Volatility, inflation, and rate hikes: why context is key

28 January 2022

6 minute read

While the rollercoaster start to the year may feel uncomfortable in the short term, we believe there is little reason for investors to panic.

First, volatility – particularly in equity markets - is nothing new. Broadly speaking, the industry definition of a market correction is a +10% drop from the most recent high. Based on historical data, the S&P 500 index experiences such a drawdown every 12 months or so.

Despite these bumps along the way, not too long ago the index was at all-time highs, and it has generated a total return of more than 450% over the last 20 years, or 9% a year (This is based on our in-house assessment of historical Bloomberg data from the time of writing – 27 January 2022. Past performance is never a guarantee of future performance).

Second, while some areas of the equity market have suffered more than others, the overall volatility, as measured by the VIX index, is still relatively low. In other words, the current bout of uncertainty may feel much worse than it actually is, simply because we, as investors, have got used to equity markets going only one way since their COVID-19-driven trough in March 2020: up.

In line with our previous comments on the topic, we continue to anticipate bouts of volatility in 2022. But these should be relatively short lasting.

What’s driving current volatility?

In this particular case, January’s volatility is a sign that markets are adjusting to life with coronavirus. It means that supportive central banks can start moving from survival mode to stabilisation mode, and start to normalise monetary policy.

The reality is beginning to hit home that big spending and static interest rates simply can’t continue, especially in the context of growing inflationary pressures. This change of paradigm was always likely to unsettle markets and require some adjustments after months of unlimited support.

High-growth, low-profitability stocks have been the most vulnerable to the recent rate-shock, as their valuations heavily rely on future cash flows. Most of the initial selling pressure was focused on this group of stocks, before expanding indiscriminately to the rest of the market in a broad-based risk-off move.

The Fed’s next move

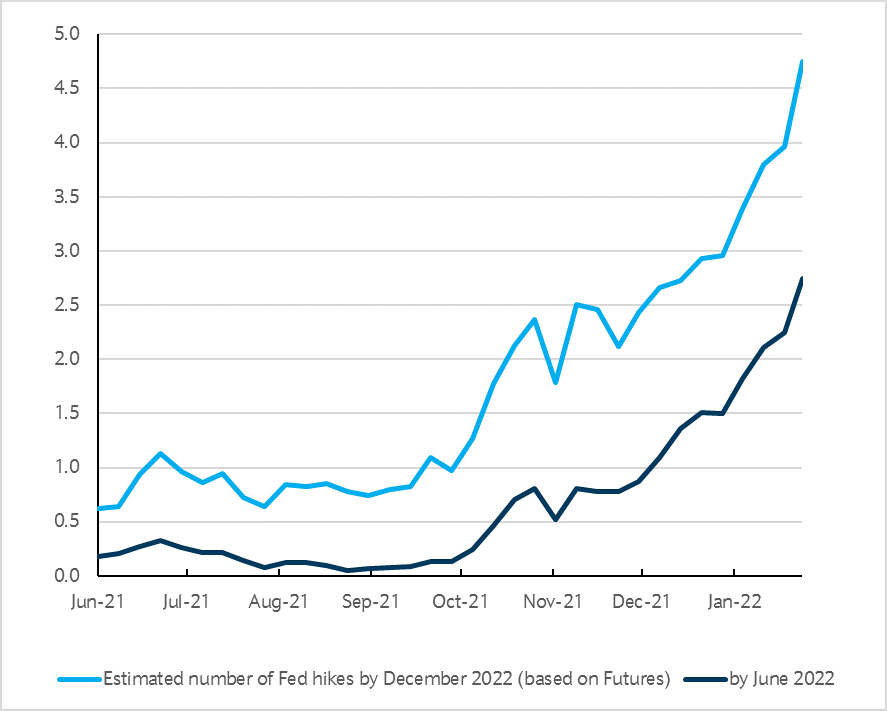

On Wednesday 26 January, the US Federal Reserve (Fed) signalled its intention to start hiking interest rates in March. Investors had been gradually pricing in this eventuality. From one single rate hike being anticipated for 2022 back in October, ahead of January’s Fed meeting, markets anticipated as many as four hikes this year.

The hawkish tone struck by chair Jerome Powell, during the press conference on 26 January, has seen a further repricing, and a fifth hike is now being discounted for this year. While there seems to be a race among forecasters as to who will call for the highest number of hikes, we remain more balanced in our interpretation of the central bank’s message.

Yes, the central bank wants to prevent inflation expectations from running away but it also wants to remain “nimble”. While the market may have interpreted this statement as “more aggressive than usual”, we believe the Fed was simply trying to convey the message that adjustments will be required along the way.

If, as we expect, inflationary pressures subside, they we would expect the Fed to slow down the pace of normalisation.

Five Reasons to stay optimistic

1. The market may have reached “peak hawkishness”

In our view, the Fed has done a lot of the heavy lifting when it comes to preparing the market for higher rates. With close to five hikes being priced in for this year, we see a higher probability that the Fed under rather than over-delivers on the market’s expectations.

Source: Bloomberg, Barclays Private Bank. January 2022

Please note: Forecasts are not a reliable indicator of future performance. The value of investments can fall as well as rise and you may get back less than you invested.

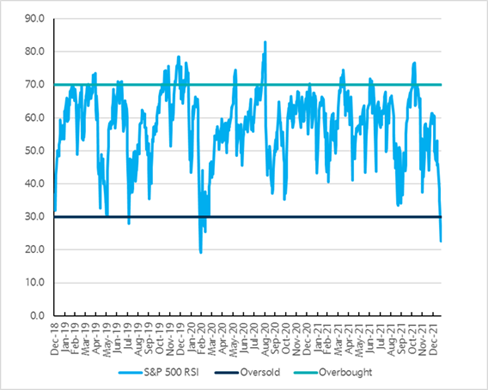

2. We are reaching oversold levels

As we can see in the chart, the S&P 500 Relative Strength Index (RS) has touched the most oversold levels since the pandemic-related bear market of March 2020. In other words, the move lower has been very violent and should abate.

Source: Bloomberg, Barclays Private Bank. January 2022

Please note: Past performance is not an indication of future performance. The value of investments, and any income can fall, as well as rise, so you could get back less than you invested. Neither capital nor income is guaranteed.

3. Fundamentals are still supportive

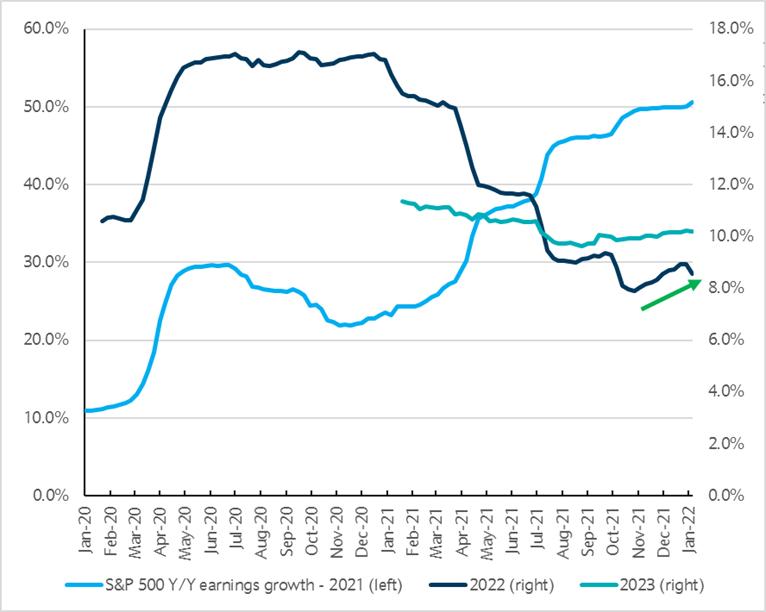

About 50% of US companies have reported results for fourth-quarter earnings. The season has been relatively good with companies on course to deliver 24% earnings growth compared to a year ago, three percentage points higher than anticipated by the consensus.

In addition, guidance and commentary from management teams haven’t been nearly as bad as the price action would suggest. As a result, year-on-year earnings growth expectations for the whole of 2022 are still firmly in positive territory - now at +8.5% in the US (Source: Bloomberg, Barclays Private Bank. January 2022).

Source: Bloomberg, Barclays Private Bank. January 2022

Please note: Past performance is not an indication of future performance. The value of investments, and any income can fall, as well as rise, so you could get back less than you invested. Neither capital nor income is guaranteed.

4. Volatility is a feature of equity markets

As mentioned earlier, the real anomaly was the unprecedented move we’ve seen since the pandemic trough. We regularly write about the importance of keeping our composure in the face of heightened volatility. History reinforces this view. In April 2021, we looked at recent pullbacks and showed that staying invested is (always) the right move and that time plays in investors’ favour.

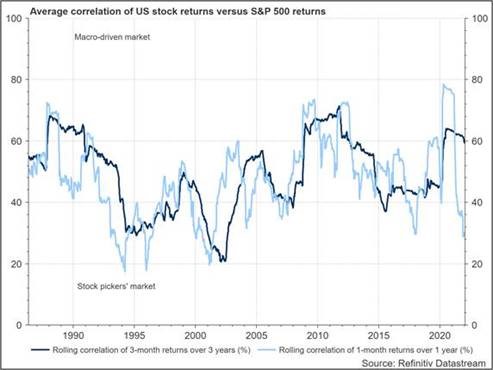

5. Opportunities for stock pickers abound

Finally, while indices may struggle, there is a lot more happening below the surface. In fact, the average correlation of stocks in the S&P 500 has collapsed as dispersion has surged. This environment is potentially great for alpha generation and stock pickers.

Source: Bloomberg, Barclays Private Bank. January 2022

Please note: Past performance is not an indication of future performance. The value of investments, and any income can fall, as well as rise, so you could get back less than you invested. Neither capital nor income is guaranteed.

Our view

We were expecting 2022 to be volatile and the first few weeks of the year have already (over) delivered. Remember that markets are inherently volatile. They operate like a pendulum, swinging from optimism to pessimism, and never settling right in the middle.

In addition, the current set up (initial move higher in a straight line, demanding valuations, change in monetary policy, and geopolitical tensions) is also conducive of large swings. As such, one should not be scared about the recent weakness. This, in our opinion, is another one of these opportunities when markets overreact, allowing for attractive entry points for long-term investors.

Related articles

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

The communication is:

- not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

- not an offer, an invitation or a recommendation to enter into any product or service and do not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

- is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

- has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.