Russia-Ukraine crisis: What’s at stake for the global economy?

Inflation and growth prospects are just two casualties of Russia’s conflict with Ukraine. As such, find out what’s next for the global economy?

04 April 2022

Welcome to our latest edition of Market Perspectives, which aims to provide much-needed context and clarity, at a time when volatility and uncertainty weigh on investors’ minds.

This year’s surge in oil prices can be found in elevated inflation levels and has led to economists rushing to reassess global growth forecasts. For instance, Barclays Investment Bank now assumes global growth of 3.4% this year, down from 4.3% in January. In this month’s report, we look at what effect soaring crude costs may have on equities, bonds, and other asset classes.

Understanding the effects of oil price shocks on equities matters. Over the last 50 years, global markets typically troughed seven months after such shocks start. While energy and basic materials tend to perform well, technology usually takes the biggest hit. But the good news is that the economy is better placed to withstand such events now than it was in the 1970s.

Bonds have suffered this year as elevated inflation persists and leading central banks remain hawkish. In this context, a defensive positioning in medium-term bonds appeal most, but we’re starting to find more opportunities for yield generation.

Beyond our usual asset class and financial market analysis, you’ll also find our latest sustainability insights.

Companies are increasingly pledging to fight climate change by producing net-zero carbon emissions by 2050. But the devil is in the detail. Taking a look into the commitments made can help to unearth those businesses set to be net-zero pioneers, and well-placed to profit from the transition to a low-carbon world.

As always, we hope you enjoy the report and we thank you for entrusting us with your investments.

Jean-Damien Marie and Andre Portelli, Co-Heads of Investment, Private Bank

Insights for April

Inflation and growth prospects are just two casualties of Russia’s conflict with Ukraine. As such, find out what’s next for the global economy?

As commodity prices surge, the economy faces an oil shock. Which sectors of the equity market tend to perform best and worst at such times?

With the Russia-Ukraine conflict adding to a lengthy list of uncertainties facing bond investors, a more defensive approach may be called for.

More companies are making net-zero carbon emissions pledges. Spotting those likely to satisfy ambitious commitments may be key to finding winners.

Find out why using forecasts can be dangerous when trying to make sense of investing in an uncertain world.

Find out why central bank monetary policy supports “quality” developed market equities and gold, while developed market bonds shine in debt markets.

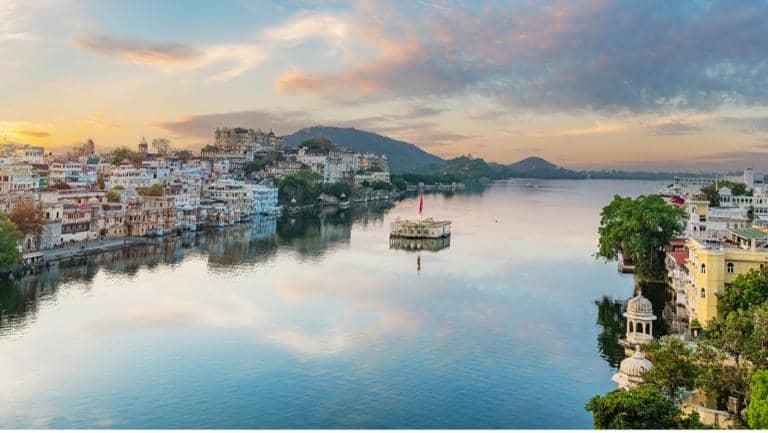

Discover the latest investment views of our team in India as they explore local trends covering inflation, equities, debt and more.

Find out about geopolitical conflicts and returns, the 60/40 asset split, Chinese equities, April’s French elections, and key long-term investment trends.

All the articles published in Market Perspectives are also available to download here as a PDF: