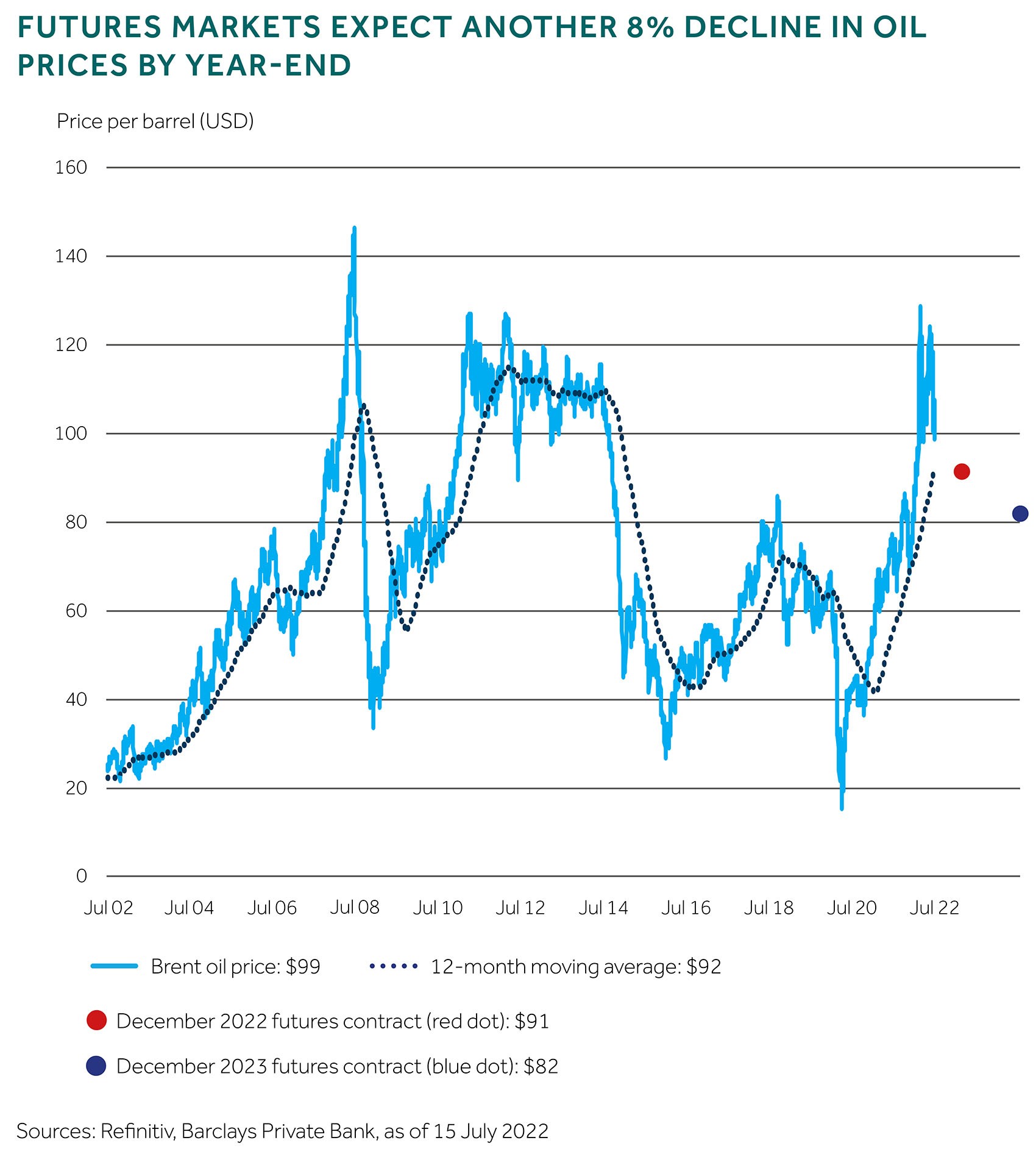

One of the biggest investor consequences of the Ukraine war has been the eye-popping run for energy prices. Until mid-June, soaring prices were driven by the European Union’s embargo on Russian oil supplies, and compounded by Opec’s reluctance and inability to increase output. However, prices have been hurt in recent weeks by increased fears of a recession and potential demand destruction.

Not surprisingly, Russia’s President has criticised Western sanctions on his country’s energy suppliers, warning of dire consequences for the global energy market. Meanwhile, Saudi Arabia and the United Arab Emirates have signalled their limited ability to increase production significantly. This is why we expect energy markets to remain highly volatile in the near term – any small shock in supplies would materially hit prices.

In summary, expect short-term volatility, but tight supply should support prices over the longer term.

Industrial metals

China’s commitment to COVID-19 lockdowns has been felt far and wide, including across industrial metal prices. Weakening Chinese demand, combined with an improvement in the supply-chain bottlenecks, have undoubtedly taken their toll.

However, we would expect those risks to dissipate progressively, as the COVID-19 infections fall and if, as we expect, the Chinese government implements a significant stimulus programme.

In the longer term, the outlook for industrial metal prices remains underpinned by favourable supply and demand dynamics. Supply is tight, following under-investment from miners over many years, while demand should be supported by the energy transition, especially towards renewable sources.

Precious metals

While inflation, recession, and geopolitical risks hang over markets, the case for investor exposure to precious metals (including gold), is strong.

Based on their historical relationship with real yields, precious metals appear fundamentally expensive. Yet, they should continue to provide diversification benefits as long as inflation risks remain.

As such, we don’t believe investors should own precious metals primarily as a driver of upside, but rather as a portfolio diversifier.

Final thoughts

The current fall in commodity prices could be timely for investors wanting to hedge more, and on a 12-month view, we believe commodities can play an important diversifier role.

The inflationary environment that we’re in lends itself to commodity exposure, while gold remains a solid safe haven option when volatility is high.

We will continue to update you in the months ahead, and Market Perspectives – our golden source of Investment Strategy thought leadership – returns in early September.

Related articles

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

- is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

- is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

- is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

- has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.