Could you start by explaining why voting and engagement activities are important for investors?

Voting and engagement are the key tools investors have to encourage companies to manage their environmental, social and governance (ESG) risks. Companies that do so effectively are likely to be less prone to severe incidents, such as fraud, litigation, or reputational risks, and may also enjoy a stronger reputation, or lower cost of capital. This, in turn, can help protect – and potentially enhance – shareholder value.

There are several examples of ESG controversies facing companies, both current and historical, that reinforce this view, such as poor worker safety, supply chain issues, and oil spills. Over time, we’ve seen a growing awareness that ESG risks can materially impact investment performance, and of the crucial role that investment managers can play in addressing ESG issues, such as climate change or diversity and inclusion.

By identifying and managing ESG risks and opportunities more effectively, we should be better placed to deliver competitive long-term returns for our clients. Our engagement activities also provide our Portfolio Managers with additional data and insights to supplement their traditional analysis.

Could you give us an overview of Barclays Private Bank’s approach to voting and engagement?

We’ve partnered with a leading stewardship provider, EOS at Federated Hermes (EOS) in the UK and Jersey, to support us with our voting and engagement activities. Through this partnership, we engage and vote globally with corporates and key stakeholders, such as policymakers and regulators.

Our engagement with corporates (via EOS) has taken place at board and senior executive level, covering a range of topics, such as climate change, climate transition plans, net zero, human rights, gender and racial equity, and executive pay. Through these activities, we’ve sought to highlight key ESG issues of concern, which could affect shareholder value and stakeholder wellbeing.

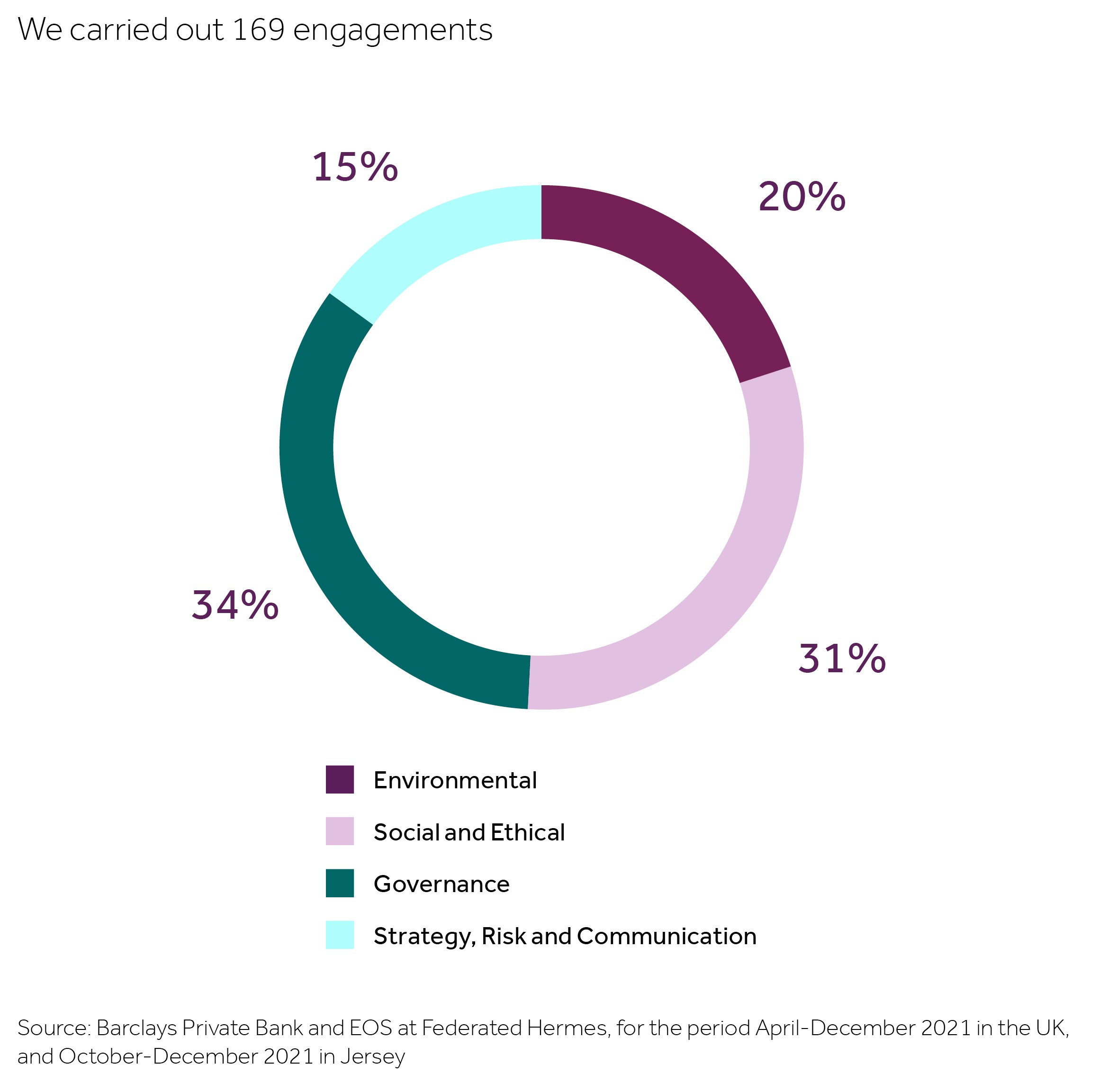

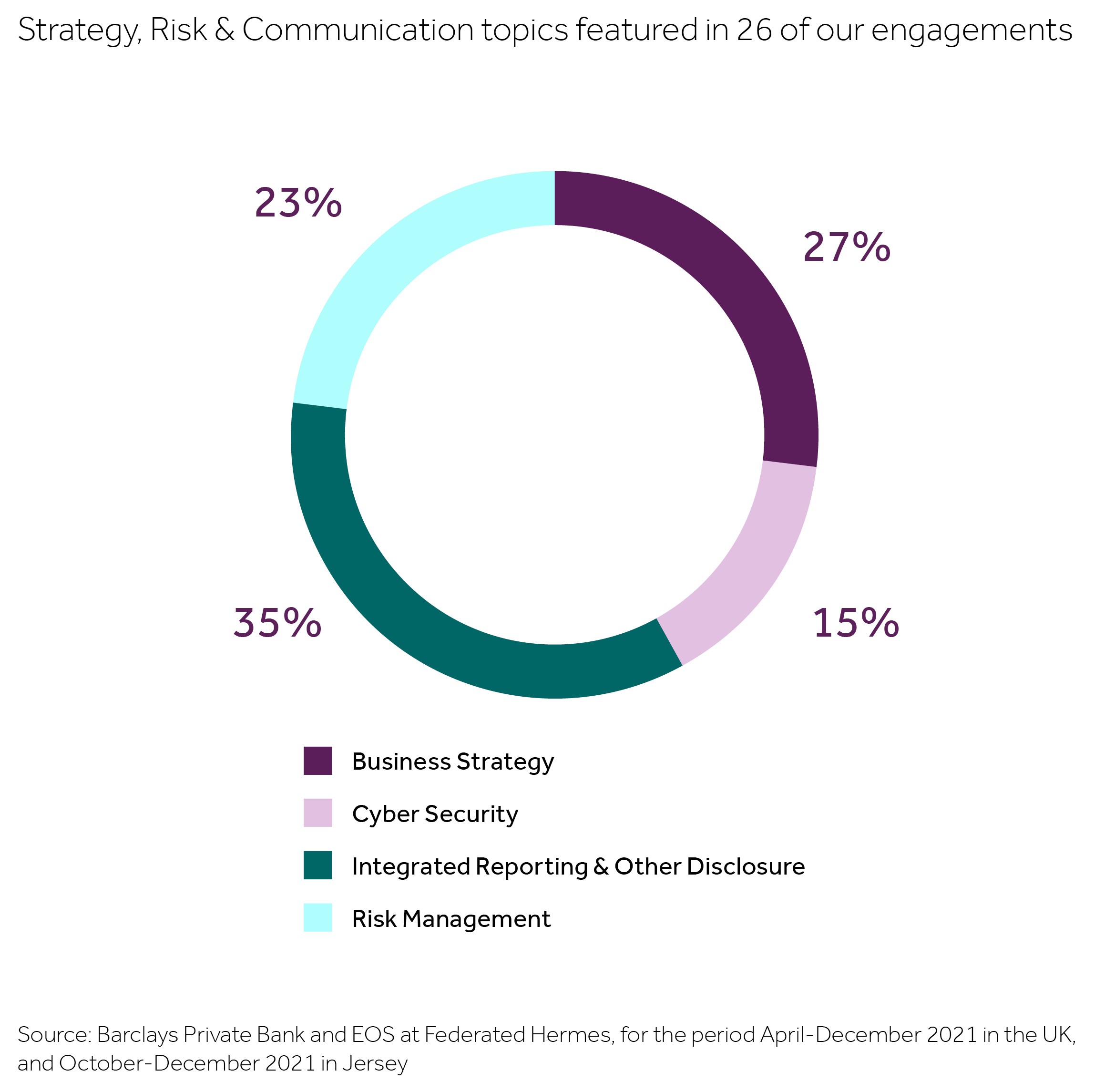

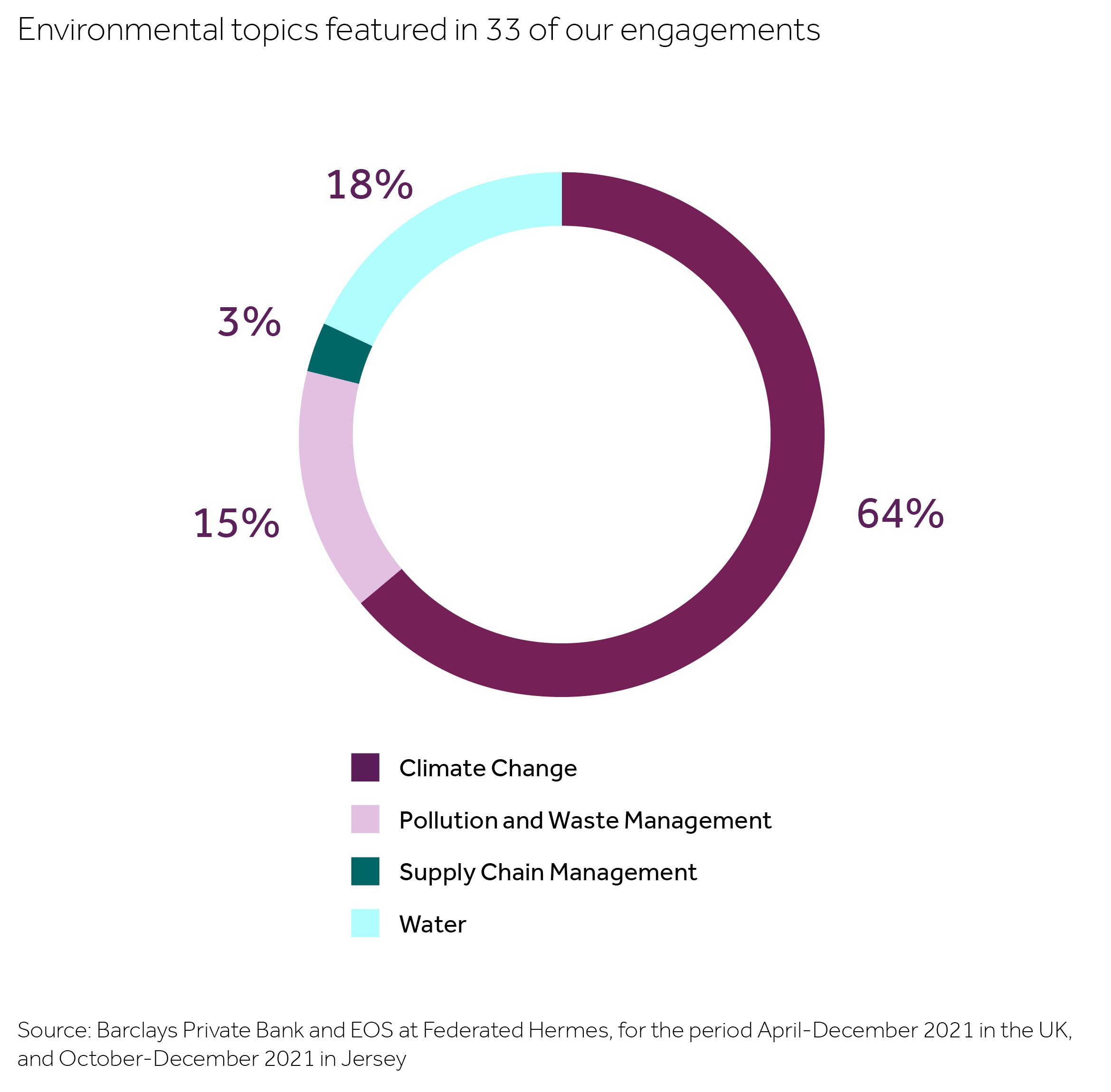

In 2021 for our sustainable strategies, we engaged with 39 companies on 169 ESG issues and objectives via EOS. Of these, 20% were environmental, 31% social and ethical, 34% governance, and 15% strategy, risk and communication.

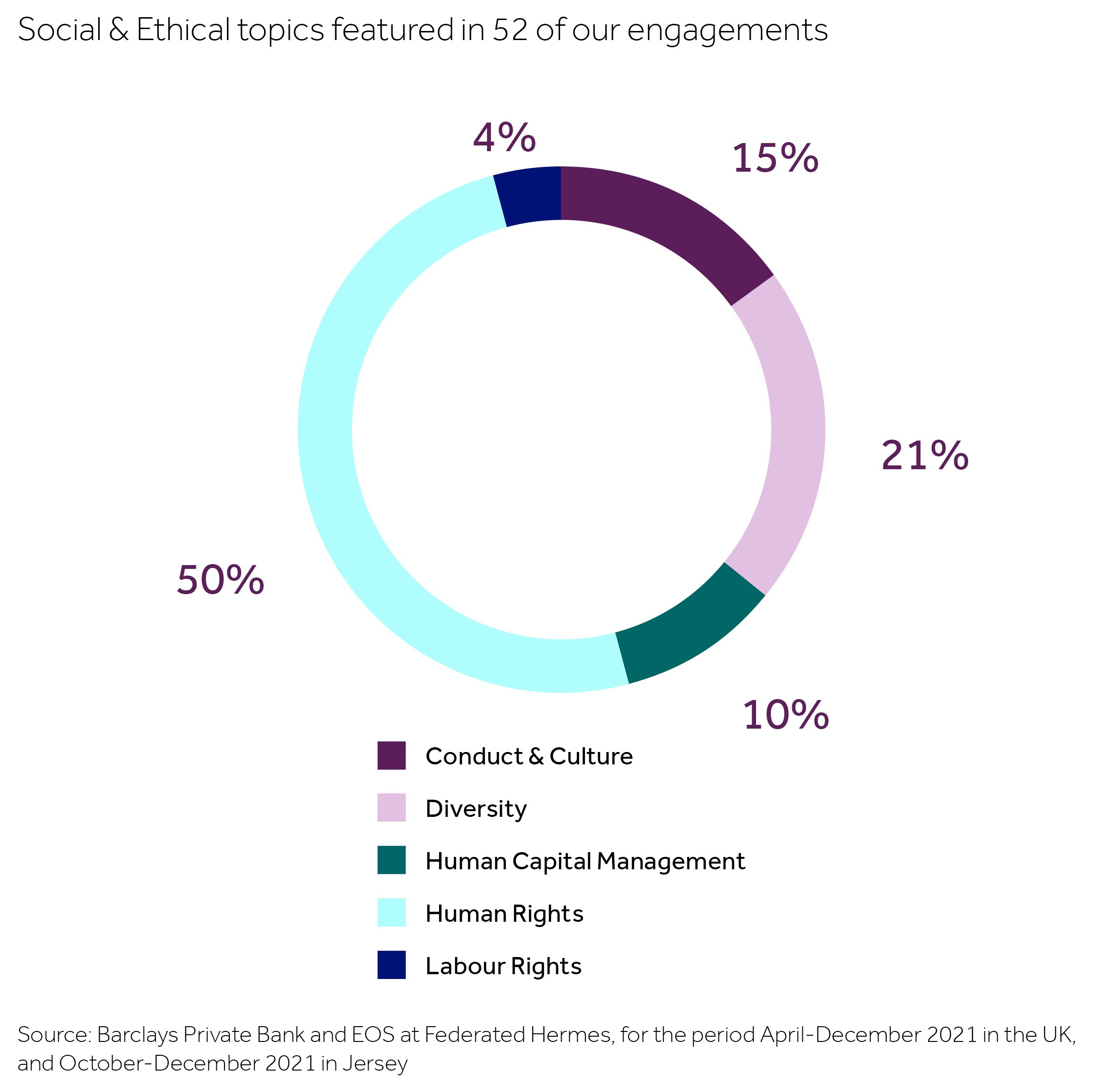

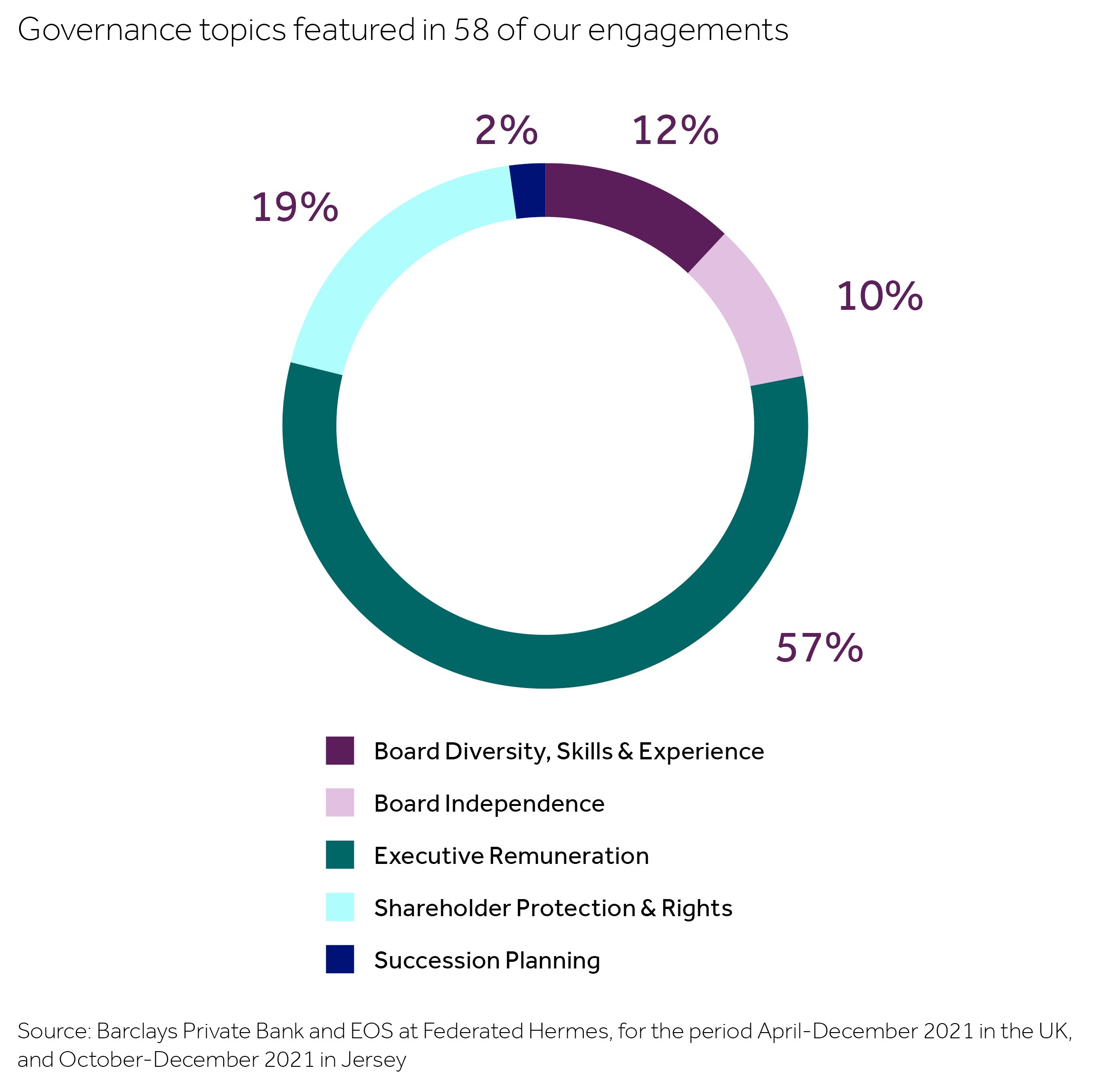

On environmental issues, we focused on improving company practices on climate change and water stewardship. For instance, encouraging companies to adopt stretching and meaningful climate targets, and to make robust TCFDdisclosures. On social and ethical issues, we had a strong focus on human rights and diversity, and executive remuneration under governance.

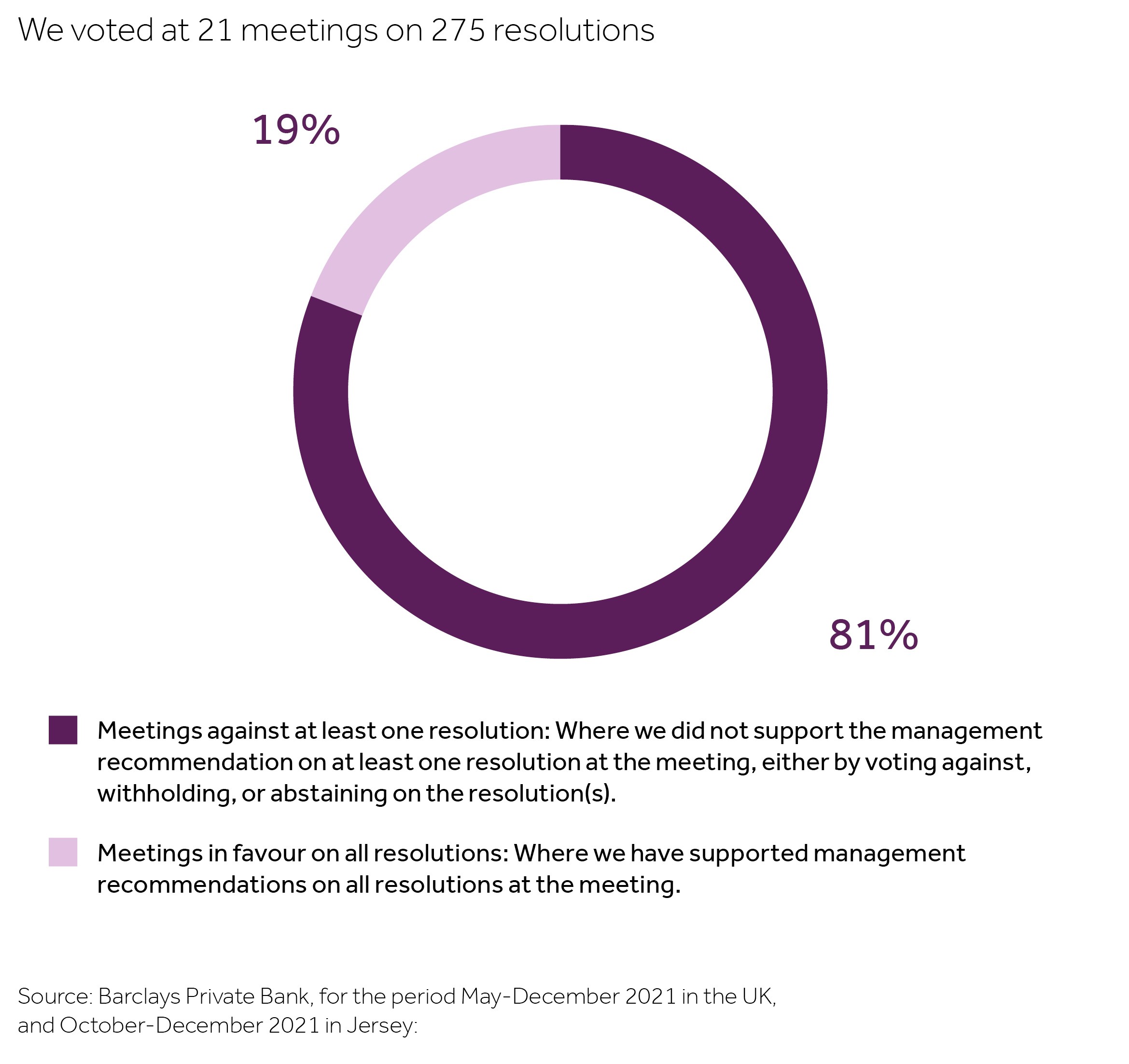

We also voted at 21 shareholder meetings, on 275 resolutions, supporting management on 84% of the resolutions we voted on. You can find more information on our voting and engagement activities in the charts below, or on our Responsible Investing webpage.

Why did we choose to partner with EOS?

EOS has a long history of leading on responsible investment, dating back to the 1980s, and was one of the founding signatories to the United Nation’s (UN) Principles for Responsible Investment.

The company works on behalf of large institutional investors, so it has significant leverage to seek change. Pooling resources with other like-minded investors creates a strong and representative shareholder voice, and is likely to make company engagement more effective than if we were engaging individually.

EOS has one of the world’s largest teams of engagers, so its activities are targeted and focused on delivering genuine corporate change – which, in turn, should benefit our clients. Their diversity of skills, experience, languages, connections, and cultural understanding gives them the gravitas and credibility to access and maintain constructive relationships with company boards.

The Portfolio Management team has always spoken to senior management of our investee companies. Has working with EOS changed this?

Our Portfolio Managers remain at the centre of decision-making, particularly around voting, and continue to engage with companies on financial issues. Our partnership with EOS has enabled them to form an even deeper, more holistic understanding of a company’s approach to ESG issues – by incorporating observations, learnings, and insights gained through engagement and voting into their ESG analysis and due diligence.

By working with EOS, our Portfolio Managers are able to track each company’s response and progress against pre-defined objectives and milestones. Overall, we believe our partnership will enable our Portfolio Managers to effect change across their holdings, and to make better-informed investment decisions.

There are clearly many sustainability issues we could engage on. Could you share some of the main areas of focus over the past year?

EOS links its engagement issues and objectives to the UN Sustainable Development Goals (SDGs), which is quite progressive in the responsible investing industry. (As a reminder, the SDGs are a set of 17 goals designed as a blueprint to achieve a more sustainable future for all, and our sustainable strategy invests in companies whose business practices actively address one or more of these goals.)

For the sustainable strategy, the most frequently engaged SDGs include:

- SDG #8 - Decent work and economic growth (i.e. human rights, risk management, diversity)

- SDG #12 - Responsible consumption and production (i.e. sustainability reporting, environmental indicators)

- SDG #13 - Climate action (i.e. climate strategy, forestry and land use)

- SDG #16 - Peace, justice and strong institutions (i.e. lobbying, bribery and corruption)

Engagement example, SDG #5 - Gender equality:

Following our engagement, five of our investee companies have enhanced their public disclosures on diversity and inclusion. This includes employee breakdowns by level, gender pay gap reporting, and detailed workforce diversity statistics.

Have there been any tangible changes so far?

Engaging for change is often a long-term process, with activities spanning several months or even years, depending on the nature of the issue. For this reason, EOS sets clear, specific and measureable objectives for each engagement at the outset, and uses a four-step milestone approach to monitor progress, as follows:

- Concern is raised with the company

- Company acknowledges our concerns

- The company commits to a credible change

- The change is implemented.

Since we began working with EOS, 37 milestones have been reached in relation to holdings in our sustainable strategies, across various engagement objectives. Some highlights include:

- A US manufacturing company enhanced its public ESG reporting, which included an alignment to the TCFD recommendations, and introduced environmental targets.

- A US scientific instrument supplier established a human rights policy in combination with its global equal employment opportunity policy, covering freely chosen employment, child labour, freedom of association, and compliance with applicable wage and hour laws. The company also released a statement on modern slavery and human trafficking that addressed its supply chain due diligence, risk assessment and management, and also references its conflict minerals statement.

- A US conglomerate improved its sustainability disclosures by providing more detail on its sustainability strategy, and introducing new targets at corporate/individual company level for material issues related to manufacturing and human health.

How do these developments fit in with Barclays Private Bank’s broader stewardship commitments?

We believe that engagement and voting activities help give us a deeper understanding of the assets we invest in, which is an essential part of good stewardship. They enable us to better manage ESG risks, which can affect investment performance, and so support us in our fiduciary duty to clients.

We also recognise our responsibility to society and key stakeholders. ESG considerations, engagement and voting activities, in our view, help alleviate the pressure for short-termism and encourage a focus on long-term value creation – to the mutual benefit of companies, investors and the world at large. These beliefs align well with the Barclays Group values of Respect, Integrity, and Stewardship.

Our voting and engagement activities are carried out, in partnership with EOS, on behalf of all our traditional and sustainable discretionary strategies in the UK and Jersey. We may engage with companies where we manage bond or equity holdings, and vote at shareholder meetings where we manage equity holdings. Further details are available on the Barclays Private Bank Discretionary Portfolio Management web page.